After a year defined by a wave of mergers – many of those involving major banking institutions in the Middle East – the financial industry has eliminated some of the region’s excess banking capacity and improved prospects. In that context, Qatar National Bank (QNB) stands as the top bank in the Middle East by Tier 1 Capital with $22,5bn capital. Qatar’s major bank has overtaken United Arab Emirates lender First Abu Dhabi Bank. Meanwhile, Saudi and Emirati banks continue to compete for positions at the top of the list and placing 6 lenders among the top 10 banks in the Middle East according to The Banker’s Top 1000 World Banks Middle East regional table.

The main Qatarí bank, QNB returned to pole position with Tier 1 capital of $22.5bn after a 12% increase over its last figures, and bolstered by a $2.8bn additional Tier 1 perpetual capital note. Qatar National Bank is also the largest Middle East bank by market cap, according to a Douglas Blakey report. QNB’s share price soared by just over 50% for a market capitalisation of $49.0bn. In fact, the bank reported some of its best ever annual results despite the ongoing political and economic rift between Qatar and some of its regional neighbours.

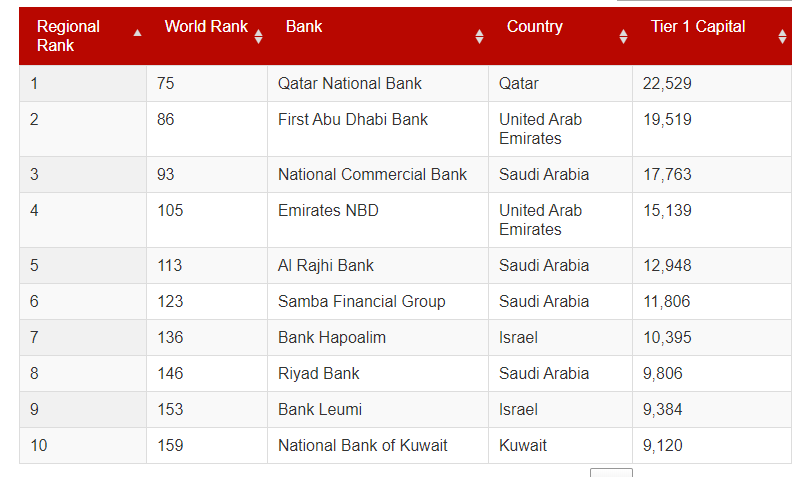

The Banker’s Top 1000 World Banks Middle East regional table ranks the most important banks in the Middle East by their Tier 1 capital. As such, First Abu Dhabi Bank’s fell to second position as its Tier 1 capital slipped 5% to $19.5bn. Saudi Arabia’s National Commercial Bank (NCB) closed the podium, as its Tier 1 capital rose 4.3% to $17.8bn.

Further out in the top 5, Emirates NBD went up to fourth place from fifth in the previous ranking, with a Tier 1 capital position of $15.1bn. Other major Saudi banks have seen their rankings impacted by multi-billion-dollar settlements in late 2018 with the country’s tax authority over the payment of religious taxes. Al Rajhi Bank, the world’s largest Islamic bank, was particularly affected, with its Tier 1 capital slipping 13% to $12.9bn, pushing it into fifth position in the region.

The Top 10 is closed by two more Saudi banks, Samba Financial Group in 6th place and with $11,8bn in Tier 1 capital and Riyad Bank (8th position and $9,8bn); two Israeli lenders: Bank Hapoalim placing 7th and featuring $10,4 billion in Tier 1 capital and Bank Leumi’s 9th position and $9,4 billion. And lastly, the only Kuwaiti bank within the top 10, the National Bank of Kuwait, ranking 10th with $9,1 billion in Tier 1 capital.

Regarding the region’s top five banks by return on capital (ROC), Saudi Al Rajhi leads the region with 21.2% for the review period. Emirates NBD holds second spot with 18.1%, followed by Qatar’s Masraf Al Rayan and the UAE’s Dubai Islamic Bank with 17.9% and 17.5%, respectively. Lebanon’s Blom Bank, which led the regional rankings in 2018, falls to fifth position, with its ROC falling from 22.7% to 17.2%.

Gulf lenders dominate the Middle East’s highest movers’ table for 2019, with Blom Bank and fellow Lebanese lender Credit Libanais (in eighth and 10th place, respectively) the only banks from outside the Arabian peninsula. Saudi Arabia’s Bank Al Jazira leads the table, with Tier 1 capital growth of 32.5%.

State of Banking In The Middle East

Differently from the cases of Europe or Asia, the Middle East saw a rise in the number of banks and financial institutions that led to an overbanking scenario. This created an anomaly in the banking sector that had to be resolved. Last year there was a wave of mergers that cleared away some of the region’s excess banking capacity and improved the outlook for industry profits. Recent M&A activity among Gulf Cooperation Council (GCC) banks is beneficial for the banking sector as it eases overcapacity and boosts earnings through synergies and increased pricing power, according to a recent article by Global Finance.

Major issues in the industry starting to show up when falling oil prices and production cutbacks in 2018 hit government budgets and slowed economic growth. That is why a consolidation was needed to help curb funding costs and improve profitability over the long run. “Slow growth and subdued credit demand in the region are among the biggest drivers of consolidation,” says Ashraf Madani, a senior analyst at Moody’s. “This has intensified competition for depositors and borrowers.” In this scenario, merged banks will gain market share and economies of scale once they overcome integration challenges.

Meanwhile, the value of conventional and Islamic bonds issued by non-financial corporations increased 86% last year to $15.6 billion, according to Global Finance. The region’s overall M&A activity is also picking up significantly. Saudi Aramco recently agreed to buy a majority stake in chemical producer Saudi Basic Industries for $69.1 billion, the region’s largest deal ever. Uber Technologies agreed to buy Dubai-based Careem Networks for $3.1 billion in the biggest tech deal in the Middle East.

Amid this heightened activity, the focus of the region’s banks is on using technology to enhance the customer experience. “Arab Bank, Global Finance’s choice as the Best Bank in the Middle East, as well as the country winner in Jordan and Yemen, has been a leader in introducing new banking technology in the region. The bank maintains a global network of treasury centers equipped with the latest systems to serve corporate customers. Based in Amman, Arab Bank is also unique in that it has a dominant presence in its home market, yet it receives 70% of its income from outside of Jordan,” was said in the article.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.