New technology and sophisticated new entrants have transformed the custody offering available in the institutional market, allowing investors to hold digital assets with confidence for the first time.

New research amongst 100 professional investors reveals the vast majority expect institutional investors and wealth managers to increase their exposure to alternative asset classes in the next two years. The survey, which was commissioned by Nickel Digital Asset Management (Nickel), the regulated and award-winning investment manager connecting traditional finance with the digital assets market, reveals 93% of respondents expect professional investors to increase their exposure to cryptocurrencies, and this is followed by 74% who expect to see an increase in allocation to real estate.

The corresponding figures for private equity, distressed assets, hedge funds, infrastructure and private debt are 70%, 70%, 69% 63% and 62% respectively.

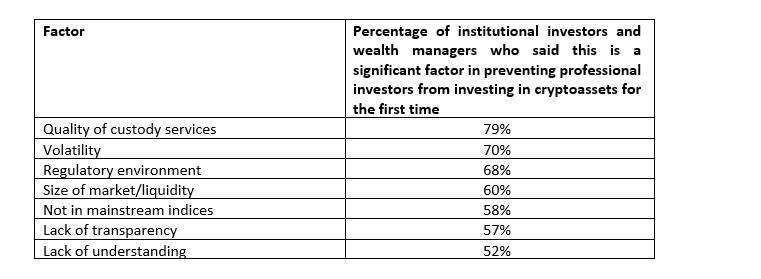

When it comes to investing in cryptoassets, 79% said securing quality custody services is a significant hurdle preventing institutional investors and wealth managers from investing in this market for the first time. This is followed by 70% who cited market volatility, and 68% who said the regulatory environment.

Security of clients’ assets is paramount at Nickel Digital. The investment manager deploys an independent institutional-grade custody solution, whereby the manager has no transfer right over the funds. This control is always retained jointly by independent Fund Administrator and Custodian, requiring cross-organisational multi party approval of all critical withdrawal transactions.

To create a highly secure custody solution, Nickel has partnered with the two leading custodians in the industry, US-based Fidelity and UK-based Copper Technologies. Their sophisticated solution includes an air-gapped, multi-signature, cross-organisation custody model with a secure Walled Garden trading environment. To ensure the greatest degree of asset safety, Nickel has adopted a MPC (Multi Party Computation) model, the latest industry development that virtually eliminates the risk of private key hacking, as private keys never appear (even for a fraction of second) on any servers in the world.

Anatoly Crachilov, co-Founder and CEO of Nickel Digital, commented:

“We are not surprised to see professional investors planning to increase their exposure to cryptocurrencies – this new alternative asset class. It has proved its resilience during the Covid-19 crisis, thus reenforcing uncorrelated nature of its returns when compared to fixed income instruments, for example ($17 trillion of which are now trading in negative yield territory), and delivering much stronger appreciation than equities, the majority of which are already trading on overstretched valuations. Digital assets offer strong diversification benefits, shifting upwards portfolios’ efficient frontier.

“In addition to this, new technology and sophisticated new entrants have transformed the custody offering available in the institutional market, allowing investors to hold digital assets with confidence for the first time.

“The growing interest in cryptoassets cannot be explained only by the recent appreciation in the value of Bitcoin, but indeed by its role as a hedge against currency debasement, a risk triggered by a record 28% expansion of US M2 money supply over the first 12 months of the COVID-19 crisis. As more institutions allocate to cryptoassets as part of their routine portfolio composition, these assets will become increasingly mainstream and an integral part of portfolio allocations.

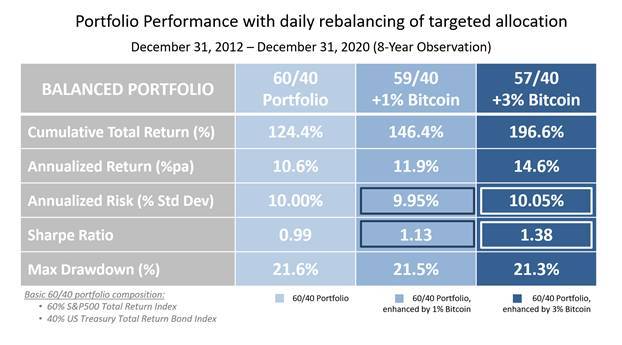

“However, Bitcoin and other leading digital assets will remain volatile for the foreseeable future, as this technology goes through an early stage of adoption curve. Price discovery will remain a highly sensitive process, as market forces are testing the intrinsic value of this new asset class. Hence investors are advised to adopt long-term views and exhibit a high-risk tolerance. They should also size their investment positions accordingly and cap allocations to between 1% and 3% of their portfolios. This asset offers an asymmetric return profile, with significant upside potential even through a relatively small portfolio allocation.

“Despite volatility, the long-term direction of travel is clear – institutional adoption and continued structural appreciation as a reflection of Bitcoin’s inelastic supply and its immutable monetary policy.”

Long term portfolio allocation

Nickel’s analysis reveals that a 1% allocation to Bitcoin within a well-diversified portfolio over a statistically significant 8-year period (Dec 2012 – Dec 2020) confirms a critical diversification effect offered by this uncorrelated asset. Indeed, such allocation offered an important return contribution, without imposing a negative impact on the risk characteristics (irrespective of numerous drawdowns which took place over that period of time). The table below summarises this effect:

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals