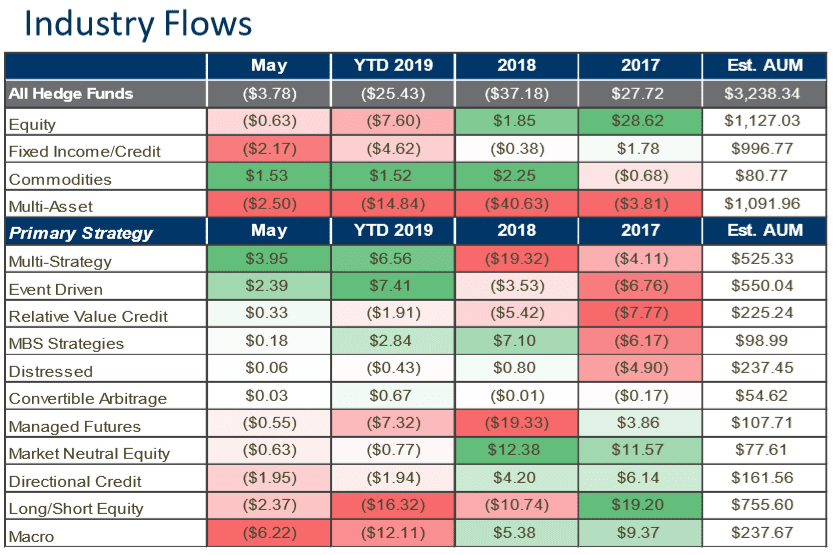

Global investors pulled another $3.78 billion from hedge funds, according to the just-released eVestment Hedge Fund Asset Flows Report. That has driven May’s results, brought year to date (YTD) flows, to -$25.43 billion. Performance losses reduced assets further, pushing total industry AUM down to $3.238 trillion. Overall industry results point to continued consolidation in the industry as investors gravitate to funds that are performing strongly and/or that are successfully marketed.

However aggregate flows were again negative in May, in past months there were targeted allocations, even within strategies, facing the largest redemption pressures. “This theme has been persisting for several months, indicating the industry is enduring a consolidation driven primarily by the ability, or inability, of managers to produce returns in-line with investor expectations. While in the near-term this process is painful, it is a natural process of re-aligning investor demands and fund capabilities in challenging public markets,” was mentioned in the report.

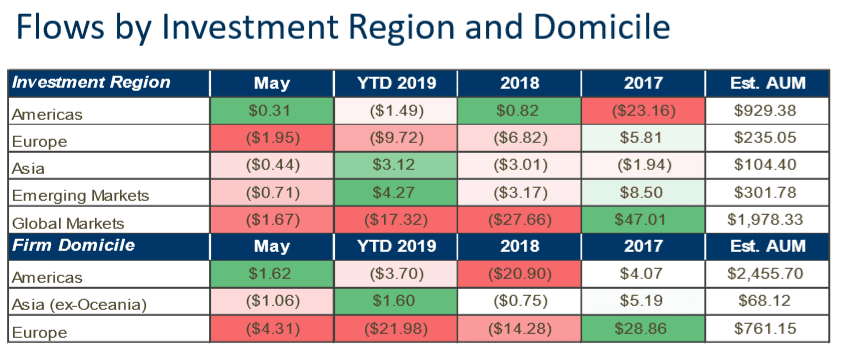

In Europe, managers continue to see assets leave in 2019. This is another repeated bullet to emphasize an important trend. As we noted last month, this is not a universal issue in Europe. There are managers able to raise capital both in the UK and continental Europe. Risk premia strategies have been successful, as have some event driven funds and even managed futures firms. The biggest drag on Europe-based fund flows in 2019 have been from long/short equity strategies which did not perform well in 2018.

Other interesting points from the new report include:

- Multi-Strategy hedge funds were the big winners in asset flows in May among primary strategies, pulling in +$3.95 billion in May, bringing YTD inflows to these strategies to +$6.56 billion.

- Event Driven hedge funds were also big asset winners in May, gaining another +$2.39 billion. Event Driven funds are also big winners YTD, pulling in +$7.41 billion so far this year.

- The apparent interest in commodity hedge funds in May, +$1.53 billion of net inflows, was highly influenced by a handful of products, rather than a sign of broad interest in commodity exposure.

- Macro hedge funds were among the big asset losers in May, with redemptions of -$6.22 billion, bringing YTD outflows to -$12.11 billion.

- Long/Short Equity funds also saw big out flows in May and YTD of -$2.37 billion and -$16.32 billion, respectively.

The negative sentiment is also felt in Emerging Markets (EM)

Likewise, the negative sentiment was also felt in Emerging Markets (EM). After a four-month stretch of aggregate inflows, EM flows were negative in May. “First, it is important to note that while EM hedge funds as a universe were receiving net inflows over the prior four months, allocations were not widespread across the group,” was pointed out in the research.

As such, in May, there was little difference in the proportion of funds with inflows (~40%), but there were not the larger targeted allocations. Within products gaining new assets in May, China-focused funds were dominant and a focus on equity was evident. While those were the products gaining new assets, there were also several China-focused equity managers who saw redemption pressures in May.

Despite the overall negative flows, many funds have been able to raise new assets

However, despite the overall negative industry flows, many funds have been successfully able to raise new assets in 2019. This includes funds in categories which are seeing the most negative outflows.

This change in the overall negative industry flows highlight the importance, firstly, of strong performance, but secondly the roles of marketing and sales within hedge funds, and the ability to find and exploit demand for funds in even some of the most challenging segments.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.