“The decline in oil prices creates more opportunities for hedge funds,” the Hedge Funds Managers expressed in a recent survey. Many hedge funds are grabbing the opportunities to buy oil companies at low valuations and build positions they can exploit later. This is evident from the disclosure made by the managers in quarterly regulatory filings with the U.S. Securities & Exchange Commission.

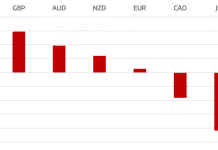

The price of crude declined by around 60% from $115 a barrel in June 2014 to below $50 in January 2015 and touched 6 year lows. Nobody had even imagined such a steep fall within six months. Economists have tried to explain it by factors such as shale oil boom, OPEC decision to maintain production and slow growth of global economy.

But their explanation have not been found adequate by others. Abdullah al-Badri, the secretary general of the OPEC says, “The demand and supply fundamentals alone could not have led to this dramatic reduction in oil price. The crude price fall had been overdone and could have been driven by speculators.” This has been further emphasized by the Bank of International Settlements (BIS), which says heavy trading on commodity futures markets has also played a part. The initial findings of a BIS analysis indicate, “The ‘financialization’ of oil futures markets has been held partly responsible for price volatility in recent months”. This observation is consistent with the UNCTAD’s earlier findings, “There is now greater presence of financial investors in the oil and other commodities markets. This has transformed real markets into financial markets. The volumes of exchange-traded derivatives on commodity markets are 20 to 30 times larger than physical production.” These reports have generated debate about the ‘financialization’ of commodity markets and the extent to which investors, big banks and hedge funds are driving prices of commodities.

However, whatever factors might be responsible for fall, it remains a reality oil price which had stayed high, hovering above $100 per barrel during last three years, is now trading around $50. As oil futures fell below $50 a barrel in January, short positions in oil futures and options touched multi-year highs. Today, this is an opportunity for Hedge Funds to invest in oil. Oil prices are poised to rebound. Historically, long term oil price chart supports this theory.

Hedge Fund Activists are buying stakes in North American oil and gas producers. For example, last quarter Elliot Management and Omega Advisors bought stakes in Continental Resources, Marathon Oil, Laredo Petroleum and Sanchez Energy.

Hedge Fund Activists see investment opportunities in relatively new and small oil companies which mushroomed during the boom in the shale industry. In the last five years, many new entrepreneurs were attracted by and high oil prices. They borrowed heavily to drill wells anticipating high earnings at high oil price above $100 a barrel. Oil under the ground and future revenue were treated as collateral for highly leveraged, high risk debt and derivatives. As per Deutsche Bank, oil companies have raised $500 billion through bonds since 2010. With continuous decline in oil price since June, bond yield has jumped anticipating default. Lower prices tend to reduce the value of oil assets that back the debt exposing producers to solvency and liquidity risks. Such companies are vulnerable to activists because of their weak balance sheet.

Oil companies have been hammered. The S&P 500 Energy index lost over a fifth in the six months, by contrast 4% increase in the broader S&P 500. Many hedge funds are buying oil companies at low valuations and build positions they can reap benefits later. For example, ValueAct Capital, an activist which manages $15bn, raised its stake in the Halliburton-Baker Hughes to $2.77 billion. Halliburton and Baker Hughes, the world’s #2 and #3 oilfield services giants, negotiated a merger deal to cope with the low oil price environment. ValueAct expects the synergies from the merger will give them a technological edge over competitor Schlumberger, the world’s largest oilfield services company.

To conclude, Hedge Funds Activists are buying up stakes in both small and big oil companies now; they believe to make money once oil prices plummeted, boosting the value of the companies.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.