By Bob Meara, senior analyst with Celent’s banking practice

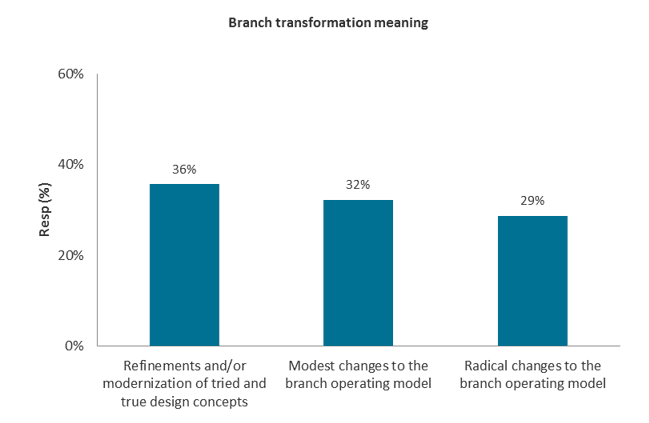

We asked that question in the past several biennial surveys of North American banks and credit unions. In the most recent survey, 160 institutions weighed in. Although the question is subjective, we asked respondents to tell us where their institution best aligned and offered three answers designed to get at how radically the branch needs to change to best deliver on its new sales and advisory focus along a spectrum from mere refinements to radical change:

- Refinements and/or modernization of tried and true design concepts

- Modest changes to the branch operating model

- Radical changes to the branch operating model

In this year’s sample there are apparently lots of “moderates” and not very many “radicals.” That may be good politically, but I find it problematic in banking. Just a third of surveyed institutions think what they need (most branch networks remain in transition) is something quite different than legacy branch archetypes designed 50 years ago primarily to efficiently administer cash, coin, and check transactions.

I understand that a bank’s vision for the branch network doesn’t necessarily define its strategy, but it is telling that a full third of surveyed institutions intend to simply tweak their branch network in response to the seismic changes in customer preferences and expectations we are witnessing. What planet are they on?

Looking into the data more carefully, one sees that most of “the third” are community financial institutions who serve comparatively rural and older branch-centric customers. Should they get a pass? With some degree of empathy, I don’t think so. Here’s why.

This isn’t the only data point that indicts this indefensible complacency at many banks. Celent recently finished yet another survey among its Branch Transformation Research Panel, a quasi-static panel of banks and credit unions invested in the topic. One of the key findings we will highlight in a forthcoming report is based on a glimpse into branch channel technology adoption. While not comprehensive, the picture is clear: many banks are asking front line staff to deliver highly personalized customer experiences without the tools to do so and are asking managers to orchestrate complex systems of personnel and processes without an adequate understanding of what’s happening across the network. Not good.

Another finding is particularly ironic.

Mobile capabilities in applications used by frontline staff are underappreciated by most banks, while enhancing customers’ mobile banking capabilities is every bank’s #1 priority. What’s good for the goose is good for the gander.

Customers aren’t visiting branches nearly as often as they used to, but when they do, their CX is exceedingly important.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals