Possessing financial literacy is a vital skill in today’s economic driven society. However, numerous individuals still grapple with the intricacies of financial jargon, which can be both bewildering and daunting. To alleviate this issue, City Index conducted an analysis using Ahrefs, a search analytics tool, to identify the top 50 most perplexing financial terms based on their monthly search popularity.

Equity: The Most Perplexing Finance Term

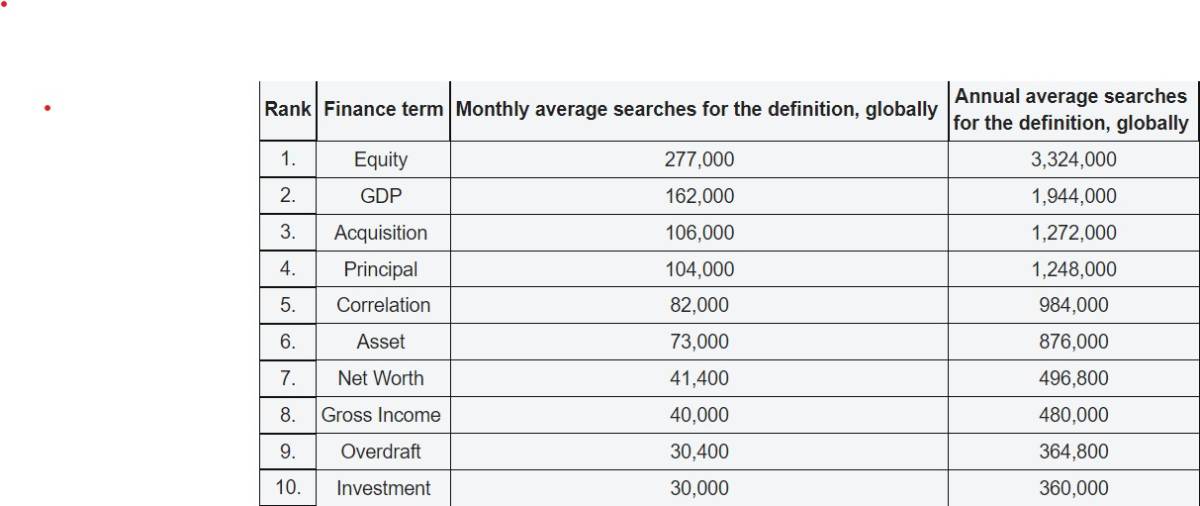

Sitting atop the list, ‘Equity’ stands as the most bewildering finance term with an average of 277,000 monthly searches for its definition. Notably, 8.1% of these searches originate from the UK. In comparison, the term’s definition is searched 9,700 times each month in Australia and merely 2,950 times in Singapore. Overall, the search frequency for ‘equity’ surpasses that of ‘GDP’, the second-ranked term, by 58.4%, with 162,000 monthly searches worldwide.

Rebecca Cattlin, a financial market expert at City Index, offers insight: “Equity refers to the figure that would be returned to a company’s shareholders if the business liquidated its assets and paid off any liabilities or debts. In simpler terms, if you own a business and your inventory, cash, and other assets equal £18,000 and any debts add up to £6,000 — you have £12,000 worth of equity — by subtracting any liabilities from your assets.”

‘GDP’: The Second Most Confusing Finance Term

The term ‘GDP’ takes the second spot with an average of 162,000 monthly searches globally. This marks almost a 35% higher search rate compared to ‘acquisition’, which ranks third with 106,000 monthly searches. Interestingly, the search frequency for the definition of GDP in India (17% of global searches) outpaces that of the UK (6%) by more than double. In total, the definition of GDP is queried almost two million times annually (1,944,000).

Rebecca Cattlin explains the term’s significance: “Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. GDP is used as a measure of the size and health of a country’s economy over a period of time. A declining GDP indicates a contracting economy and may foreshadow an impending recession.”

‘Acquisition’: The Third Most Misunderstood Term

Claiming the third spot among the most perplexing finance terms, ‘Acquisition’ draws an average of 106,000 monthly searches for its meaning. Surprisingly, a staggering 90% of these searches are from the United States.

Rebecca Cattlin clarifies the term’s essence: “An acquisition occurs when a company purchases most or all of another company’s shares to gain control of that company. An instance of an acquisition is Amazon’s purchase of Whole Foods for £10.7 billion in 2017 or Google’s acquisition of Android in 2005.”

Importance of Grasping Financial Jargon

The data may astonish some, as ‘Equity’ emerges as the most misunderstood finance term worldwide, with an average of 277,000 monthly searches for its definition. Yet, why is it so vital to comprehend financial terminology and specialized language?

“Financial terms, such as GDP, wield substantial influence over both business proprietors and the general consumer, often without their realization. The possibility of an impending recession stemming from a contracting GDP can lead to heightened mortgage rates for homeowners and heightened financial perils, including business insolvency. Consequently, the comprehension of financial jargon has never been more crucial, enabling us to grasp the economic landscape and its impact on us,” Rebecca Cattlin concluded.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.