With the year already past the half-way point, several economic trends have become apparent that will continue to have a major influence over the global economy – and the investment landscape – for years to come. Here, we have outlined five trends that are currently shaping the global economic picture.

US leads the global economic recovery

Perhaps the biggest story in the global economy over the past couple of years has been the ongoing recovery from the economic crisis of 2008, a recovery that has been led by growth in the US economy. As the pace of economic growth in the US has strengthened, the Federal Reserve has begun to taper its quantitative easing programme in response.

In part, the strength of this recovery has been down to the thoroughness with which the US cleaned up the toxic legacy of 2008, with bad debts having been written down, banks having been recapitalised, property markets re-balanced, and companies streamlined. This is in sharp contrast with Europe, where meaningful reforms are still non-existent and zombie banks continue to exist.

However, the biggest driver of the recovery has been the influx of cheap, plentiful energy in the form of shale gas, which has also enabled the US to wean itself off its reliance on Middle Eastern oil. At present, petroleum prices in the US are around a quarter of what they are in Japan, and this huge cost advantage coupled with rising wage costs in China are leading many firms to bring advanced manufacturing factories back to the US from Asia. Also, America is completely self-sufficient in terms of food, unlike China, which is frantically buying up farmland around the world in order to cope with anticipated food shortages.

Africa on the rise

Although Africa only seems to get global attention in times of famine, natural disaster, or war, this may be set to change in the coming years, with many of the fastest-growing countries in 2014 being in Africa. While Africa’s untapped commodities wealth has been well-documented, it is interesting to note that non-commodity countries are also growing strongly, helped by low rates of inflation and increased trade with the rest of the world – particularly China.

With the Arab Spring causing huge political instability in North Africa, business attention has turned towards Sub-Saharan Africa, which is on course to be the fastest growing region in the World in 2014. This growth has been aided by huge infrastructure improvements, and South Africa is fast establishing itself as the leading economic power in the continent, taking the lead in fields such as telecommunications.

There are many other innovations taking place across Africa, with Kenya establishing a growing tech industry and leading the world in mobile financial payments, while the Ivory Coast has recovered from its civil war and is re-establishing itself as an important trading centre.

Although the continent still has major problems, such as the civil war in the Central African Republic, terrorism in Somalia, and conflict between Muslims and Christians in Nigeria, the continent as a whole is in a better state than it has ever been. One symptom of this is the emergence of an African middle class, and we can expect this trend to continue in the years to come.

European recovery looking shaky

Although Europe is slowly emerging from recession, the aftershocks of the Eurozone crisis are still being felt, and the slightest instability could cause another eruption. And there are plenty of potential instabilities on the way – Portugal looks like it may have some trouble exiting its bailout, a new Greek debt write-off looks likely, and Slovenia looks as though it might need a bailout for its banking system. Meanwhile, capital controls remain in place in Cyprus and Iceland, with no comprehensive solutions to their respective financial crises being in sight. Europe-wide, the threat of deflation has never been too far away, with the ECB stating that it prepared to use all available means to prevent this, although any move towards QE may encounter stiff resistance in Germany.

The only European nation making a solid recovery is the UK, which was the fastest growing G7 economy in 2013 due to expansion in its technology and financial services sectors.

Commodity cycle turning upward

With the end of the bear commodity cycle, institutional money is starting to flow back into commodities space. With economies around the world improving, the demand for commodities is increasing, and institutions are positioning themselves to be in on the ground floor of this trend. Over the past few years, miners and commodity companies have had a hard time of it, but there are clear signs that this trend is reversing.

Currently, the price of foodstuffs does not paint an accurate picture of the future demands that will be placed upon this industry, particularly with the global population growing at a rate of 3 million people a week.

With the easiest deposits of Copper and Iron Ore having been exhausted, grades of many metals will continue to decline, and their values will rise correspondingly over the coming years. It is only in the field of fossil fuels that this trend has been reversed, due to the wave of new extraction methods such as fracking and shale oil extraction driving up supply, with more and more people looking for things like fracking fluid ends to improve the process even further

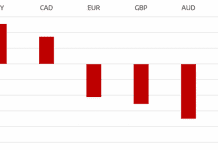

Emerging markets suffer as Fed tapers QE

As the Fed tapers its quantitative easing scheme, emerging markets that have benefited from the flow of cheap US dollars have been feeling the pinch, causing currency volatility and causing economic problems in the affected nations. Meanwhile, China is trying to transition its economy away from infrastructure and state directed lending to one led by consumer demand by introducing a number of modernisations to its property and business laws. However, it remains to be seen whether China can avoid getting stuck in the infamous middle income country trap that so many other countries in Latin America and Asia have fallen into. Although the strong economic growth in the country may have a stabilizing effect, the prevalence of bad debt in its financial system and the lack of transparency in its shadow banking system, there is a chance that China could be headed for a credit crisis of its own in the near future.

In India, an economic crisis seems to be brewing, with the government having been panicked into imposing capital and commodity (particularly Gold) controls in 2013 in an effort to cope with its balance of payments deficit. And despite hopes in Brazil that the World Cup would lift the national mood, widespread protests during the tournament reflect the fact that economic growth there has stalled, and that the high cost of living there and other social issues are a long way off being solved.

Having enjoyed several years of increasing economic and political power due to its huge oil and gas reserves, Russia is starting to feel the pinch from the West’s new-found enthusiasm for alternative oil and gas extraction methods such as fracking.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.