The British Business Bank Equity Tracker report shows the number and value of private investment deals has increased in the UK for last year. While the overall amount invested has reached record levels there is evidence that the political backdrop has created reticence for the support of earlier seed stage investment.

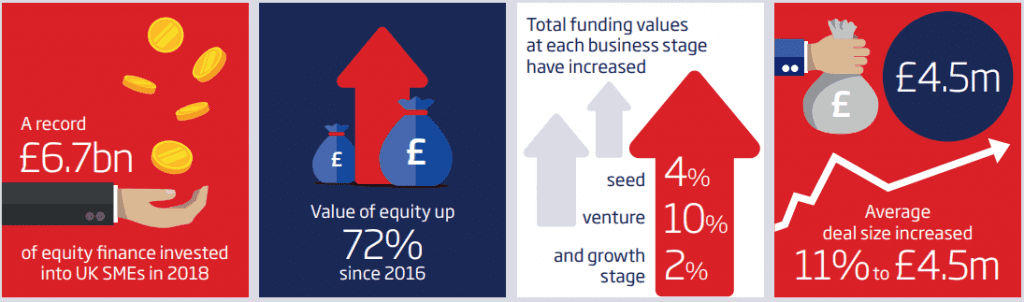

The amount of equity invested in smaller UK businesses rose by 5% to £6.7bn in 2018, the highest amount recorded. Launched during London Tech Week, the report reveals the UK tech sector remains the focus for equity investors, with 44% of investment going to tech companies. Equity investment in tech businesses increased by 24% in 2018 with £3bn invested, the highest amount to date, mirroring wider equity market trends. The report also found that London’s dominance as the centre of the UK’s equity market is waning. 2018 saw the value of equity finance investment outside of London increase by 29% (£616m), to stand at £2.8bn.

Jenny Tooth, CEO of the UK Business Angels Association, has joined us to share her expertise about what this report means for start-ups, private investors and regional investment support.

Angels have been most affected by economic and political uncertainty

“In this report we have witnessed seed stage deals decline by 12% meaning that, for the first time on record, the levels of these types of deals have fallen below the level of venture capital deals. A key component of seed stage funding is business angel investment and we are concerned that the report reveals a decline of 19% in deals done by Angels in 2018 and 28% decline in deals done by Angel Networks. This reflects the fact that Angels are likely to have been affected by overall economic and political uncertainty which may impact their overall personal investments and thus their capacity to make investments in small businesses, potentially concentrating on growing their existing portfolio.

Visible Angel Market is the tip of the Iceberg!

One of the main constraints to have surfaced from this report is that only 30% of all equity deals are visible. This makes it extremely difficult to provide a truly representative picture of the equity market. This especially reflects the reporting on angel deals. Many angel deals are private investments to private companies, and therefore there is no compulsion to release the details of such deals publicly. It would be conceivable therefore that a substantial amount of the 70% of equity deals that we aren’t aware of, may be investments by business angels.

What is absolutely clear is that we need a better understanding of the angel market. For this reason, the British Business Bank, in collaboration with the UK Business Angels Association, are conducting research in 2019 into the UK angel market so that we can gain a better understanding of business angel investing here in the UK.

Regions – Some improvement but continuing regional disparity in the level of investment

The report shows some important readjustment between London and the rest of the regions with 54% of all deals and 41% of total equity value invested in the regions in 2018 compared with 44% in 2017 and an overall increase of 29% in equity deals invested outside London. UKBAA has also been seeing an increased level of activity among angels in the regions with a number of new syndicates being established in regions in the North and West including Wales. However, there remains a lack of mobilised angel investment capacity available to entrepreneurs across the regions. Since most angel investors invest within a two-hour journey, we need more regional lead angels with industry experience to lead and mobilise other local investors, especially to respond to regional sector strengths.

This underlines the importance of UKBAA’s work in the regions in building an effective ecosystem to connect the Angel and VC community, through our Angel Hubs and our regional Connected Investing events. It is our hope that with the research that is being conducted this year, we will have a far greater indication of how robust angel activity really is in the regions, and where disparities continue to lie.

Angels remain a significant source of investment for first round early stage businesses seeking less than £500k

Trends overall are showing a focus on larger deals in venture capital and private equity which have increased by 11% in deal size. There has also been a significant ongoing decline in companies raising funding for the first time with an ongoing increase in the proportion of further funding rounds. However, at seed stage, there has been a continuing decline in smaller deals, with around only half (54%) of all deals lower than £500k. However, it’s important to bear in mind that Angel groups form an extensive part of this seed investment below £500k, underlining the importance of angels as a vital source of funding and the need to continue to support the further growth and capacity of angel investment.

Angels are the most significant Investors in Female Founders at seed stage.

The statistics from the report show a worrying decline overall in the level of equity investments overall in female founders in 2018. However angel investments in women founders represent 22% of seed stage deals, highlighting that angel investors are a significant source of investment for companies with at least one female founder and demonstrates the importance of encouraging more female angel investors who are much more likely to support female founded business.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals