The gender balance is something still very sensitive for the finance industry. This series of articles on women in alternatives have examined the findings of a study carried out by KPMG into this topic. The first part reported on the survey itself and the current status of women in the industry. The second part handled women’s projections for 2016.

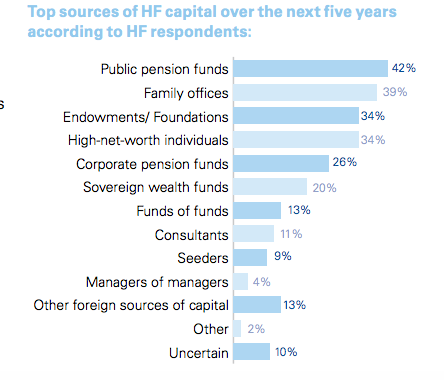

This third part in this series looks ahead further, to 2020, where more change is afoot. One of the biggest changes that is predicted is an increase in institutional investors. Responding to the survey, almost 60 per cent of hedge fund participants reported that they felt that capital inflows would improve, and lower than 10 per cent said it would worsen. Public pension funds were expected to lead inflows into this sector.

Source: KPMG, Breaking away, The path forward for women in altnernatives

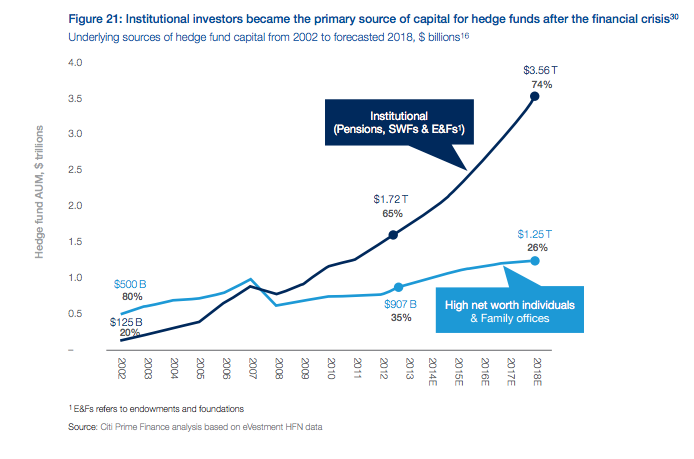

The World Economic Forum (2015) to some degree agrees with this assessment. They report that:

“Sources of capital for the industry have evolved over time… the capital base has steadily shifted from small scale long term investors to large institutional investors (e.g. pension funds).”

Indeed, the World Economic Forum (2015) explains that pensions are the biggest investors with the greatest influence in the alternative investments industry overall. It was reported by the World Economic Forum that pension funds, either corporate or public comprise investments that make up $38 trillion. Putting it in other words, this is the biggest group of institutional capital in the world. It is explained that larger and more advanced funds have worked with alternative firms for investments and these organisations have a say in the shaping of the industry, just through their activities alone. They are argued to be particularly important with regard to growing the transparency of the industry and cutting back on fees in investments in this area.

Source: WEF, The Future of Alternative Investment, October 2015

According to KPMG research (2015) many women believe that pension funds will be very important players in the industry in the upcoming five years. However, some reported that pension funds were finding it hard to get the level of exposure hoped for with hedge funds, given their large size. This means that despite the increases, some organisations are looking for cheaper and more liquid approaches. Nonetheless it is fully expected that since these organisations have such a large amount of capital to invest they will continue to play a massive role in the alternative investment industry, specifically in hedge fund capital raising. It is anticipated that fund managers will be feeling the pressure of this.

In the years ahead the women also predicted that there would be a shift towards sovereign wealth for venture capital and private equity fund raising. Top sources of private equity and venture capital over the next five years according to those currently running and working on funds felt that sovereign wealth funds would be the biggest contributor, with 54% reporting this. However, 51% still believe that high net worth individuals will be an important source of capital in these areas, and family offices were thought to be a top source for 45%. In this area, pension funds were only thought to be a top source for 36% of respondents.

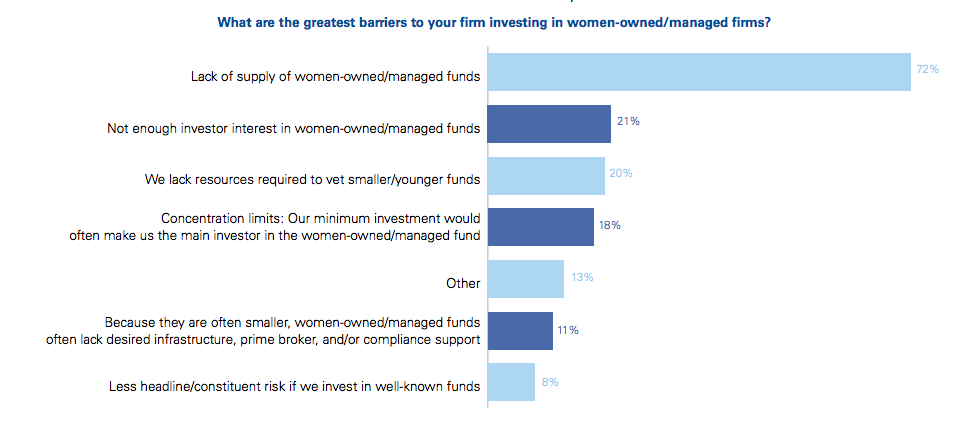

Turning to demand for women owned or women managed firms, 43% felt uncertain whether mandates would increase the demand for women owned or managed funds in the upcoming years. Investors felt more positive about this than fund respondents. Just 31% of fund professionals believed that mandates would increase demand. However, none of the investors included in the survey believed that there would be a decrease in their capital in women owned or women managed funds. On a positive note, 26% expected to be increasing their allocations to women owned or women managed funds.

Source: KPMG, Breaking away, The path forward for women in altnernatives

Overall, 65% of the participants in the survey felt that investments in women owned or managed funds were positive, with only 2% responding negatively. Some felt that they were conflicted on this topic since there could be stigma associated with getting a mandate like that. One of the unfortunate conclusions of one woman was that there is too much focus on the idea of a “women led” firm rather than a “good firm” when really that shouldn’t necessarily be drawn into the thinking. Many felt simply that women owned funds should be handled in exactly the same way as male owned funds.

In conclusion to this series it can be seen that women have made great strides. Yet until women led firms start being treated or judged in the same way as male led firms, equality may not be achieved. Here’s hoping that women progress their position further by this time next year.

Related Posts:

Women in Alternatives: 2011 vs. 2015

Women in Alternatives: What’s coming in 2016?

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.