A new research has been released by State Street Corporation about The Impact of Brexit on the UK fund management industry. The report surveyed 100 institutional and alternative investors comprising hedge funds, real estate funds and private equity firms to analyse the outlook for the UK fund management industry after it finalises its exit from the European Union.

According to the latest research, more than one-third of survey respondents (34 percent) believe there will be an increase in merger and acquisition activity within the fund management sector, driven by European fund managers looking to acquire UK-based firms to give them a presence in the local market post Brexit.

Against this backdrop, while the survey’s overall findings suggest a fairly negative outlook for the UK fund management industry after Brexit, there is still strong appetite for companies to maintain and grow their presence in the UK.

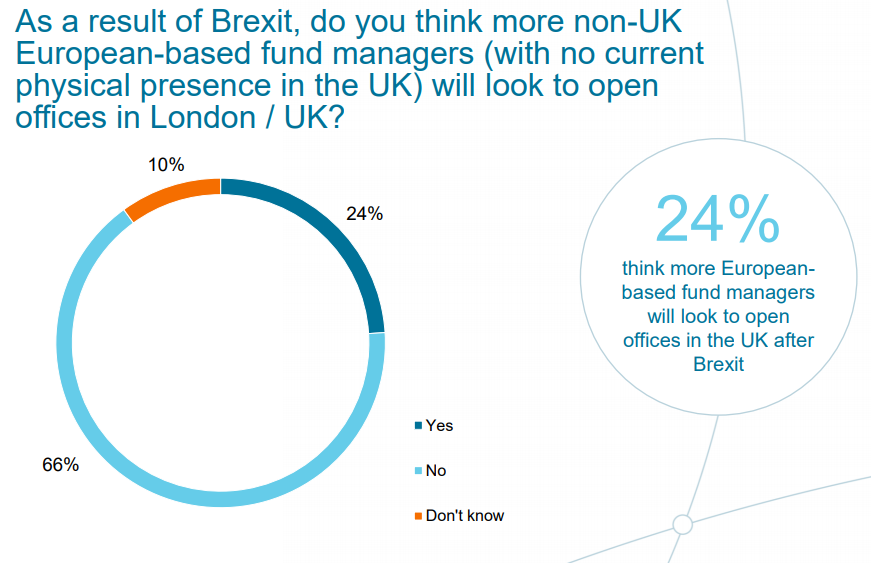

Nearly a quarter of survey respondents (24 percent) believe that more European-based fund managers will look to open offices in the UK after Brexit. Furthermore, the fund structures that investors believe will prove the most popular for European and other foreign fund managers looking to expand their UK operations include Investment Trusts (44 percent), Unit Trusts (21 percent) and Open Ended Investment Companies (20 percent).

Other key findings include:

- Nearly a quarter of survey respondents (24 percent) believe that more European-based fund managers will look to open offices in the UK after Brexit (where they don’t already have a presence). 22% think more Asian and US fund managers will open more offices here

- 15% think non UK European based fund managers who already have offices in the UK will add to their number of employees in the UK as a result of Brexit

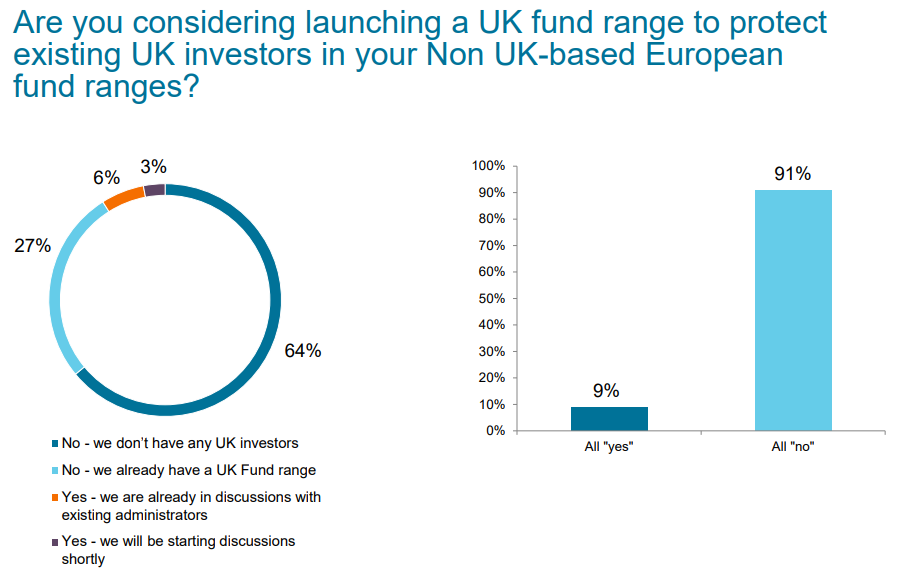

- Main reason given for non-UK based fund managers expanding operations in the UK post Brexit is the belief that the UK is home to a huge amount of investment management expertise and knowledge. The second main reason is the size and growth expectations of the UK market – they will increasingly want to target UK investors

- 55% of respondents think UK authorities will make it more appealing to open London offices post Brexit

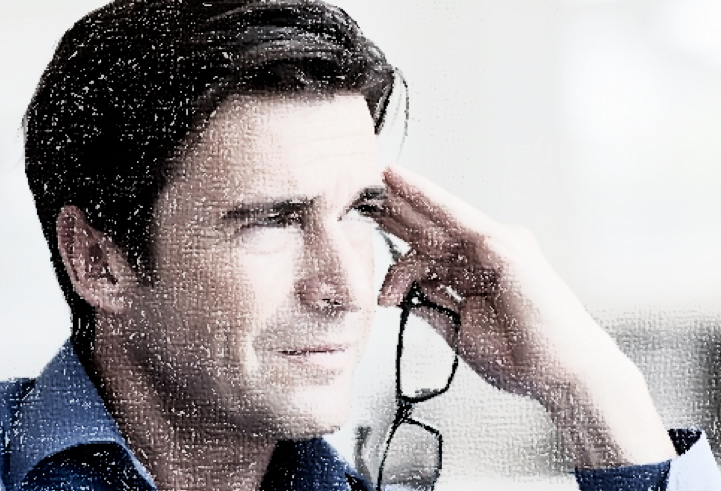

- 9% of fund managers are currently considering launching a UK fund range to protect existing UK investors in their non UK based European fund ranges.

- The fund structures that investors believe will prove the most popular for European and other foreign fund managers looking to expand their UK operations include Investment Trusts (44 percent), Unit Trusts (21 percent) and Open Ended Investment Companies (20 percent).

“Our research suggests that, despite the headwinds and complexity that Brexit is causing, the UK is still a hub for a tremendous amount of investment management expertise, and an attractive centre for fund management activity in Europe,” said Brian Allis, head of State Street Global Services’ EMEA product team. “It is reassuring to see that, however negative the outlook for the UK fund industry may be right now, investors still want to maintain and grow their presence locally.”

State Street Corporation (NYSE: STT) is one of the world’s leading providers of financial services to institutional investors, including investment servicing, investment management and investment research and trading. With $33.99 trillion in assets under custody and administration and $2.81 trillion in assets under management as of September 30, 2018, State Street operates in more than 100 geographic markets worldwide, including the US, Canada, Europe, the Middle East and Asia.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals