The Investment Process

The objectives of every investor differ and various portfolio designs serve a variety of purposes. Due to the extent of the hedge fund industry, some investors work towards broad exposure while others concentrate on a specific style of investment. Some investors in hedge funds have a predisposition towards absolute return strategies that are non-directional while various other managers have an explicit or implicit prejudice towards the strategies that are directional. The difference between non-directional and directional is possibly the most common grouping of the various strategies that are a part of the hedge fund industry.

The actual process of investment only starts once the investors are aware of the objectives that have to be fulfilled. There are basically two variables at the most common level, as well as two processes. These two variables are the hedge fund managers themselves, which are the constituents of the portfolio, and the allocation, which is the allotment of a capital to these elements. One important aspect to keep in mind is that these two processes and variables are dynamically interconnected.

The sections below highlight the various aspects that are involved in the selection and observation process of one hedge fund manager. We will then move on to cover portfolio construction and then deal with a few elements of the risk that is involved in hedge fund investing.

Selection of manager and their monitoring

Manager evaluation

The basic factor that contributes towards success is the identification of a manager and their evaluation. Investment in hedge funds are fundamentally a business of people in relationships. When an investor allocates capital to a manager, they expect to contribute to the craft of the manager and not in a specific strategy of investment or an automated process. For example, allotting funds to a convertible manager of arbitrage does not result in involvement in the trade of purchasing the bond and management of the channel through the sale of the stock. Despite the popular suggestions of the main academia, the actual strategy is more complex than this.

Review of the manager

This is indeed a continual and a dynamic process and the process of due diligence is never-ending. It is vital to understand the exact sector in which the manager is operating in order to fully comprehend the manager and the value that they add. Only a manager that is able to accept change and adapt to it while working successfully on widespread risk management is able to excel and be successful in this industry. They have to fully realize and understand the dynamic and ever-changing nature of not only the markets, but also of the strategies; thus, this becomes an ongoing process of evaluation and appraisal.

Selection and Monitoring of the Portfolio

Portfolio Construction

Mostly the construction of a portfolio is a mixture of a bottom-up (selection of a manager) and a top-down (allocation of assets) approach. The objectives and goals of different investors will vary and these can be based on either the geographical differences or the differences in strategy and style of investment. Various investors place more focus on their personal contacts within the industry while others go with a more econometric attitude towards the construction of portfolios. There is no absolute way in portfolio construction and those based on mean-variance space do offer a starting point, but are not entirely perfect due to issues of liquidity and certain other significant factors.

Experience of risk management

One of the most significant issues in hedge fund investing is being able to recognize and understand the various characteristics of the risk. Managers must possess expertise in the area of the most intricate financial instruments along with various strategies of trading.

Leverage

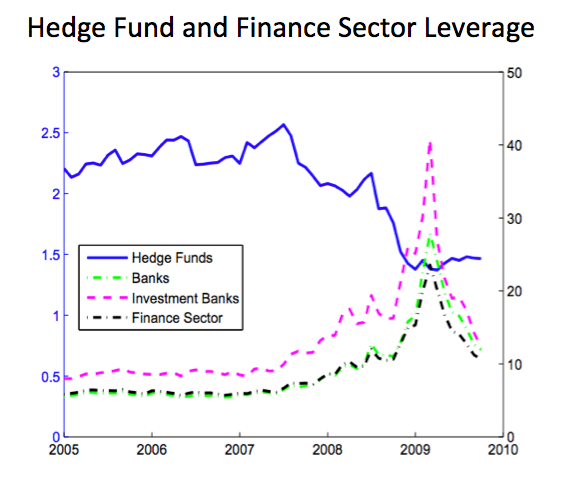

The correct and improper use of leverage is a significant topic in the area of hedge funds. High and sophisticated use of leverage is a defining characteristic of the hedge fund industry. Leverage plays a key role in hedge fund management. It is a fact, that many hedge funds rely on leverage to enhance returns on assets. In addition, leverage amplifies or dampens market risk and allows funds to obtain notional exposure at levels greater than their capital base. Also leverage is often employed by hedge funds to target a level of return volatility desired by investors. Manipulation with leverage assists hedge funds to respond to chafing investment opportunities. They are using leverage in taking advantage of misplacing opportunities by simultaneously buying assets which are perceived to be underpriced and shorting assets which are perceived to be overpriced. (Research Paper by S. Gorovyy (Columbia University), G. B. van Inwegen (Citi Private Bank) and A. Ang (Columbia University and NBER), Columbia University, 2011).

Source: Hedge Fund Leverage, Research Paper, Columbia University, 2011

This graph represents comparison of average gross hedge fund leverage with the leverage of banks, investment banks and the finance sector. The left-hand axis corresponds to average gross hedge fund leverage and the right-hand axis corresponds to the leverage of banks, investment banks and the finance sector.

As stated in the Research Paper mentioned above, changes in hedge fund leverage are more predictable by economy-wide factors than by fund-specific characteristics. Decreases in funding costs and increases in market values both forecast increases in hedge fund leverage. Future increases in leverage are predicted by decreases in fund return volatilities.

More detailed information on the topic of Hedge Fund Leverage might be obtained from the Research Paper, Columbia University, 2011.

Related Posts:

Roadmap to Hedge Funds – Part 1 What exactly is a Hedge Fund?

Roadmap to Hedge Funds – Part 2 Value Proposition

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals