J.P. Morgan and Societe Generale have invested in fintech firm, Wematch, as the company advances its plans to transform traditionally voice-traded financial markets.

Wematch provides technology which augments how traders at banks match, negotiate and manage trades. This brings the audit and control benefits of electronic tools to voice trading, delivered as web-based software-as-a-service technology.

It was that pontential what took J.P Morgan to invest further in the company as Pasquale Cataldi, Head of Markets Lab, J.P. Morgan, points out: “J.P. Morgan was an early supporter of Wematch. As a member of our InResidence Programme, the platform showed real potential to transform the interbank interest rate dealing market through automation, resulting in audit and control benefits. The level of market adoption has already been encouraging and we’re delighted to continue the journey with them.”

Likewise, Albert Loo, Deputy Head of Sales for Global Markets at Societe Generale, added: “Societe Generale is excited to contribute to the Wematch development after a successful collaboration within our Global Markets Incubator. Innovation in trading technology will drive efficiencies for market participants and we strongly believe that Wematch can sustainably improve dealing processes across asset classes.”

According to data provided by the company, there are now 40 banks and more than 750 traders on Wematch cross assets with more onboarding and billions of dollars in deal flows matched using its technology.

Despite the growth and benefits of e-trading, in some markets institutional investors still conduct most of their trading over the phone, or through interdealer brokers. It is at this point were Wematch’s solution enter as it delivers the benefits of the newest web technologies to traders at banks, improving the matching and negotiation process, cutting costs for banks and increasing efficiency and reducing conduct risk for traders.

Gregory Mimoun, co-CEO of Wematch, said: “Wematch is delivering the next generation in trading protocols, with intuitive GUIs and workflow tools to give voice trading professionals the edge. Everything we build is designed to support the trader’s decision, giving them the tools to make the right call with confidence and certainty.”

Wematch came through J.P. Morgan’s In-Residence Programme and Societe Generale’s Global Markets Incubator to foster the expansion of the fintech’s offer across asset classes and instruments.

The funding takes J.P. Morgan’s and Societe Generale’s relationship with Wematch from users to investors, with the banks already active on Wematch across all existing platforms.

There is enormous potential for Wematch to help the capital market industry in further adopting digital solutions across multiple markets globally, and to adapt this awarded technology to internal and client-facing solutions.

Despite pressure from regulators for more trades to be conducted on electronic trading venues, it is estimated that over 80% of structured products and FX derivatives are still transacted by voice.

The interest rate swaps market is worth USD 2.1 trillion a day, according to the Bank for International Settlements, with over 70% of that business handled by phone negotiation.

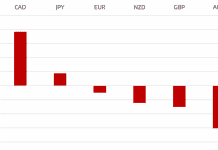

Wematch launched its interest rates offering in June, with 10 banks matching and negotiating Euro IRS curves, butterflies, basis and gadgets structures, with single stock & Index options to follow in the coming months. This was built on existing Wematch services for securities lending and equity derivatives and the firm now plans to build out services to more asset classes and instruments.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals