The success of a Forex trader relies on their knowledge of market trends. Prices move upwards or downwards based on different factors. From domestic policy changes to international trade wars, the sheer number of factors that influence trading is daunting. Luckily, the expert community has developed Forex strategies that may be adopted by newbies in South Africa. Here are the most popular approaches to prediction.

Forex traders make a profit or loss based on the accuracy of their forecasts. If you expect the base currency in your pair to gain value, you can buy more lots in order to benefit from the expected rise. If a downtrend is anticipated, traders are likely to sell their instruments before the drop. This way, they can purchase larger volumes of the same assets at a lower price.

Hedging the Risks

In South Africa, reliable brokers like FXTM provide clients with state-of-the-art tools that facilitate decision-making. Trading terminals like MetaTrader 5 offer a variety of graphs and charts, as well as a special calendar.

Visuals provide sufficient data for in-depth market analysis. Meanwhile, the ‘take profit’ and ‘stop loss’ indicators allow automatic execution of trades at the most favorable levels. Overall, with modern technical features, online trading can be mastered by anyone who is willing to learn. Here are two fundamental methods that form the basis of successful strategies.

Fundamental Analysis

Every trader needs to be aware of key political and economic factors that sway currency values. Each pair is connected to the money systems of two countries, and these must be watched closely. The range of possible drivers includes both micro- and macroeconomic indicators.

In the fundamental analysis realm, traders pay attention to news concerning the health of the related economies. Conclusions are based on current data describing their strength. For instance, traders will pay attention to the following:

· Interest Rates

When interest rates for investment rise, more capital flows into the country. Holders of assets choose locations with the most welcoming climate. As a result, the currency appreciates.

· GDP

This is a crucial indicator of economic power. It measures economic activity in the country overall. Basically, it reflects the sum of all products and services produced over a certain period. The higher the value – the higher the probability of better interest rates and currency appreciation.

· Employment

Growing unemployment points to the weakness of the economic system and eventually leads to lower interest rates. These, in turn, cause the currency to depreciate.

· Trade Balance

The deficit in this field is a negative sign. It means that imports are bigger than exports. When the demand for the country’s products is low, there is a low demand for the currency. As a consequence, it loses value. In addition, important factors include:

· budget,

· inflation,

· manufacture.

Finally, economics is intertwined with geopolitics. Even speeches by high-ranking politicians can affect currency values. Important statements are referred to as ‘concrete economical announcements’. If this concerns the US government or economy, they are especially vital. Most traded pairs include the USD, which is the dominant currency worldwide.

Technical Analysis Aids

So, how can you keep track of all potential factors? The task seems daunting and it would be a challenge without modern tools. Traders keep an eye on the standard economic calendar. It shows predictions based on available economic indicators and recent history. Generally, such dedicated calendars reflect the following aspects:

· time,

· date,

· currency,

· new data,

· actual,

· forecast,

· previous.

Technical Analysis

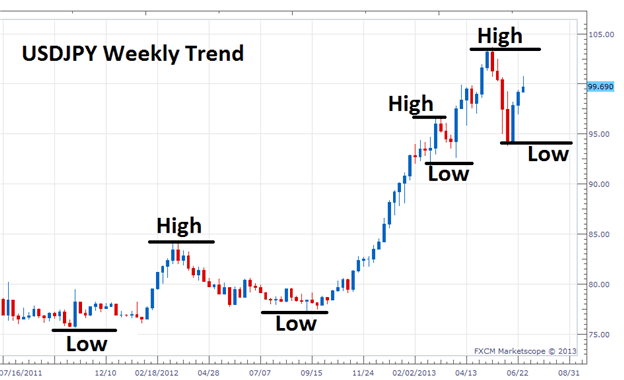

This dimension rests on price data, aiming to spot patterns and foresee future movement. The fundamental principle is the inevitable repetition of regularities – i.e., trends. Price-based patterns are referred to as signals.

The objective is to reveal current signals by looking back at preceding ones. This is used for daily forecasting. Adherents of technical analysis discard randomness and view fluctuations as predictable in nature.

The range of tools includes visual aids representing market data – price and volume charts. Analysts aim to spot entry and exit points for intended trades. Successful strategies help identify trends and understand their potential strength and stability. A trader will zoom in on the following indicators:

· trends (upward, downward, or sideways),

· strength of trends (based on volume/open interest),

· volatility (the scope of fluctuations observed daily),

· cycle indicators (recurring market patterns),

· support and resistance (levels at which prices grow or fall before reversal),

· momentum (probability of the trend losing or maintaining strength after a certain period).

The Bottom Line

Forex predictions require knowledge and experience. Successful traders analyze the market constantly, using different strategies and tools. The fundamental and technical systems are two major approaches that should be studied closely. They can also be applied simultaneously.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals