It has been spread all around the crypto-world that digital currencies and their consequently derivative products are walking on the tightrope, with its most well-known asset, Bitcoin, coming from an outstanding exchange rate of $19,000 a BTC, in December last year, to the current $3,235.76 that is traded now against the US Dollar. And beyond those who think that crypto might be living on borrowed time, a new research by the University of Cambridge finds otherwise, as what has experienced this volatile market this year is a sign of maturity and, at last, the much needed government attention to set its limits in terms of security and regulation.

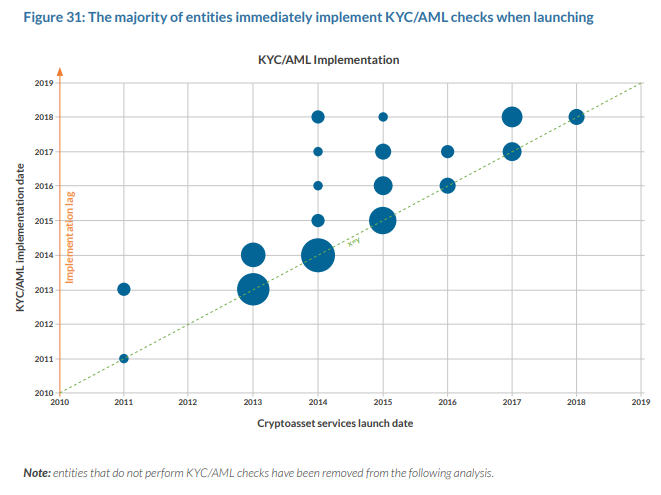

That means that the free-for-all law doesn’t work anymore in the cryptoasset ecosystem, and the introduction of KYC/AML schemes, otherwise mandatory by regulatory institutions, has made its way through within the cryptoasset service providers. In fact, the 2nd Global Cryptoasset Benchmarking Study has found that cryptoasset service providers are fostering their compliance efforts, even when not

explicitly subject to regulatory oversight.

Know Your Customer (KYC) refers to due diligence activities that financial institutions and other regulated companies must perform to ascertain relevant information from their clients for the purpose of doing business with them. Anti-Money Laundering (AML) refers to laws or regulations designed to stop the practice of generating income through illegal actions. Regulated financial services providers are responsible for the implementation of internal KYC and AML policies.

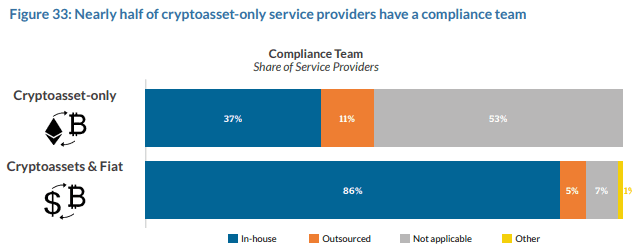

As such, a roughly 37% of cryptoasset-only service providers have an in-house compliance team and more than half perform KYC/AML checks. While an average of 14% of KYC/AML checks result in service providers not opening new accounts or closing existing accounts, some firms claim figures between 50% and 80% – well above comparable traditional finance benchmarks. Additionally, the majority of surveyed companies rely on traditional services for third-party support in conducting KYC/AML checks rather than specialised blockchain analytics providers.

Given the background of being built by non-explicitly financial players, it is a sign that main crypto service providers are adapting as fast as they can to the current financial game rules.

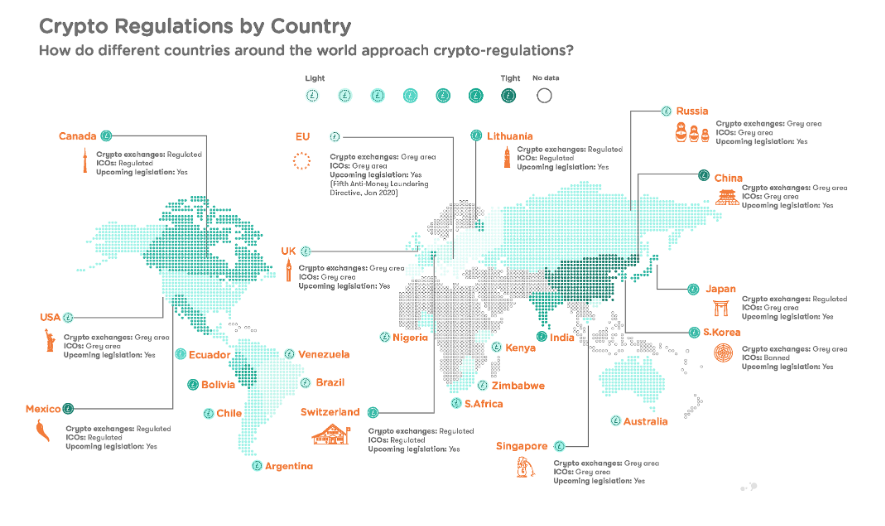

Indeed, and as the study found, there are active efforts at industry self-regulation, with most of entities collaborating with regulators and policymakers to address regulatory issues. This can be seen as, while only 5% of surveyed cryptoasset-only service providers hold an operating license for their jurisdiction, as opposed to 39% of fiat-supporting entities, the study found that the 30% of cryptoasset-only service providers are planning to apply for a license or register with local authorities. This again reflects the industry’s willingness to proactively engage with compliance.

Compliance that has come this year from different institutions worldwide in the shape of drafts and ongoing regulatory projects that have had a irrefutable measurable impact on operations: up to 38% of fiat-supporting service providers have closed a location as a result of regulatory actions.

Other key highlights of the findings include:

- Millions of new users have entered the ecosystem, but most remain passive. Total user accounts at service providers now exceed 139 million with at least 35 million identity-verified users, the latter growing nearly four times in 2017 and doubling again in the first three quarters of 2018. Only 38per cent of all users can be considered active, although definitions and criteria of activity levels vary significantly across service providers.

- Firms are increasingly operating across segments. The cross-segment expansion observed in 2017 has continued. 57per cent of cryptoasset service providers are now operating across at least two market segments to provide integrated services for their customers, compared to 31 per cent in early 2017.

- Multi-coin support is rapidly expanding. Multi-coin support has nearly doubled from 47per cent of all service providers in 2017 to 84 per cent in 2018. This is a trend primarily driven by the emergence of common standards on some cryptoasset platforms (e.g. ERC-20 on Ethereum) that has resulted in a rapid increase in the supply of tokens.

- The majority of identified mining facilities use some share of renewable energy sources as part of their energy mix. The study estimates that as of mid-November 2018, the top six proof-of-workcryptoassets collectively consume between 52 and 111 terawatt-hours (TWh) of electricity per year. The mid-point of the estimate (82 TWh) is the equivalent of the total energy consumed by the entire country of Belgium – but also constitutes less than 0.01 per cent of the world’s global energy production per year. A notable share of the energy consumed by these facilities is supplied by renewable energy sources in regions with excess capacity.

- Mining is less concentrated than commonly perceived. Cryptoasset mining appears to be less concentrated geographically, in hashing power ownership, and in manufacturer options than commonly depicted. The mining map exhibits that hashing facilities and pool operators are distributed globally, with growing operations in the USA and Canada.

All of these new findings reflect “the growing maturity – and recent cooling off – of an industry that experienced huge growth in 2017. The aggregate market capitalisation of cryptoassets skyrocketed from $30 billion in April 2017 to more than $800 billion at its peak in early January 2018, until coming down again to hover at around $200 billion,” was explained in the study.

The annual survey by the CCAF provides a systematic empirical analysis of the rapidly evolving cryptoasset ecosystem, illustrating the structure of a dynamic industry composed of four key segments (mining, storage, exchange, and payments) that collectively grew more than 160 per cent in 2017. The analysis is based on non-publicly available data from more than 180 startups, established companies, and individuals covering 47 countries across all world regions.

This year’s edition of the study uses the term cryptoasset rather than cryptocurrency in the title. 2017 has seen a tremendous explosion in the number of tokens that have been issued on top of existing platforms rather than coming with their own, custom distributed ledger. This trend requires expanding the vocabulary to move the discussion from cryptocurrencies to the broader term of cryptoassets, which appears to have become the commonly-accepted umbrella term when referring to the ensemble of (public) blockchain-based tokens, including, of course, cryptocurrencies.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.