COVID-19 has fast-tracked the transition to digital payments across the Asia-Pacific (APAC) region as consumers opt for the comfort and safety of digital channels rather than expose themselves to disease vectors such as cash, according to GlobalData, a leading data and analytics company.

The APAC region is made up of a collection of countries located in or near the Western Pacific Ocean. APAC stands for Asia-Pacific (A-sia PAC-ific). This region is also known as Asia-Pac, or AsPac. The term grew in popularity in the 1980s when it was being used to discuss commerce, politics and finance. Additionally, APAC is also known (and less commonly referred to) as the APJ region, which also stands for the Asia Pacific Japan region.

Because there is no clear definition of the Asia Pacific region, the region varies by context. Generally, though, it is a term used to describe countries throughout East and South Asia, Southeast Asia and Oceania. In some cases, the term is used to describe countries located in the Americas, which lie along the coast of the Eastern Pacific. At times, it is also used to describe all countries in Asia and Australasia and the Pacific island nations.

By area, China is the largest country in the region, followed by Australia, India, Indonesia and Mongolia. The smallest by area is Macau. In terms of population, China is the most populous is the Asia-Pacific region was a population of over 1 billion people. India follows closely behind, also boasting a population of over 1 billion. The smallest by population is British Indian Ocean Territory, which has a population of just 3,000 people.

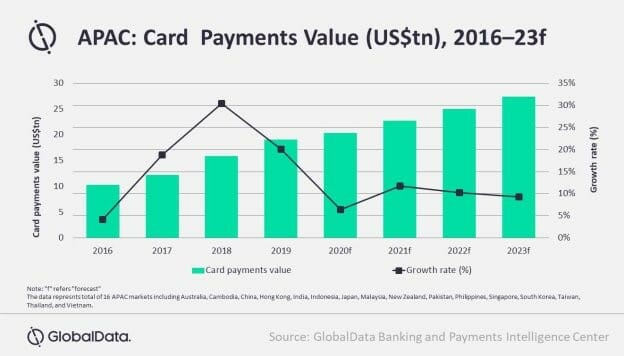

Consumers globally and in Asia are increasingly going digital and are embracing electronic payments like never before. According to GlobalData revised forecasts, the total card payments in APAC market is expected to grow by 6.5% to reach US$20.3 trillion in 2020. This is expected to rise further to US$27.4 trillion by 2023.

Even cash-intensive countries in the region such as India, Japan, Taiwan, the Philippines, Malaysia, Indonesia, Vietnam, and Cambodia are witnessing similar trend, with rise in card payments.

Kartik Challa, Banking and Payments Analyst at GlobalData, comments: “While most Asian markets are traditionally cash-dominated, there has been gradual rise in digital payments in past few years due to constant push by the governments, banks, and payments companies. The current COVID-19 pandemic has further accentuated the importance of digital payments among the consumers.”

Consumer spending in most markets will be affected by the pandemic, resulting in loss of business of payment companies in the short-run. With many of these countries now gradually easing lockdown restrictions, a rise in business activities and consumer spending is being witnessed, thereby positively impacting the card payments market.

The pandemic is aiding card payments growth, mainly driven by rise in online purchases and increase in preference for contactless payments over cash for in-store purchases. According to the South Korean Ministry of Trade, Industry and Energy, online retailers’ sales in South Korea registered year-on-year growth of 34.3% in March 2020, majority of the payments were made via payment cards.

While there is high adoption of contactless payments in countries such as Australia and Singapore, the current crisis has given push to contactless payments in other markets where it was not very popular.

In addition to payment cards, use of mobile payment is expected to become more widespread. QR-based merchant acceptance solutions like Singapore-based SGQR and Malaysia-based DuitNow QR will see surge in use as they are cheaper and convenient.

Challa concludes: “The pandemic has accelerated shift to digital payments in Asia and the region is now seeing years of change condensed into a couple of months.”

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals