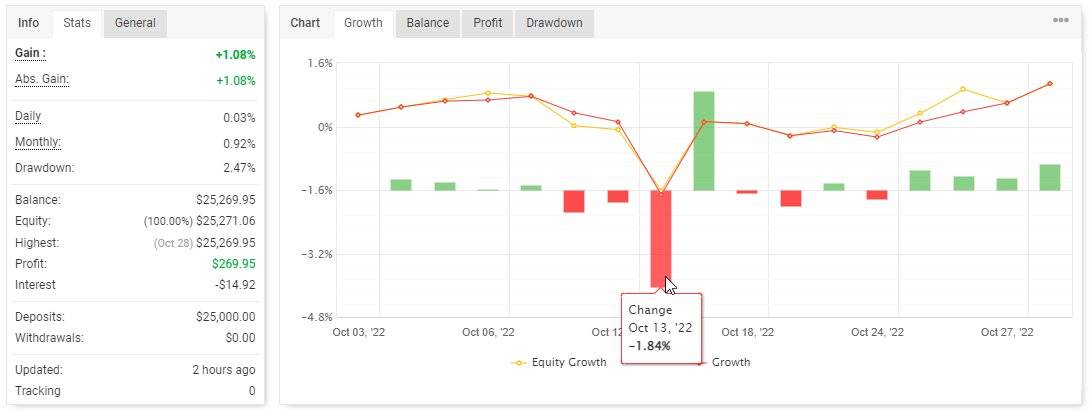

We returned +1.08% for the month of October on a drawdown of 2.5%.

The return of 1.08% graphically over the month of October looked like this:

October begun well but midway through the month there was a drawdown of 2.5% with a daily loss of -1.84%.

This was caused by a whipsaw movement across nearly all market instruments after US inflation news.

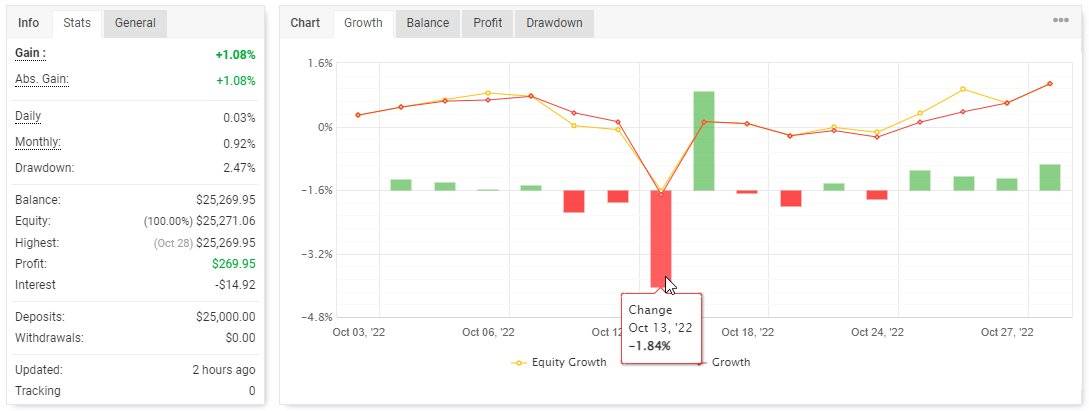

The chart at the time looked like this:

At this announcement, we held long positions, as the algorithms predicted the market to rise. Instead on the news the market dropped and our positioned exited incase the market dropped further.

The quick recovery into profit was due to the trading systems entering the market again with the expectation it would rise- and it did.

From the strong recovery we had a generally flat week of trading before finishing off the last week of October with a nice steady rise.

Had we not had that unfortunate market wide whipsaw our return would have been 2+% for the month- however in trading the good comes with the bad, and can only return what is given- and we were given 1.1% for October.

We move onto November with a long term outlook for safe, consistent trading but hope for another positive month.

Originally posted on https://www.bmams.com.au/

The post BMAMS: October 2022 Trading Result first appeared on trademakers.

The post BMAMS: October 2022 Trading Result first appeared on JP Fund Services.

The post BMAMS: October 2022 Trading Result appeared first on JP Fund Services.