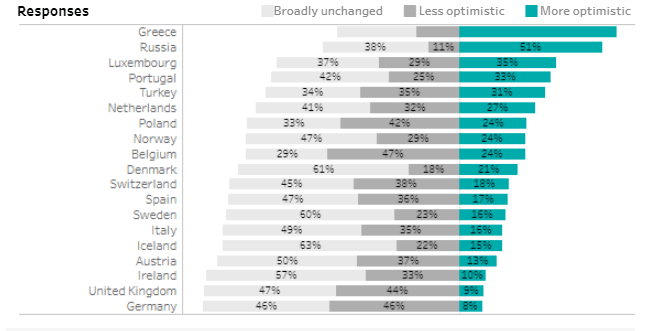

The latest European Deloitte CFO survey found that this increase in pessimism has caused the risk appetite to fall further

Over a third (36%) of Europe’s CFOs feel more pessimistic about their companies’ financial prospects, according to the latest edition of the Deloitte European CFO Survey. This percentage has doubled since the first survey in spring 2015, when the figure stood at 18%.

Risk appetite tumbles further

Fewer than one in five CFOs (18%) consider now to be a good time to take on risk, the lowest percentage on record. This overtakes last edition’s record low of 20%.

It is most noticeable in countries inside the euro area where just 16% are keen to take on risk at present. Industries more heavily reliant on global trade – including those in the automotive, industrial and transport sectors – show the least risk appetite.

The fall in risk appetite correlates with the continual increase in perceived financial and economic uncertainty. Almost seven out of ten CFOs (69%) now rate the current level of uncertainty as high or very high.

Financial forecasts worsen

Expectations for margins and revenues are at their lowest levels since the survey began. For the first time, the number of CFOs expecting a decline in their company’s margins in the next 12 months (38%) outnumber those expecting an increase (30%).

However, expectations for revenues remain positive on average, with more CFOs expecting an increase in revenues (49%) than a decrease (27%). In the automotive sector the proportions are inverted, with more than 60% expecting a decrease in revenues. Only six months ago, this share was 34%.

Key Findings:

• Over a third of European CFOs (36%) feel pessimistic about their companies’ financial prospects;

• Risk appetite hits a record low as only 18% consider this a good time to take on risk;

• Expectations for revenues and margins fall to their lowest level since 2015;

• Pressure on businesses to act on climate change mounts from clients and employees.

Investment and hiring outlook continues to drop

In total, 27% of Europe’s CFOs forecast an increase in capital spending in the next 12 months, down from 36% in the spring. In the euro area, 30% plan to increase spending, compared to 22% in non-euro countries. The greatest spending intentions came from Belgium, where 68% intend to increase spending. Meanwhile in the UK, 78% intend to decrease spending – the highest in Europe.

Hiring intentions have declined, with 32% of respondents planning to decrease headcount against 27% planning an increase. Hiring intentions in countries within the euro area are slightly more optimistic, with CFOs planning an increase in the headcount outnumbering those planning a reduction (30% versus 24%).

Ian Stewart, UK chief economist at Deloitte, said: “Trade disputes, elevated uncertainty and a global slowdown have knocked the confidence of European CFOs. While European equities have soared, risk appetite in the real economy among CFOs has dropped to a four-year low. Faced with an uncertain outlook, CFOs are shelving investment plans and doubling down on cutting costs.”

Climate change concerns

Around half of CFOs (51%) say that clients and customers are applying pressure for companies to take action on climate change*. In addition, almost half (47%) feel this pressure from their own employees and 70% say they feel pressure from three or more stakeholders.

In response to this, 70% of companies said they are increasing or planning to become more energy efficient, for example in their buildings. However, more than half (51%) have not yet adopted any carbon emission targets and only 27% plan to assess the risk of climate change to their business.

Richard Houston, senior partner and chief executive of Deloitte North and South Europe, concludes: “The survey findings show only a handful of companies are integrating climate change risk into business planning in a significant way. Efforts are certainly increasing, but more needs to be done across industries on an international scale – this should also help businesses connect with a new generation of consumers, employees and investors alike.”

This is the tenth edition of the Deloitte European CFO Survey, which takes place on a six monthly basis, the survey collates the findings of surveys conducted in Austria, Belgium, Denmark, Germany, Greece, Iceland, Ireland, Italy, the Netherlands, Norway, Poland, Portugal, Russia, Luxembourg, Spain, Sweden, Switzerland, Turkey and the United Kingdom. In total, 1,371 CFOs took part in these surveys.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals