In recent years, Latin America has become very important for cryptocurrency use because of economic changes, a lot of inflation, and more people wanting digital financial services.

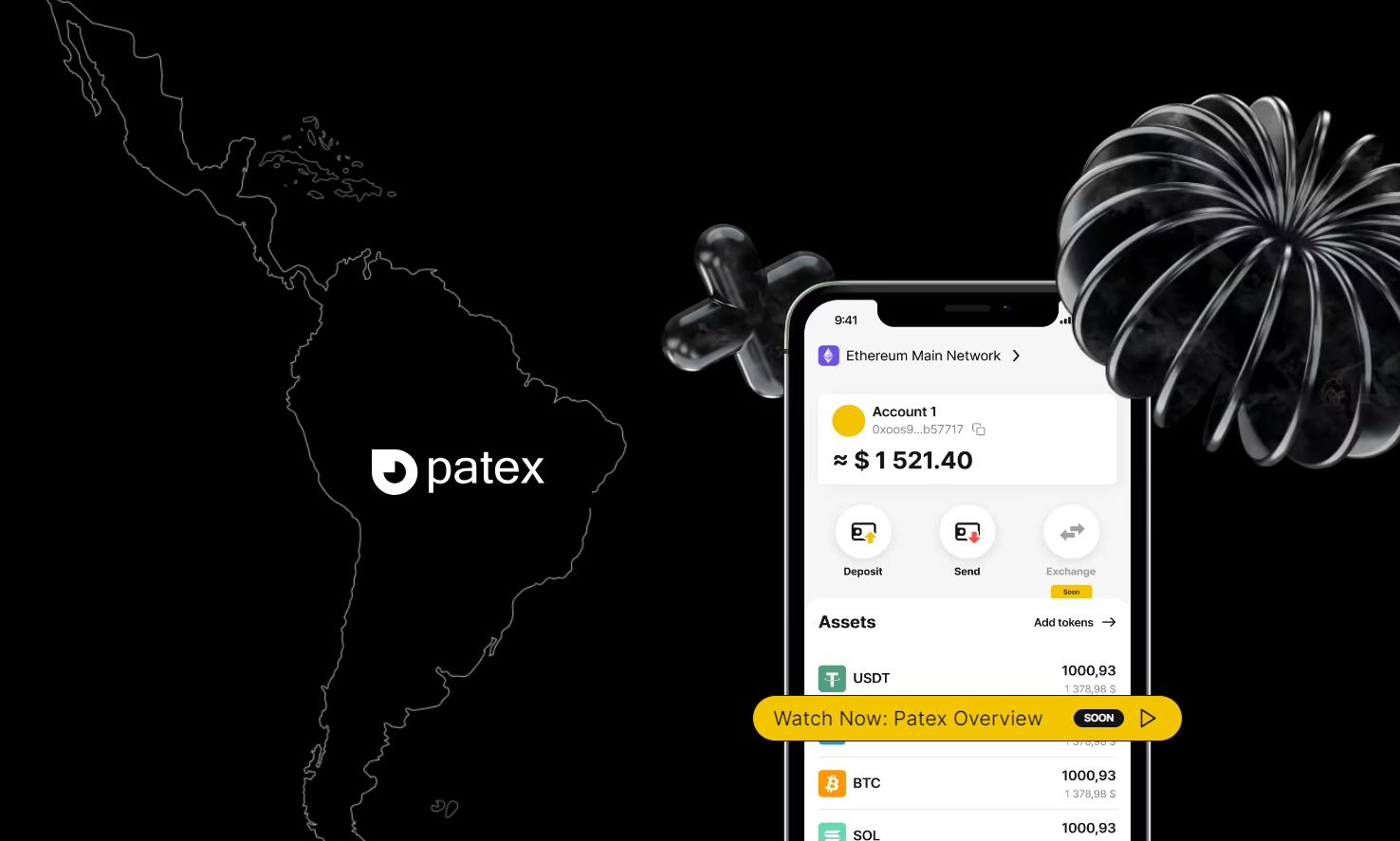

In this fast-changing environment, one cryptocurrency is standing out: PATEX. The way Patex the biggest blockchain ecosystem in Brazil is becoming famous in Latin America shows not only its strong technology but also how it meets the special needs and hopes of the people there.

PATEX (the ecosystem’s native token) has a new way of working with digital currency. It really captures what the Latin American market wants in a cryptocurrency:

- stable,

- safe,

- easy to get.

It is more than just online money, unlike other world cryptocurrencies. It’s a tool to help people control their money better and gives hope to many in a region with many money problems.

This article will explore the core reasons why PATEX is the top cryptocurrency in Latin America. It will look at its special features, how it fits in the market and its big role in the region’s financial world.

Overview

PATEX, the native token of the Patex ecosystem, plays a pivotal role in this innovative blockchain network. As a governance token, it empowers users with decision-making capabilities, influencing the direction of the ecosystem’s development. The utility of PATEX extends beyond governance. It serves as a versatile tool within the C-Patex Exchange, one of the key components of the ecosystem.

Function of PATEX

The diverse uses of the token reflect its multifaceted nature. On the C-Patex Exchange, it functions as a means to pay trading fees, providing a streamlined and cost-effective trading experience. This token is about transactions and community engagement, too. Users can earn PATEX tokens by participating in network activities, contributing to the ecosystem’s vibrancy and growth.

Moreover, PATEX allows users to access special features of C-Patex Specializations. These specializations offer advanced functionalities, enhancing the user experience and offering deeper insights into the crypto world.

The token also plays a role in education and learning through the Patex Campus. By completing various levels of quizzes and learning modules, users can earn PATEX, making education rewarding in a literal sense.

In terms of network support, PATEX is used to distribute rewards among validators. This mechanism ensures the smooth functioning of the blockchain, rewarding those who help maintain its integrity and security.

Market Performance and Adoption

PATEX stands as a pioneering force in the Latin American cryptocurrency landscape. Its significance is amplified by being the first crypto serving the vast population of 670 million across the region. This revolutionary token adopts a community-centric block model, a contrast to the traditional miner-reward systems, fostering a more inclusive and participatory digital finance environment.

Latin America’s embrace of PATEX is reflected in its impressive market growth and public sentiment toward digital assets. The region, ranking 7th globally in cryptocurrency market size, witnessed an extraordinary 40% growth in crypto transactions in 2022, totaling $562 billion. This surge highlights the increasing trust and acceptance of cryptocurrencies like PATEX among Latin Americans, with over half the population engaging in crypto transactions.

The rising popularity of PATEX can be attributed to its alignment with the region’s unique financial capabilities. Latin America, despite its robust $5.5 trillion cumulative GDP, faces some of the world’s highest inflation rates. This economic backdrop creates a fertile ground for cryptocurrencies.

PATEX, with its innovative approach and user-centric model, offers a compelling solution to the region’s financial challenges, positioning itself as a key player in the burgeoning Web3 economy.

PATEX in the Patex Ecosystem

PATEX is intricately woven into the fabric of the Patex ecosystem, demonstrating its versatility across various applications. As a cornerstone of this ecosystem, PATEX interacts seamlessly with several key products, enhancing the user experience and expanding its utility.

The Patex Layer 2 blockchain, designed for the issuance and tracking of Central Bank Digital Currencies (CBDCs) and other cryptocurrencies, integrates the token for various operations. This integration enables efficient and secure transactions, reinforcing the blockchain’s strength and reliability.

In the realm of exchanges, the C-Patex Exchange, a centralized cryptocurrency platform, utilizes PATEX for regulation, management, and the launch of CBDCs and other digital currencies. This exchange is a critical component, providing a regulated and user-friendly environment for crypto transactions.

The ecosystem also features a unique ‘Proof of Value‘ community reward system, where the token’s presence is vital. Users are incentivized based on their transaction activities, fostering a participative and rewarding community environment.

Further expanding its reach, PATEX is integral to the Patex Wallet, a non-custodial, cross-chain crypto solution. This wallet enables secure storage, sending, and receiving of cryptocurrencies, highlighting its role in ensuring transactional security within and beyond the Patex ecosystem.

Additionally, the Patex Campus, an educational platform, leverages PATEX to introduce individuals to the world of Web3. Through this platform, users can earn native tokens by engaging in educational content, thus aligning learning with tangible rewards.

Future Prospects

Looking ahead, PATEX is poised to continue its trajectory of growth and innovation in the Latin American crypto market. With the region’s rapidly expanding digital economy and increasing acceptance of cryptocurrencies, the potential to further integrate into everyday financial activities is immense.

Future developments may include technological advancements that enhance its scalability, security, and usability, aligning with the evolving needs of the Latin American market. Additionally, as the Patex ecosystem continues to grow, the utility and application of PATEX are likely to expand, opening new avenues for usage and adoption.

The continued focus on meeting the specific needs of Latin American users, coupled with strategic partnerships and collaborations, will be key in driving PATEX’s future success. As digital finance becomes more prevalent in the region, this crypto is well-positioned to be at the forefront, shaping the future of cryptocurrency usage and finance in Latin America.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals