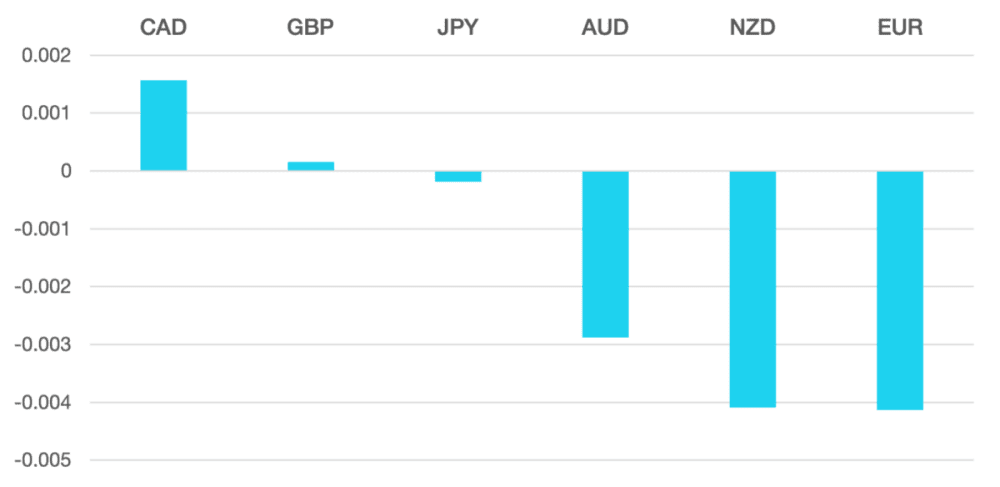

Last week the US Dollar gained slightly as we saw stiff resistance being met but the overall trend remains in place. Economic data was mixed including a stronger GDP number but softer CPE. The DXY gained a marginal 0.2% during the week.

The Euro remains on the back foot. The single currency is struggling with disappointing economic data releases and a dovish ECB. The Single currency lost marginally against the Dollar.

The Pound had a small positive week as PMI numbers beat expectations. Apart from that the Pound was subdued as markets look to the BoE release of this week.

Commodity currencies were supported by Oil but with the small Dollar strength gains were minimal. We had small falls for AUD and NZD, but NOK rallied, and JPY ended the week flat.

Oil continued its volatile trading with large weekly swings within the continuing range. Oil gained 6% to close above $78.

The week ahead is data heavy with interest rate decisions, with decisions from BoE and the Fed. We also have Nonfarm Payrolls on Friday.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Fed Cuts Priced in Now first appeared on trademakers.

The post Fed Cuts Priced in Now first appeared on JP Fund Services.

The post Fed Cuts Priced in Now appeared first on JP Fund Services.