By Donald A. Steinbrugge, CFA – Founder and CEO, Agecroft Partners

The Chartered Financial Analyst Institute (CFA), one of the most important organizations in the investment industry, is expected to announce performance presentation standards for the hedge fund industry sometime later this year. Currently, they are formulating their recommendations and we applaud their efforts. Ideally, these standards should benefit hedge fund managers by leveling the playing field on which they compete, as well as investors, by providing consistent information that will enhance their investment decision making process. It is extremely important that the CFA Institute achieves both objectives in order to have broad adoption across the industry. Now is the time for the hedge fund industry to speak up. Agecroft Partners feels compelled to share our updated views on what we expressed earlier this year in an educational video hosted at the CFA Institute.

Today, there is no consistency across the hedge fund industry in how net performance is calculated and presented. There is some consistency in performance and risk disclosures, but they provide very little clarity. Most disclosures offer worst case scenarios as hedge fund law firms seek to limit their client’s liability. This does help keep less sophisticated investors away. Unfortunately, this type of disclosure provides limited information to be used by sophisticated investors to measure risk-adjusted performance across managers.

The most important issue that needs to be addressed is standardizing how to calculate and present a hedge fund’s net performance. One might suggest simply subtracting all fees and expenses from gross returns. Unfortunately, most things are not as simple as they first appear. Here are four scenarios that illustrate the inconsistent ways various fund managers calculate performance:

1. A hedge fund is launched with non-fee-paying partner capital. After two years of managing internal capital only, they begin to add external capital to the fund.

- Some hedge funds will show the net performance of the fund. This will overstate the manager’s skill level, since there were no fees charged for the first two years thereby inflating the net return. The average fee charged in later years will continue to be below the stated fees due to the non-fee-paying assets of the fund.

- Other managers calculate their performance assuming that all assets in the fund paid full management and performance fees from day one.

The difference between these two approaches, assuming a 10% gross return and 1.5% management fee with a 20% performance fee, is more than 3% annualized during the first two years of the fund. This difference in performance is unacceptably misleading. While past performance does not guarantee the future, this data is an important part of the fund selection process.

2. A hedge fund is launched with a reduced fee founder’s share class at a 1% management fee and 10% performance fee. Once the fund reaches $150 million in assets, the founder’s share class is closed to new investors with the reduced fees grandfathered for current investors. New clients are required to pay full fees at 1.5% and 20%. In this situation, we have seen hedge funds calculate net performance in the following three ways:

- Net performance of the fund includes the founder’s share performance in the early years and then adds the higher fee share class once the founder’s share is closed.

- Net performance is calculated from day one assuming there was no founder’s share discount and full fees were paid on all assets in the fund. This approach puts the founder’s share class at an unfair marketing disadvantage if this share class is still open for subscriptions as investors in the founder’s share would have a higher net return than the full fee share class.

- Performance is calculated net of the founders share fees until the share class is closed and then restating performance from day one assuming all assets of the fund had paid the higher full fee schedule since the inception of the fund.

3. A hedge fund manager charges a graded fee schedule, where average fees decline for larger allocations. Once again, there are multiple ways of calculating net performance, including the net performance of the fund or assuming all investors in the fund had paid the highest fee schedule.

