What is RegTech?

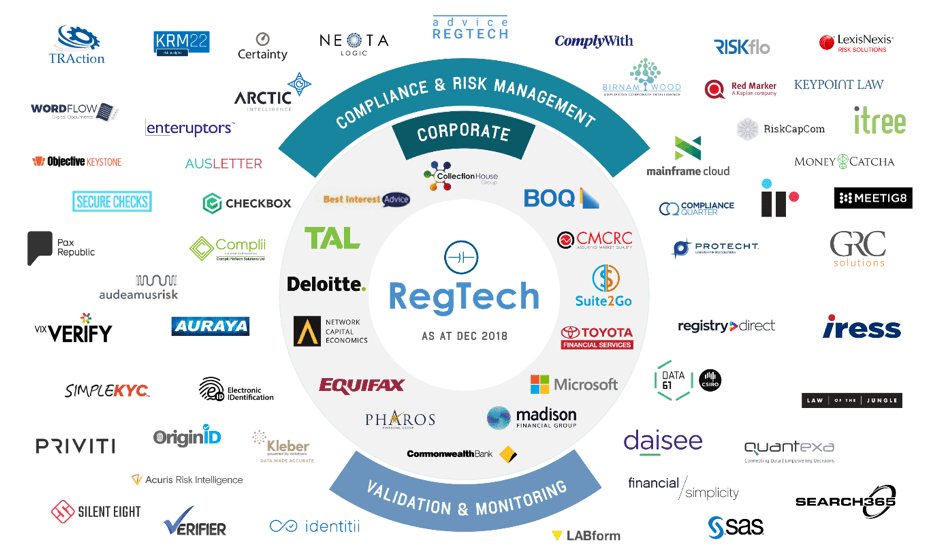

Regulatory Technology (RegTech) is a subset of FinTech, the adoption of the latest technologies designed to help and facilitate companies in the financial, healthcare, insurance, and other fields to maintain regulatory compliance with increasingly demanding and changing regulatory requirements.

RegTech involves dealing with Anti-Money Laundering and Countering the Financing of (AML/CFT), FATCA or CRS, as well as the new European Payments Directive (PSD2) and the new Regulation of Data Protection (GDPR).

RegTech companies are now engaging in machine learning, natural language processing, Biometrics, blockchain, AI, Big Data and Advanced Data Analytics and other technologies so as to bring the influence of digital transformation to the world of regulatory compliance.

Why is RegTech important?

The rise of digital products has increased data breaches, cyber hacks, money laundering, and other fraudulent activities. RegTech is a community of tech companies that solve challenges arising from a technology-driven economy through automation. RegTech reduces the risk to a company’s compliance department by offering data on money laundering activities conducted online with the use of big data and machine learning. It can perform activities that a traditional compliance team may not be accustomed to, due to the increase of underground marketplaces online. RegTech has the potential to be transformative in its reduction of compliance costs.

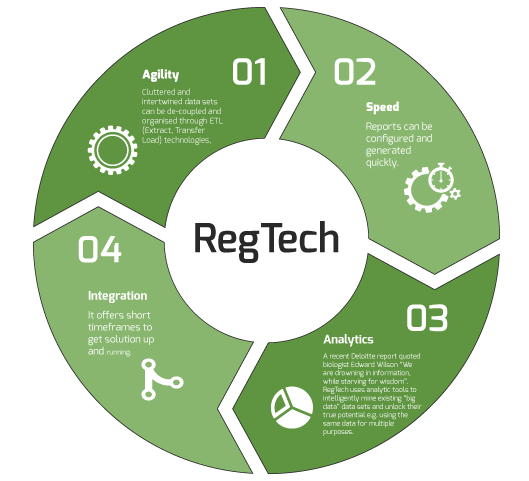

RegTech companies offer four characteristics:

1. Agility: Decompose and organise chaotic and disheveled datasets through the process of ETL (Extract, Transfer, Load) efficiently

2. Speed: Generate and construct reports from standardised data

3. Integration: Composition of reports in short time frames to get solutions up and running

4. Analysis: Intelligently mine existing datasets to unlock their true potential by presenting it in a simple and easy to understand

The reason traditional solutions vary from the RegTech solution is ‘agility’. While traditional solutions offer a robust design created to deliver specified requirements, they are largely stringent and require coding to be enhanced or changed. This leads to added complexities in the process, involving more manpower and cost.

RegTech companies help financial firms automate regular compliance tasks and reduce operational risks associated with meeting compliance and reporting obligations. This helps reduce the cost involved, improves performance and security, adds flexibility and considerably reduces the time required to complete the task.

How Can It Help Financial Services Firms?

Regtech is the use of emerging technologies by both financial institutions and regulators that are designed to improve the abilities of compliance departments to monitor risk, generate reports, manage billions of transactions, stay compliant and reduce the rate of false noncompliance alerts and to make the writing, communications, interpretation, implementation and monitoring of regulations more effective and more efficient. It changes the current compliance game for the better.

Regulatory changes in the financial sector are increasing globally at an astonishing rate. Confronted with the sheer volume of new regulatory changes imposes high complexity and rigorous timelines upon financial institutions. Notwithstanding the prospect of severe penalties for non-compliance as the recent high profile fines imposed by regulators that are punitive and very costly. The Libor Scandal in 2007-2013 cost Citicorp, JPMorgan Chase & Co., Barclays PLC, The Royal Bank of Scotland plc and UBS AG a total of $2.5bn. HSBC agreed to forfeit $1.256 billion for AML failures and the FCA fine in 2017 for Deutsche Bank to the tune of £163 million because of serious anti-money laundering controls failings.

