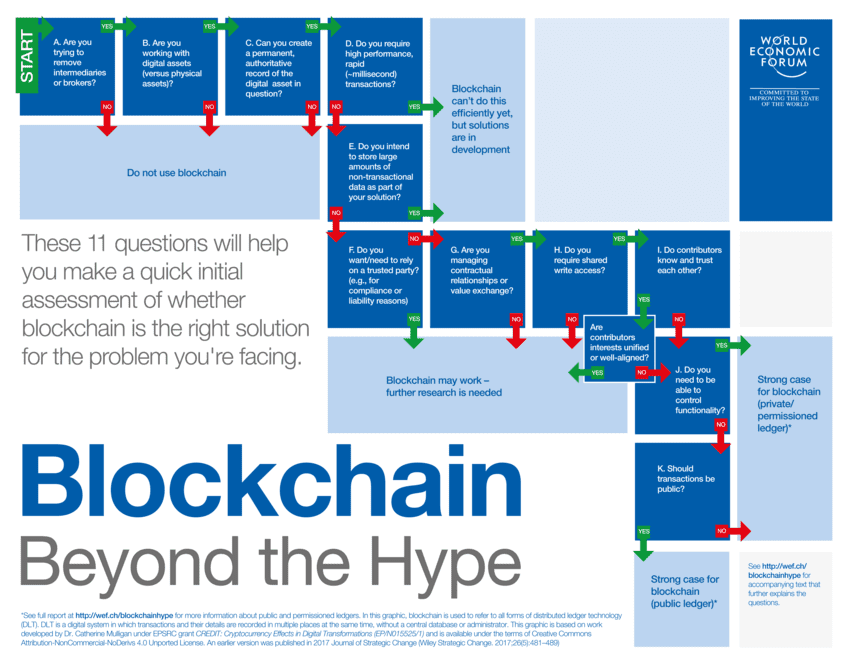

Blockchain is now an undiscussable for businesses. It is thought that by 2023, blockchain will support the global movement and tracking of $2 trillion of goods and services annually across many industries. That is why Blockchain technology is seen as a solution for a wide range of real world challenges. But the question remains: how can we know that blockchain is the right technology for a business? Deutsche Bank Chief Data Officer JP Rangaswami and other colleagues at the World Economic Forum have come up with an exhaustive guide to help entrepreneurs that are asking themselves that exact same question.

This distributed ledger technology (DLT) has been proposed to power financial products, to provide cybersecurity solutions and even to enable people to sell their homes without a real estate agent. Deutsche Bank and World Economic Forum blockchain guide is a 11-question document that most entrepreneurs should ask themselves before going all-out with blockchain technology and it is based on an analysis of how blockchain is used in a variety of projects around the world and following interviews with selected chief executive officers.

The guide is broken down into different paths, which were incorporated into a framework of “yes” and “no” questions. And its goal is to assist a business leader once a specific problem is articulated. “This framework cuts through the noise about blockchain and refocuses the technology into the way business leaders think,” said Jennifer Zhu Scott, Founding Partner of Radian and member of the Global Futures Council on Blockchain.

Likewise, Deutsche Bank Chief Data Officer JP Rangaswami added that: “These 11 questions were developed and then trialled with chief executive officers at a workshop at the World Economic Forum Annual Meeting 2018. The test group included C-suite executives from large corporations, most of whom said they were actively considering adopting blockchain technology in some manner.”

The 11 question blockchain guide

- Are you trying to remove intermediaries or brokers?

2. Are you working with digital assets (versus physical assets)?

3. Can you create a permanent, authoritative record of the digital asset in question?

4. Do you require high performance, rapid (millisecond) transactions?

5. Do you intend to store large amounts of non-transactional data as part of your solution?

6. Do you want/need to rely on a trusted party (e.g., for compliance or liability reasons)?

7. Are you managing contractual relationships or value exchange?

8. Do you require shared write access?

9. Do contributors know and trust each other?

9.1 Are contributors interests unified or well-aligned?

10. Do you need to be able to control functionality?

11. Should transactions be public?

Basically, if the answer to all those questions is “yes”, blockchain is highly recommended for that company. If, otherwise, the answer is negative, this distributed ledger technology might not be the right solution.

Use Case: A Special Effect Company

The guide also illustrates how it can be implemented in a real-life company. In this case, a special effects company and their software – that is used by millions of game developers and industrial designers – was put into test.

One of the main challenges these kinds of companies face is providing large-scale graphics processing units to render customer projects – these games require a lot of processing capacity and this can be an expensive process.

At a first glance, Blockchain technology can actually help greatly this company as it could enable it to tap into undiscovered possibilities to solve its business problem: completing more projects for less money.

The special effects company needs to access as much processing power as possible from a variety of processing units for the cheapest amount of money possible. Since most devices have consumer-grade processors already installed, everyone with a device could contribute their processing power for a fee. In short, when you don’t need the processing power, you can sell this down time to this special effects company that needs some extra processing power for their new game, and get paid for it (or receive a token on the blockchain).

This is the path the company took when implementing the 11 question guide as shown in Deutsche Bank and World Economic Forum research:

“The company doesn’t need a middle man to help them get this extra processing power (this is the move from A to B on the toolkit graph). Their assets are digital and there are no other companies managing the assets (move from B to C to D).

Since the transactions can take place overnight, they can move from D to E. Once a job is complete, the software company doesn’t have to store that data, so that gets them to F. Everyone can participate. Move from F to G.

The company has to prove that they paid you for this time, but they don’t have to know specifically who wrote the contract, so they can move from G to H to I. For the last steps, network needs to be able to control the functionality (for upgrades for example) and be public. This analysis shows that the application should select a public, permission-free ledger. This solution applies blockchain to allow distributed graphic processing units to be shared across the globe, reducing costs, and reducing waste from underutilized units.”

This is only an example of how this guide could help entrepreneurs all around the world that are thinking of implementing blockchain in their business. Though blockchain is not for everyone as needs differ from one company to another, this guide can easily point out whether it would be beneficial or not.

Blockchain is a computer technology that allows its participants to store and share data securely within the network. “Blocks” store the pieces of information, including the date, ID of transaction, time and even IDs of who is participating in that data transaction and in the whole of the blockchain. These blocks store information that distinguishes them from other blocks called “hash” that allows participants to tell it apart from every other block within the “chain.”

This is basically how a blockchain works, a sort of database that highlights basic principles: trustless, security as every piece of information is encrypted using cryptography and transparency as all participants need to agree to every modification made in the blockchain. And these principles can be reproduced in almost every business area.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.