Over the past few months COVID-19 pandemic has triggered a massive crisis in the global economy. We’ve seen continual upheavals in economic activity and that has challenged the very notion of decision making. We’re facing worst losses in stock market history, disruptions and global shifts like digitization, technology transformation, changing geopolitics, evolving business models and historic job crisis. Increase in uncertainty is leading firms to reevaluate business models that depend on global supply channels.

In order to save lives from the pandemic, countries have pushed economies into a Great Lockdown which also triggered the worst recession since the Great Depression. Above 75 percent of countries are now reopening at the same time as the pandemic is escalating in many emerging market and developing economies. Several countries have started to recover. However, in the absence of a medical solution, the strength of the recovery is highly uncertain and the impact on sectors and countries uneven.

The International Monetary Fund (IMF) has declared the dark side of global economy by warning deeper recession than it previously projected as the coronavirus pandemic caused more widespread damage than expected and will be followed by a sluggish recovery. With that scenario, it is no wonder that International Monetary Fund (IMF) reduced its growth forecast for the world economy.

“We are definitely not out of the woods. We have not escaped the great lockdown,” IMF’s chief economist Gita Gopinath said at a press briefing. “This is a crisis like no other and will have a recovery like no other.”

Deep Downturn in 2020

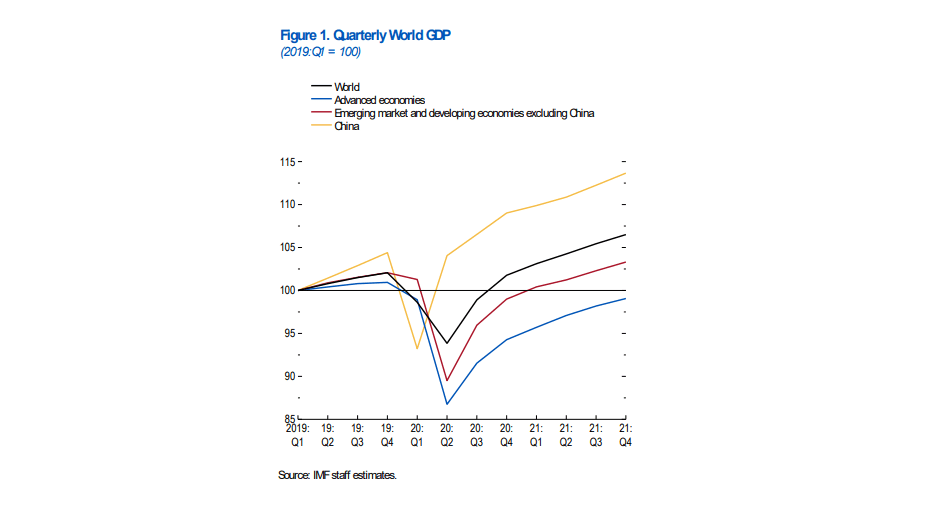

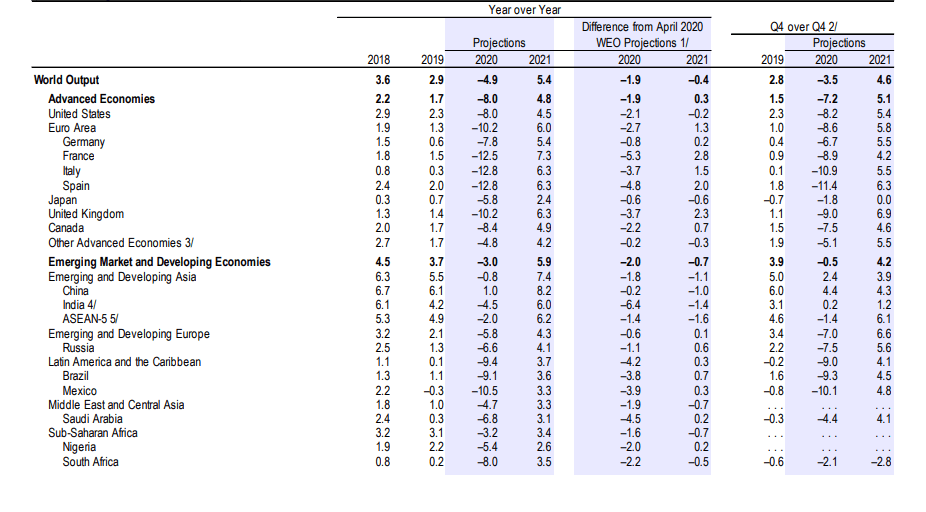

The findings, published in the IMF’s latest World Economic Outlook Update predicted that the global economy would contract by 4.9% this year, causing the agency to revise down its growth forecast by 1.9 percent for 2020. Significantly worse than the 3% decline expected in its April forecast, while GDP will rebound by 5.4 percent in 2021, this will still leave GDP 6.5 percent lower than in pre-Covid-19 projections of January 2020.

“Economic data available at the time of the April 2020 WEO forecast indicated an unprecedented decline in global activity due to the Covid-19 pandemic. Data releases since then suggest even deeper downturns than previously projected for several economies,” the IMF stated.

The forecast assumes countries will not reimpose comprehensive lockdowns even if the pandemic flares up again.

The fund made drastic downward revisions to most of the April forecasts made in the early days of the pandemic, and IMF economists fear the coronavirus will leave lasting scars on employment, businesses and trade.

Hanging over the predictions is the bill for massive government incentive plans, which were drove by extremely low interest rates and likely restrained the recession from turning into a depression even as they created huge and ever-increasing debt levels. However, the fund also mentioned that thanks to these financial measures from “government crisis-fighting efforts including $11 trillion in spending and tax cuts, have kept the economic collapse from worsening,” the fund said.

Along with backing continued central bank support for low interest rates, the IMF is calling for wealthy nations to grant substantial debt relief to the world’s poorest countries. The fund also broadly praised central banks like the Federal Reserve for providing stimulus to help shore up financial markets, but warned that much of the economic recovery next year will depend on that ongoing support.

The fund also ruffled the feathers of banks and market speculators by saying that investors were “apparently betting on continued and unprecedented support by central banks”, adding that “markets appear to be expecting a quick V-shaped rebound in activity”.

“This has created a divergence between the pricing of risk in financial markets and economic prospects,” the IMF said, which in other words, portrays the post-March COVID-19 stock market rally as a gamble.

Fund officials blamed the darker forecast on the effects of social distancing; blemishing to global production capacity from the lockdown of activity; and the productivity cost of new safety and hygiene rules.

The labor market has been severely hit and at record speed, and particularly so for lower-income and semi-skilled workers who do not have the option of homeworking. With activity in labor-intensive sectors like tourism and hospitality expected to remain subdued, a full recovery in the labor market may take a while, worsening income inequality and increasing poverty.

In fact, the fund described the COVID-19 impact on low-income households as “adverse” and “acute” while “imperiling the significant progress made in reducing extreme poverty in the world since the 1990s”. The IMF pointed to International Labour Organization data estimating more than 300 million jobs were lost in the second quarter of the year.

And with some economies still struggling to control the coronavirus, the IMF further predicts that prolonged lockdowns will exert an additional toll on economic activity in countries struggling to control infections.

“A more prolonged decline in activity could lead to further scarring, including from wider firm closures, as surviving firms hesitate to hire jobseekers after extended unemployment,” the fund warned.

The Fund also warned that financial and stock markets were not reflecting the pessimistic economic outlook, “raising the possibility that financial conditions may tighten more than assumed in the baseline.”

Although the IMF had signaled that it might downgrade its global projections, following negative assessments from other international organizations such as the World Bank and the OECD, financial markets took the report badly.

“Maybe we can say the world has bottomed out, for now, and we’re in a recovery phase,” said Gita Gopinath, the IMF’s chief economist. “But still, the strength of the recovery is highly uncertain because there is no solution yet to the health crisis. By the end of next year, the pandemic will have cost the global economy $12.5 trillion in lost output,” she added.

Sluggish Turnaround in 2021

The IMF is still forecasting a rebound in 2021, expecting the global economy to grow by 5.4% next year through that is still almost 7% below pre-coronavirus estimates.

Many countries around the world have announced re-openings of the economy, reflecting the global desire for a return to normality amid the coronavirus pandemic. The challenge, however, is that policymakers are still uncertain about how far to go in revealing populations to the renewal of full business activity. The International Monetary Fund (IMF) in its most recent assessment, released on Thursday, June 25, said that the outcome of reopening is far from certain.

This pandemic has led to a demand shock as businesses and households cut back spending. Globally, business lockdowns were at their most intense through mid-May but activity remains low compared to pre-coronavirus pandemic levels.

Meanwhile, the outlook for 2021 isn’t much better. In 2021, global growth is expected to rebound to a 5.4% growth rate, down 0.4 percentage points from the April forecast. The recovery is expected to be “sluggish” with the level of gross domestic product still about 6.5 percentage points lower than the pre-COVID-19 projections of January.

Notably, the fund said the “adverse impact on low-income households is particularly acute, imperilling the significant progress made in reducing extreme poverty in the world since the 1990s.”

The downturn is expected to hit bottom in the April-June quarter this year and then start to recover gradually.

The IMF stated in its release, “Similarly to the April 2020 projections, there is pervasive uncertainty around this forecast. The forecast depends on the depth of the contraction in the second quarter of 2020 (for which complete data are not yet available) as well as the magnitude and persistence of the adverse shock.”

The IMF said policy support can partially offset the deterioration in private domestic demand. But, in the baseline, global activity is expected to trough in the second quarter of 2020, recovering thereafter.

Consumption is projected to strengthen gradually next year, and investment is also expected to firm up, but to remain subdued. Global GDP for the year 2021 as a whole is forecast to just exceed its 2019 level.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.