“Venture capital financing has had another record quarter. Almost $30bn was invested in companies worldwide, a substantial growth on the amount of capital invested during the same quarter last year. Although the number of companies receiving funding is slightly down, the growth in capital being invested will be welcome to young firms looking for private investment,” says Christopher Elvin, Head of Private Equity Products at Preqin, a leading source of information, data and research on Alternative Investments.

Global Venture Capital delivered two consecutive quarters of strong deal making

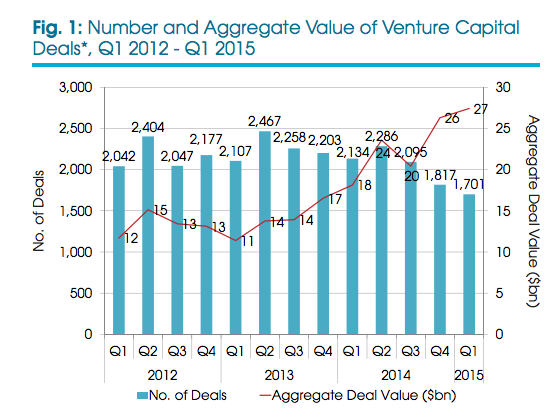

In the first quarter this year, the Global venture capital industry surpassed its own deal- making record established in the previous quarter. There was a 4% increase in the aggregate value of deals. Global venture capital investments in start-ups in Q1 this year exceeded $27bn, the highest ever in a quarter. Investments in Q1 2015 recorded an increase of 50% from US$18bn during the same quarter last year.

Source: Preqin, Venture Capital Investment in Q1 2015 Up 50% on Q1 2014

However, there was six percent drop in the number of companies receiving venture capital investment globally. The number decreased to 1,701 from 1,817 during the previous quarter. The average size of deals has been growing significantly over recent years. The average size of later stage deals in Series D or E financing round this year crossed $100mn, more than one-third jump from previous year. There were also big size investments exceeding $1bn each such as SpaceX and Uber Technologies.

In this quarter, the average value of angel and seed financing rounds was $1.5mn, the highest since 2007. It was 25% higher than the last year average.

“With the average size of deals growing significantly, there might be slight concerns that valuations for potential investments are becoming inflated,” says Christopher Elvin, head of private equity products at Preqin but adds, “VC deal activity to remain strong for the entire 2015.”

Source: Preqin, Venture Capital Investment in Q1 2015 Up 50% on Q1 2014 :

The U.S. Venture Capital firms raised $7.0 billion, up 21% over previous quarter

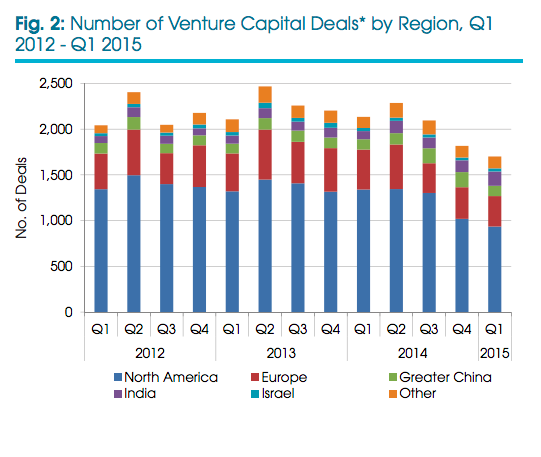

U.S. venture capital firms raised $7.0 billion in the first quarter, a 21 percent increase over last quarter. Investments are, however, concentrated in only some areas in the U.S. An analysis of data indicates that investment continues in high-growth companies clustered in the Northeast and West Coast – California, Massachusetts and New York. Major part of start-up investments went to just eight states out of 50 states in the U.S.

The number of funds raised during the quarter reduced to 61 funds, the lowest quarter for venture capital funds since the second quarter of 2013. It witnessed a decrease of 24 percent compared to the number of funds raised during the fourth quarter of 2014.

“The total number of funds raised during the quarter was down significantly from the banner fundraising year we witnessed in 2014. On the bright side, total dollar commitments was higher than the previous two quarters, a clear indication that investor demand for the asset class remains robust after a strong performance in 2014,” said Bobby Franklin, President & CEO of the National Venture Capital Association (NVCA).

A similar trend was seen in Europe Venture Capital. In Europe, the aggregate deals value at $2.8bn was 41% higher than that in the previous year. However there was 4% drop in the number of deals.

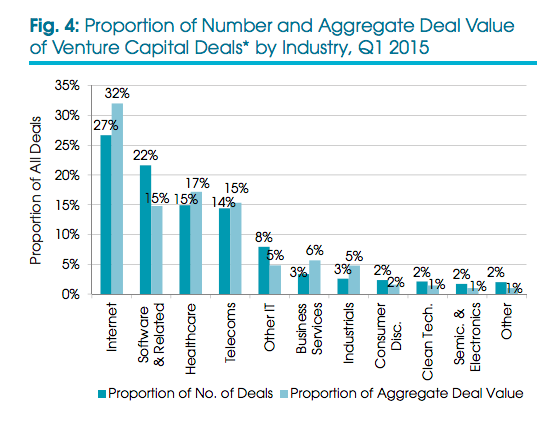

VC funding in healthcare IT sector drops 35%

Venture capital funding in the Healthcare information technology sector, which had witnessed 100% growth in 2014, could not sustain the growth rate. In the first quarter of 2015, venture capital funding for health information technology declined by 35%. According to Mercom Capital Group, a global communications and research firm, funding fell across the board with the exception of Mobile Health. Investors are watching the health start ups’ performance before making fresh commitments.

Source: Preqin, Venture Capital Investment in Q1 2015 Up 50% on Q1 2014

Dry powder up at $132bn

Dry powder, committed but unutilized capital has increased by 10% in three months. It is at $132bn at March end, up from $121bn at the start of the year. The managers are taking longer times to find suitable start-ups opportunities to invest.

To conclude, the venture capital is on the growth path. Start-ups investment has picked up. Managers have adequate funds to meet growing demand for risk capital by innovative start-up ventures. With revival of the global economy, the venture capital industry will see higher activities in 2015.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.