The alternatives industry is undergoing considerable change. Fund managers have had to focus on improving the efficiency of their operations, increasing transparency and making sure that interests line up. Most companies and people in this industry are dealing with, or expect to be addressing an increase in competition for capital. There is likely to be a corresponding increase in new products that are customisable, and fee approaches that are different than in the past. Other anticipated changes are the fact that large funds are getting very big, while smaller funds are competing for the left over capital.

According to KPMG research (2015):

“Women run funds may find capital raising more challenging than their male peers.”

This was not an observation plucked out of thin air – rather it was based on a study that KPMG carried out with female alternative fund managers. Female alternative investment fund managers and investors were invited to take part in an online survey, which led to some interesting findings. The study aimed to look at women’s successes and challenges in the industry to move the situation forward for the better. The study focused on gaining view points from a range of different females working in the industry, and in total 328 women were surveyed. The surveys were enhanced through some in-depth interviews as well. Twenty five per cent of those surveyed had 20 years of experience in financial services, and nearly 50% were found to have 11 to 20 years’ experience.

Women in Alternative Investment in 2011

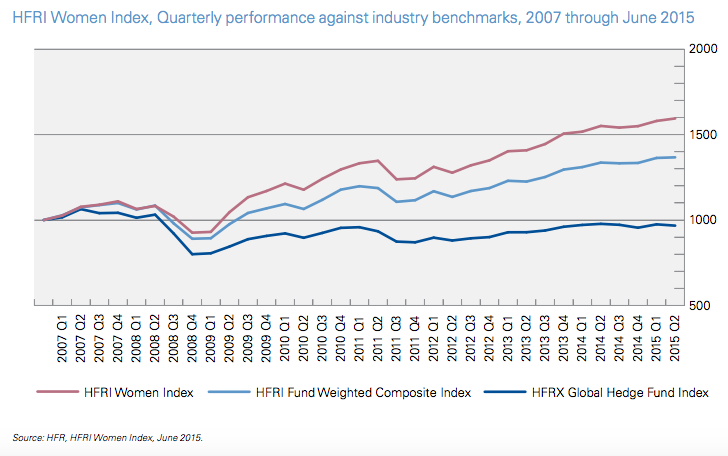

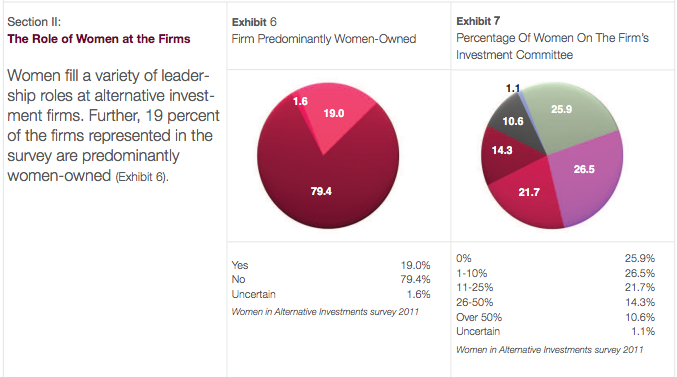

According to Rothstein Kass, back in 2011 there were more women than ever before managing alternative investment funds. This was an interesting development at the time, since just a few years before that there had only been a few women really having an impact in this area.

Source: Women in Alternative Investment Industry Outlook and Trends, 2011, by Rothstein Kass Institute

Rothstein Kass found that there were significantly more women involved in the industry and these women were starting to have a noteworthy impact on the direction of the industry overall. At that time, 65 per cent of the survey respondents said that they felt that their gender made it much harder for them to succeed in the industry that they had chosen. This was a problem exacerbated by the fact that there are stereotypes in the workplace that lead to the idea that women are more focused on family and personal responsibilities and less interested in their careers. Nonetheless, 25 per cent of those surveyed had expected to be managing their own fund within a five year time frame. All of these figures are interesting when comparing them with the situation uncovered by KPMG in the most recent survey.

Woman in Alternative Investment in 2015

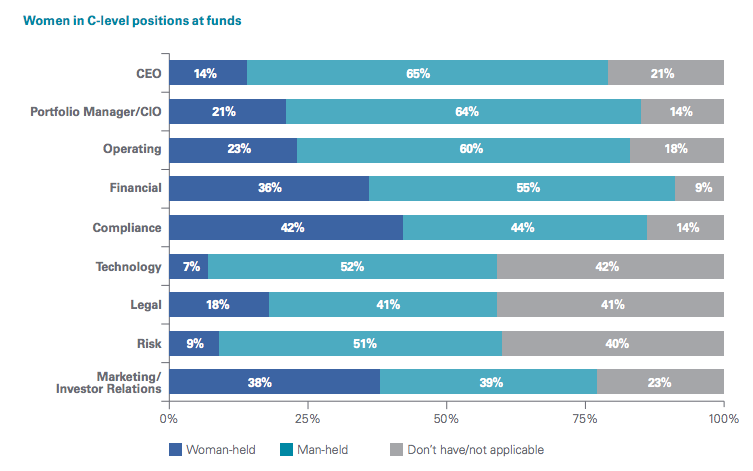

Although situation shifted considerably since 2011, KPMG identified to some degree that women still have a glass ceiling to break through in the alternatives investment industry. KPMG reported that most of the women surveyed held C-level positions in various areas such as marketing or finance, but few were found in CEO, CIO or portfolio manager positions.

Source: Breaking away, The path forward for woman in alternatives, Sept. 2015, KPMG

However, when looking at this in greater depth it was found that women have greater representation at CEO, CIO or portfolio manager levels in hedge funds, rather than in private equity or venture capital where they were still under represented. More concerning, it was discovered that 39 per cent of firms included in the survey had no females at all on their investment committee, and 40 percent were found to have no general partners who were females. Women were found to be the majority on investment committees in just seven per cent of cases. This is clearly an area where change will be needed to redress the balance, and women will continue to have to fight stereotypes to break the glass ceiling in the alternatives investment industry.

In no areas of the alternative investment businesses did women hold a greater percentage of the roles than men. They came the closest to this in compliance (women held 42% of roles and men, 44%), marketing and investor relations (women held 38% of roles and men 39%) and financial roles (where women held 36% of roles and men, 55%). The areas where women were represented particularly poorly were risk, technology and legal, along with the senior positions already outlined. Against this background, the following two parts of this three part series examine perspectives of women in this industry for 2016 and 2020 in turn.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.