Whilst the current COVID-19 pandemic induced crisis is yet to reach its peak, and is leaving a trail of personal and economic destruction, we should expect a new Fintech landscape to emerge, in many respects, when the dust settles. What does this mean for the Fintech sector in terms of opportunities and how does this impact the individual?

2019: A bumper year for Fintech financing

2019 was the most active year for Fintech financing, M&A and IPOs, according to a new report by Financial Technology (FT) Partners. Fintech companies raised a total of US$44.6 billion in funding through 1,813 transactions. This made 2019 the largest ever year in terms of deal count, up 10% from 2018, according to their 2019 Fintech Almanac.

Whilst the currently forced hiatus for the world economy will lead, in the short term, to a flight to more stable assets and cash, well priced deal activity will continue to happen, especially in Fintech sectors such as payments and digital assets development. This will lead to additional automated and low touch interactions in both the consumer and business sectors.

Irrespective of the unfortunate crisis, one can argue that the Fintech sector had overheated in terms of venture/ private equity valuations relative to earnings and EBIDTA. Of course, a level of forward valuation is needed in this sector; however, a balance also needs to be maintained. If there is no eventual sustainable revenue and profitability, the ‘house of cards’ can tumble down. Competitively priced assets are good for investors as they will continue to invest with confidence if they are making money, and ultimately it is good for entrepreneurs as, in the medium term, far more stable and potentially better valuations can be realised underpinned by strong foundations.

Is there a silver lining?

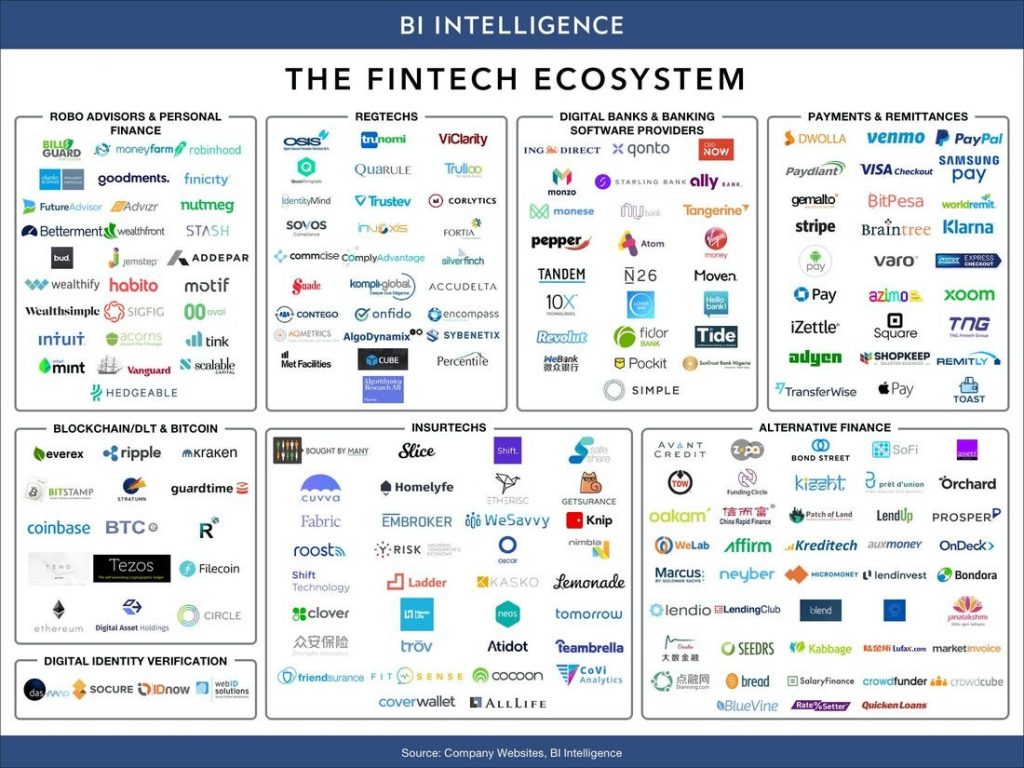

If we can look beyond the crisis, the smart money will return in greater abundance into the Fintech sector buoyed not only by the better priced opportunities but also by potential accelerated growth opportunities in certain Fintech sectors as a result of damage to the ‘bricks and mortar’ businesses. So which will be the hot sectors?

A mix of technical skills, capital investments, government policies, regulatory framework, and entrepreneurial and innovative mindset will continue to be the driving forces to establish Fintech as a key enabler to financial services across the globe. Individual Fintech hubs will increasingly interconnect to become ‘Smart Fintech Hubs’ enhancing opportunities for cross border transaction flows and services, with less intermediaries and lower costs.

Initiatives such as Global Financial Innovation Network (“GFIN”); a cross-border regulatory sandbox for firms testing innovative financial products, services or business models across multiple jurisdictions; will act as catalyst, enabled by technology, to move things away from silos to interconnection.

Digital Financial Market Infrastructure

As I have observed in a previous article, exchanges are pretty much standalone pools of liquidity with no direct business level interconnectivity between them. This is arcane in an era where we are all going digital and yet the exchange construct is still analogue. Digital exchanges offering tokenisation of real assets, and digital custody will be winners from the crisis as they transform the construct we know today.

This is already starting to happen in regulated environments as opposed to the ‘crypto wild west’. Talk of new market flash crashes and closing markets is absurd when the technology can handle any level of volatility. The issue, in reality, is the inability to recalibrate capital deployment and move assets seamlessly between these legacy silos cost effectively.

Better use of new technologies, such as blockchain, make this interconnection more possible. Combining this with the power that Artificial intelligence unleashes will also enable data to be monetised in a democratised fashion as opposed to just being farmed by numerous corporations today for their gain. Our personal data has value and so why should we not be paid when this is utilised? Why can we not sell our own future potential now for a percentage of future value, much like equity in a company can yield a return based on performance?

The current crisis will change our mindset and habits and make us revaluate our current way of doing things, as we sit quarantined with time on our hands, to think outside the current box we have found ourselves in for so long.

Robo-Advisory

Another beneficiary from the crisis will be Robo-advisory, which is reforming the landscape of wealth advisory services. The need for no touch and low touch investment solutions, which can deliver more informed intelligent analytics back to the user, will be higher than ever. Robo advisors are the next level in the evolution of asset management and financial advice. Digital advice is already becoming a pre-requisite for wealth management firms serving the mass market as well as prominent clients.

The growth of Robo advisory services is attributable to the fact that it enables low-cost services, scalability, cognitive advice, and next-generation user experience. We are already seeing significant activities, which also include the integration Artificial Intelligence (AI) into Robo-advisory.

Next-generation payments

In branch banking and physical cash, payments have suffered as a result of the crisis as bricks and mortar businesses have been forced to shutter their doors for the greater good. The crisis represents a huge opportunity to accelerate cashless payments. Retail and consumer payments are leading the way in the adoption of innovative payments capabilities aided by the growth in e-commerce and increased penetration of mobile phones. B2B opportunities are also gaining increased traction as a result of being more efficient and cost effective. Some key trends in digital payments are:

· Adoption of contactless payments. This includes Near Field Communication (NFC) adoption, host card emulation and QR code generation for electronic interactions between consumers and retailers.

· Adoption of payment hubs.Banks are getting interested in looking at investing in harmonising their payments infrastructure by moving to payment hubs. These hubs can process any form of payments irrespective of the origination channel.

· Real-time payments. This is revolutionising the retail funds transfer process by providing electronic cash to anyone in the span of a few minutes. Peer to peer money transfers has been around for a while and has witnessed high growth.

· Move towards cashless societies. Sweden, Norway, and Denmark are on course to becoming cashless societies and are adopting ‘no cash’ models. This has been aided by their banks adopting the Fintech revolution and responding to innovation.

· Virtual currency. Built on blockchain infrastructure this offers better speed and efficiency of transaction.

· Omni channel offerings. The framework of digital payments provides a seamless customer experience across channels leading to better transaction experience.

· Rise of marketplace banks. Challenger banks are being supported across geographies and given licences to operate freely (there are plenty of examples in the UK). Banks, by adopting open banking, have started exposing their APIs to third parties for large scale payments.

· Fintech companies digitising the international remittance process. Apps integrated with mobile money wallets have had a huge impact in accelerating the digitisation of international remittances. Additionally, blockchain remittance is a new but growing alternative to traditional third party international money transfer methods.

The future of payments was already transforming, as new entrants enable the market with new technologies; such as contactless payment, NFC enabled smartphones, cloud-based PoS, and digital wallets. The crisis will accelerate this trend and the need for existing players to collaborate across sectors to increase customer acceptance, penetration of digital payments and create a beneficial model for each participant.

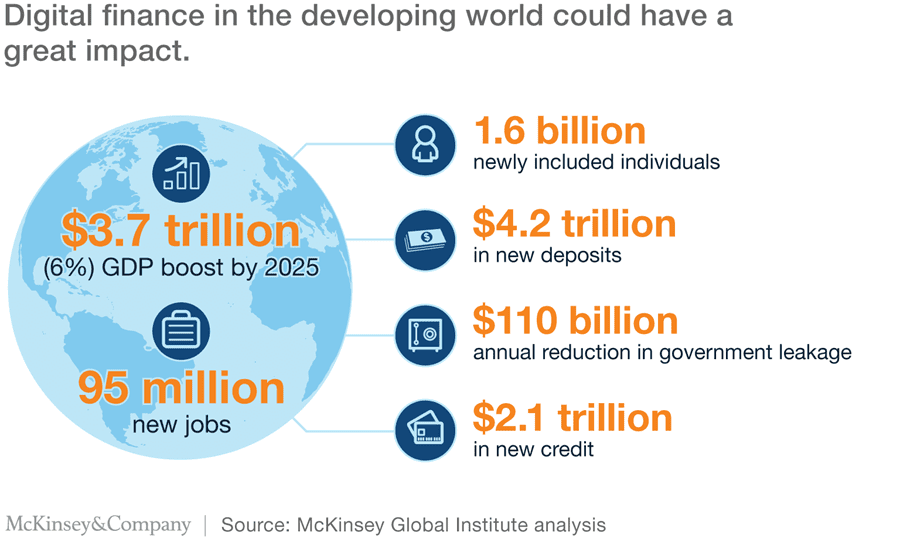

What about financial inclusion?

The current crisis has also lead to some panic amongst largely cash based economies with GMEX being contacted by multiple countries to understand how we can address this with digital payments and other services.

The global banking sector is aware of the need for financial inclusion in rural and remote areas of countries. According to the World Bank as of April 2017, globally, 1.7 billion adults remain unbanked, yet two-thirds of them own a mobile phone that could help them access financial services. Digital technology could take advantage of existing cash transactions to bring people into the financial system, the report finds. For example, paying government wages, pensions, and social benefits directly into accounts could bring formal financial services to up to 100 million more adults globally, including 95 million in developing economies.

There are other opportunities, to increase account ownership and use, through digital payments: more than 200 million unbanked adults who work in the private sector are paid in cash only, as are more than 200 million, who receive agricultural payments. The crisis will merely accelerate the desire to tackle the issues that have ensued from a very large parallel cash-based economy in many developing countries.

What can we conclude?

Whilst there is a lot of personal and economic pain being caused by the current COVID-19 pandemic, with months of quarantine ahead, with both companies and households in survival mode, there will ultimately be an end to the crisis. History has shown us this with previous such crises over more than a century.

The move to increase online activity and digital services, as a result, will accelerate what was already an increasing trend. This bodes well for Fintech organisations that have genuine differentiators, regulatory cover and readiness of services in the digital market infrastructure, cashless payments and Robo-advisory space. The need for financial inclusion will be greater than ever before, and digital technologies and innovative use of digital assets will help further facilitate this.

From the dust, a new way of doing things better will emerge and we will not only become more resilient as a society but also more robust as a global world economy.

Hirander has expertise in extensive electronic trading and FinTech spanning 25 years, with successful syndication to investors and substantial exits. He is the Chairman & CEO of GMEX Group and its climate fintech platform-as-a-service ZERO13, which won the COP 28 UAE TechSprint for the use of blockchain to scale climate finance. He is one of the Top 10 influential business leaders of blockchain technology in the UK All Party Parliamentary Group report. He is also featured in LATTICE80’s Top 100 influencer list for the UN Sustainable Development Goals agenda for pioneering blockchain technology solutions. Hirander was also recognised as the Most Influential CEO 2024 – UK (Carbon Credits) by CEO Monthly, a digital magazine published by AI Global Media.

Previously he was the co-founder and Chief Operating Officer of Chi-X Europe Limited, instrumental in taking the company from concept to successful launch. At the time of his departure in February 2010, Chi-X Europe was the second largest equities trading venue in Europe, just behind the LSE Group, and was subsequently sold to Bats Global Markets (now part of CBOE Global Markets) for $365M.