Financial Institutions (FIs) have partnered with FinTech on several aspects of the business in recent years. Their primary focus was on customer-facing areas, companies have now started devoting attention to back-end aspects also. Within the FinTech ecosystem RegTech as a forte segment it has gained significance, with a lot of pressure from regulators on overall data compliance and governance.

Regulators have asked financial institutions to take on several modernisations on their businesses and many of the organizations have struggled with regulatory-driven transformations. RegTech established a solid foundation within the FinTech environment to overcome this and come up with solutions that are targeted to new and complex regulations, litigation and regulatory remediation areas faced by financial institutions (FI), combined with overall reduction in cost compliance.

The transactions that took place online in real-time, RegTech tools seek to monitor to identify issues or anomalies in the digital payment domain. Any anomaly is related to the financial institution to analyze and regulate if fraudulent activity is taking place. Institutions that identify potential threats to financial security early on are able to minimise the risks and costs associated with lost funds and data breaches.

A bank may find it too complex, expensive and time consuming to examine the huge amount of data that it receives. RegTech firms can predict potential risk areas that the bank should focus on, by combining information from a bank with data from previous regulatory failures. The RegTech firm saves the bank time and money by creating the analytical tools needed for these banks to successfully comply with the regulatory body. The bank also have an effective tool to comply with rules set out by the financial authorities.

In order to share information RegTech companies collaborate with financial institutions and regulatory figures using cloud computing and big data. Cloud computing is a low-cost technology wherein users can share data quickly and securely with other entities.

“As the pace of technological change increases it requires regulators to adapt to a new landscape and devise new ways of working together. There are still many areas to look at and in many ways our work is just beginning. We expect future challenges to include understanding and working with data privacy and data-sharing requirements across many jurisdictions and regulators”, as per Global Financial Innovation Network (GFIN), GFIN – One Year On, June 2019.

How FinTech navigates through regulatory frameworks?

“Regulation is not seen as a barrier but some firms stress the need for additional guidance on how to interpret current regulation. Firms do not think regulation is a barrier to [machine learning] deployment. The biggest reported constraints are internal to firms, such as legacy IT systems and data limitations. However, firms stressed that additional guidance around how to interpret current regulation could serve as an enabler for [machine learning] deployment”, Bank of England, Machine Learning in UK Financial Services, October 2019

The list of financial technology challenges for firms continues to grow. Technology-enabled solutions have driven a trend of start-ups pushing the limits of innovation and using the new capabilities offered by concepts such as artificial intelligence and machine learning. Financial services firms themselves are also developing solutions in-house often in ring-fenced ‘labs’ where innovations are tested before being deployed.

This year the greatest challenges are expected to be the need to keep up with technology advancements; apparent budgetary limitations, lack of investment and cost, and then data security.

The 4th annual FinTech, RegTech and the Role of Compliance Report 2020 has highlighted the ebb and flow of attitudes on the adoption and use, in practice, of technology in financial services. This year’s report also examines the shifting role of the regulator and global concerns over tackling rising cyber-risk.

The report also provides insight into how financial services firms’ risk and compliance functions are responding to the issues, challenges, and potential benefits of the current digital and technological transformation of the industry. Rather than looking at individual solutions, the report highlights the key points for firms and boards (along with their risk and compliance functions) to take into account when considering the placement and use of possible technology-enabled solutions.

“Holding individuals and firms to account when IT failures happen is essential, not only to prevent individuals making the same mistakes again, but also to focus the attention of senior management on the risk of incidents and incident management. The regulators must use the enforcement tools at their disposal to hold individuals and firms to account for their role in IT failures and poor operational resilience. The regulatory mechanisms to ensure accountability for failures must have teeth, and equally as importantly, be seen to have teeth”, commented about it the UK Treasury Select Committee report: IT Failures in the Financial Services Sector, October 2019

As digital transformation sweeps through almost every industry, regulatory bodies have needed to create legislation and guidelines governing technology use. The more regulation there is, the more difficult it is to navigate the regulatory framework. In highly regulated industries, regulatory technology designed to make regulatory compliance easier is vital. The good news is that leading regulators, firms and suppliers have understood that just like FinTech has challenged firms to rethink and reimagine their customer experience, high levels of regulatory change are forcing the industry to focus on digitizing regulatory compliance.

Maintaining regulatory compliance is costly and burdensome, so vendors have stepped up AI-driven efforts to improve the efficiency and effectiveness of compliance. RegTech applications provide several different functions to users, including risk management, identity management and financial crime identification.

RegTech sprints and other collaborative efforts have also taught us the importance of using semantic technologies to align the shifts in obligations to the policies and controls that will ultimately be used for evidence as to how the business was done.

These technologies contextualise the obligations, make the definitions precise and clarify the data requirements for each trade, deposit or money transfer. The process which a business relies upon to meet the obligations can be expressed, the controls identified, and the owners pinpointed.

When information is exchanged with the market, regulator or client, there is an opportunity to use distributed technology to eliminate the need for static reports and allow the individual actors to derive the information they need to know. Solutions need to be practical, and providers need to be careful not to over-promise and under-deliver; and above all, developments should be aimed at genuine problems and not simply be solutions looking for a problem.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.