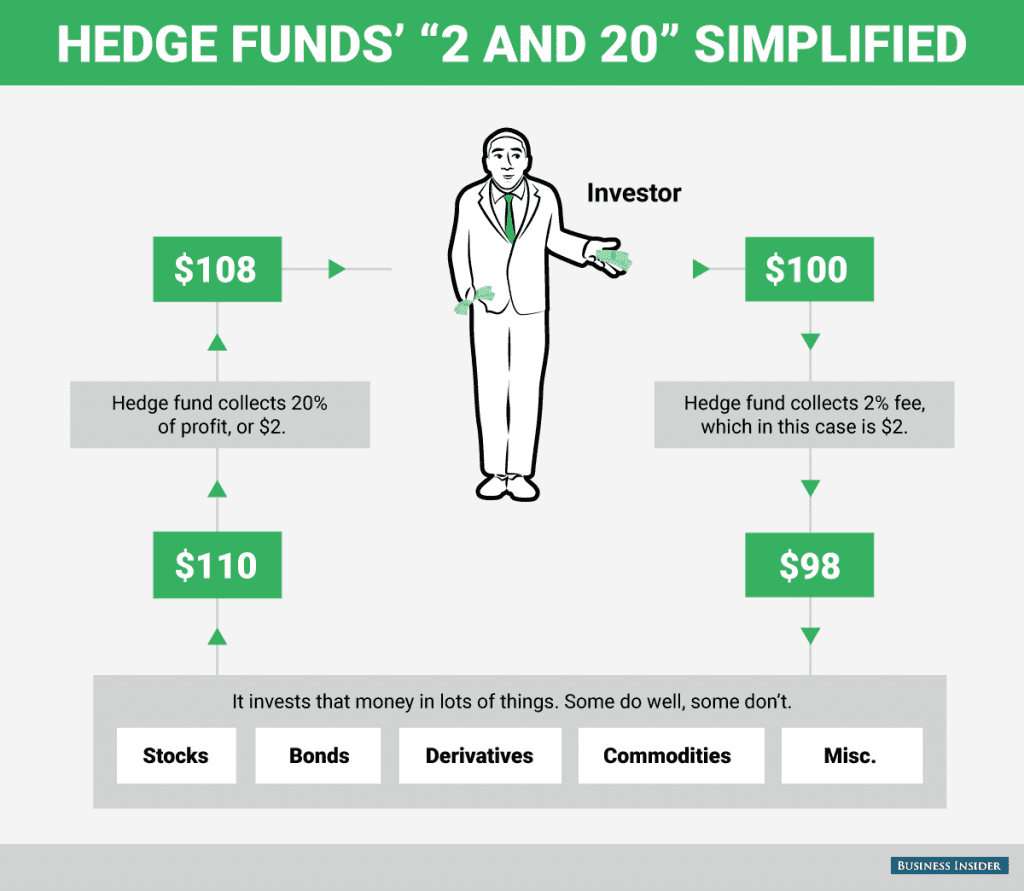

4. A manager charges 2% management fee and 20% percent performance fee in the early years of the fund but decides to reduce their fee schedule to 1.5% and 20% to be more in line with market standards. This scenario creates the opposite pattern to that of the founder’s share class example (and something we expect to see more of in the future). In this scenario, presenting fund returns since inception understates net returns with respect to the fees currently charged.

Agecroft Partners believes the industry standard should be that hedge fund net performance reflects the current highest available fee schedule and assumes it is paid on all assets in the fund since its inception. If fees are raised or lowered, historical performance should be restated to reflect net performance since inception based on the currently available fees. The one exception would be if the change in fees coincided with a major change in how the fund was managed.

Additionally, the CFA is reported to address other issues regarding hedge funds and investment funds later this year. Particularly sensitive are those of Security valuation guidelines; Expenses allocated to the fund; Assets under management used to calculate performance; How to handle performance for Separate Accounts and Funds-of-One; Simulated track records and The Alternative Investment Management Association (AIMA) Due Diligence Questionnaire (DDQ). To find out more about what’s those changes are about and how they are going to affect the hedge funds industry, stay tuned for the next entry tomorrow.

About the author

Don is the Founder and CEO of Agecroft Partners, a global hedge fund consulting and marketing firm. Agecroft Partners has won 38 industry awards as the Hedge Fund Marketing Firm of the Year. Don frequently writes white papers on trends he sees in the hedge fund industry, has spoken at over 100 hedge fund conferences, has been quoted in hundreds of articles relative to the hedge fund industry and has done over 100 interviews on business television and radio.

Don is also chairman of Gaining the Edge-Hedge Fund Leadership Conference; consider one of the top conferences in the hedge fund industry. All profits from the conference are donated to charities that benefit children.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals