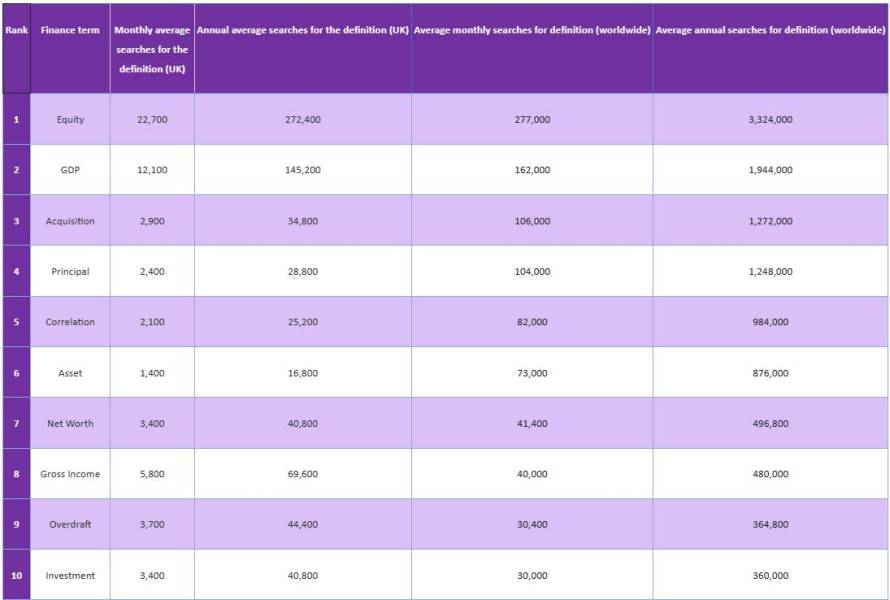

City Index’s latest study unveils the top 50 most confusing financial terms, shedding light on the challenges people face in navigating the complex world of finance. ‘Equity’ emerges as the most misunderstood term, dominating online searches with 277,000 monthly queries globally, while ‘GDP’ and ‘Acquisition’ follow closely.

As UK inflation hits 4% in December, delving into the intricacies of finance becomes paramount. However, many are still grappling with the complexity of financial terms, as revealed by City Index’s comprehensive study. Using Ahrefs, a search analytics tool, the study identifies the top 50 most confusing financial terms, offering insights into the challenges people encounter. In a world where economic decisions impact daily lives, comprehending these terms is not just a choice but a necessity.

Rebecca Cattlin, a financial market expert at CityIndex, comments:

“Financial terms, such as GDP, have a huge impact on both business owners and the average consumer; perhaps, without many even realising it.

A looming recession as a result of shrinking GDP can lead to increasing mortgage prices for homeowners and increasing financial risks, such as business failure and bankruptcy

Therefore, it has never been more important to understand financial jargon, the economic world around us and how we are being affected.”

Top Most Confusing Financial Terms

‘Equity’ ranks as the most confusing finance term with an average of 277,000 monthly searches for its definition, with 8.1% (22,700) of these searches coming from the UK. In comparison, the meaning and definition of ‘equity’ are searched 9,700 times each month in Australia and just 2,950 times in Singapore. Overall, the meaning of ‘equity’ is searched 58.4% more frequently than the term ‘GDP’ in second place with 162,000 monthly searches around the world.

Rebecca Cattlin, a financial market expert at City Index, comments: “Equity refers to the figure that would be returned to a company’s shareholders if the business liquidated its assets and paid off any liabilities or debts. In simpler terms, if you own a business and your inventory, cash, and other assets equal £18,000 and any debts add up to £6,000 — you have £12,000 worth of equity — by subtracting any liabilities from your assets.”

‘GDP’ is the second most confusing finance term, with an average of 162,000 monthly searches for its definition around the globe, with 12% of these searches coming from the UK. ‘GDP’ has almost 35% more searches than ‘acquisition’ in third place with 106,000 monthly searches. The definition of GDP is Googled over twice as frequently in India (17% of all global searches) than in the UK (6%). In total, the meaning of GDP is searched almost two million times each year (1,944,000).

Rebecca Cattlin, a financial market expert at City Index, comments: “Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. GDP is used as a measure of the size and health of a country’s economy over a period of time. GDP falling shows that the economy is shrinking, and can be a sign of a looming recession.”

‘Acquisition’ is the third most widely misunderstood finance term, with its meaning searched for on average 106,000 times each month. Interestingly, as many as 90% of all searches for ‘acquisition definition’ come from the United States.

Rebecca Cattlin, a financial market expert at City Index, comments: “An acquisition is when a company purchases most, or all of another company’s shares to gain control of that company. An example of an acquisition occurred in 2017 when Amazon purchased Whole Foods for £10.7bn, or Google’s acquisition of Android in 2005.”

‘Investment’ places 10th with 30,000 searches for its definition each month on average, just 400 searches fewer on average than ‘Overdraft’ (30,400 global searches per month).

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals