Sweden goes to the polls this weekend in a general election – expect another populist uprising.

For decades, Sweden has been highlighted by many as a shining example of utopian society. High taxes, but above-average educational and very generous welfare systems combined with a low crime rate, have made Sweden the envy of the world. However, societal frictions have been rising, and many Swedes appear to be especially disgruntled with the country’s “open arms” immigration policy. There is also criticism of the welfare state (known as Folkhemmet – people’s home), with some linking its slipping standards to the strains that immigration has placed on it. The ruling Social Democrat party has seen its popularity plummet in recent years, with some support going to the extreme left but most of it to the right-wing of the political spectrum. Compared with other societies, the decline in Sweden’s social mood seems (characteristically) mild, but it has traced out a familiar path.

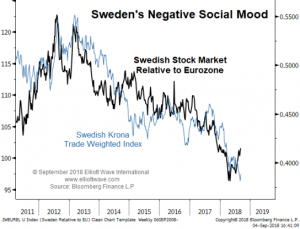

Our chart shows the Swedish stock market’s (currency neutral) relative performance to the Eurozone (black line), along with the Swedish krona trade-weighted index. Having outperformed since 2002, the Swedish stock market started underperforming the Eurozone in 2012. This relative measure has been signaling that social mood in Sweden has been subtly trending negatively for over half a decade. The close relationship with the Swedish krona is a reflection of capital flows as investors have sought returns elsewhere. If Swedes do vote in numbers for more populist, right-wing agendas this weekend, many commentators will portray it as a bit of a shock. The truth is, though, that a shift to the political extremes will provide a symptomatic exclamation mark to a negative social mood trend that has been going on for years.

One of Sweden’s greatest gifts to the world has been the music of the legendary 1970s group ABBA. Essentially upbeat and optimistic, it appears to be in stark contrast with the Sweden of 2018.

About Murray Gunn

Murray Gunn is Head of Research for Elliott Wave International’s Global Market Perspective, a monthly summary of the firm’s 25 analysts’ views on every major freely-traded market in the world (www.elliottwave.com). After earning his Master of Arts (Honors) degree in Economics from the University of Dundee in Scotland in 1991, Gunn went into fund management. He quickly realized that textbook descriptions don’t apply to real-world markets, which in turn led him to technical analysis and the Elliott Wave Principle. He worked as a fund manager in global bonds, currencies and stocks, including long posts at Standard Life Investments and a five-year stint in the Middle East at the Abu Dhabi Investment Authority. Gunn then joined HSBC as Head of Technical Analysis. He has served on the board of the Society of Technical Analysts and delivered lectures on the Elliott Wave Principle to students at The London School of Economics, Queen Mary University and Kings College London. You can read Gunn’s commentary in Elliott Wave International’s Global Market Perspective, Interest Rates and Currency Pro Services, and on deflation.com.

About Elliott Wave International

Elliott Wave International (www.elliottwave.com) is the largest independent technical analysis firm in the world. We cover every major financial index in the world, around the clock, and many of our publications have won top awards in their categories. We do not take our lead from Federal Reserve Policy, news headlines, Presidential elections or the latest economic statistics. In fact, we forecast the forces that produce those outcomes, so we — and you — can expect them to happen.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals