Nowadays, banks have become a rudimentary aspect of life. Especially, if you are a working professional. Even if you are a graduating student, your bank still plays a prominent role in helping you sift through majority of your financial requirements.

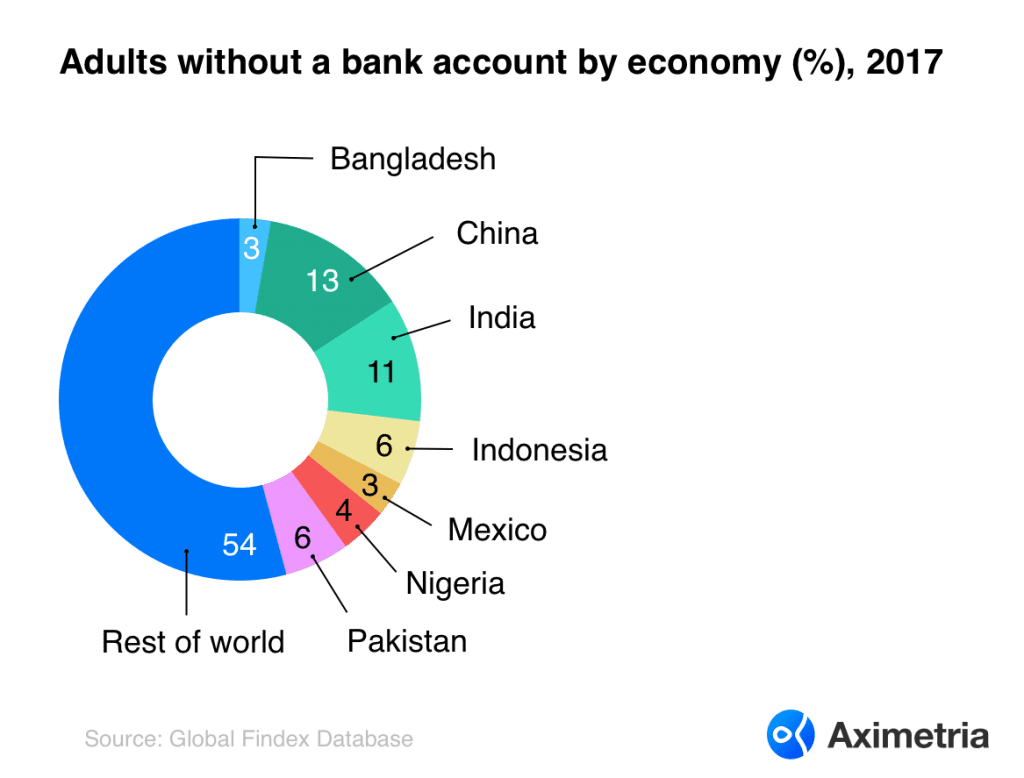

In spite of this normalcy, you may find it hard to believe that about 1.7 billion adults across the world are unbanked. Broadly speaking, these people don’t have an account in a bank or any other financial institution, and are considered excluded from the mainstream economy. According to the World Bank’s 2017 Global Findex report, this number was 2 billion in 2014.

As per the same report mentioned above, China is home to the world’s largest unbanked population (225 million), followed by India (190 million), Pakistan (100 million), and Indonesia (95 million). These nations along with Nigeria, Mexico, and Bangladesh constitute nearly 50% of the world’s unbanked population. Even the United States has 8.4 million unbanked adults, meaning that that no one in the household has a checking or savings account, according to the Federal Deposit Insurance Corporation (FDIC). The FDIC further states that an additional 24.2 million U.S. households are underbanked, meaning that the household has an account at an insured institution but also receives financial products or services like money orders, check cashing, international remittances and others — outside of the banking system. These numbers are staggering.

But why? Why have people remain unbanked in these economies?

Key reasons include:

- Lack of adequate financial liquidity;

- Don’t feel the need for a bank account, as it is an expensive premise;

- Scarcity of appropriate documentation to open an account;

- Distance;

- Infrastructure.

By now, you must have realized that the situation is not easy to fix. Financial instability is an undeniable feature of all these emerging and frontier-market economies. That in turn extends to the official currencies of these nations, and are also subject to the whims and fancies of the government in power. Banking landscape in African countries like Nigeria and Angola, for example, stumbles on many additional challenges, from the lack of infrastructure and poor road networks to insufficient financial education.

However, there is a potential solution to handle the unbanked situation ingeniously.

As you might know, virtual currencies – popularly known as cryptocurrencies (like Bitcoin, Ethereum, etc.), have pretty much been the talk of the town.

Cryptocurrencies:

- Can help prevent fraud;

- Are easily accessible;

- Help in identity theft prevention;

- Enable faster transactional settlements.

But high volatility renders them unsuitable for use. Enter stablecoins, stable versions of their wild crypto counterparts.

As opposed to the highly fluctuating nature of cryptocurrencies, stablecoins are in general equanimous, when it comes to market value. Why? Because, they are “stable” and are pegged (or linked) to national currencies like USD, EUR, CNY or JPY and sometimes to real-world assets like gold or oil. This is to keep their value stable unlike the price of Bitcoin or Ethereum which keeps varying every time.

Advantages of stablecoins:

- Stability in trading from the comfort of your smartphone;

- Easy liquidation for traders and investors in a situation of market collapse;

- Insulation from sporadic volatility.

Primarily, there are three kinds of stablecoins:

- Fiat-collateralized;

- Cryptocurrency-collateralized;

- Non-collateralized (algorithmic).

Out of these three, a fiat-collateralized stablecoin is the most basic and simple form of this cryptocurrency. A central entity (or custodian) puts up an amount of fiat currency as collateral, and a stablecoin is issued against the fiat currency at a 1:1 ratio. This form of stablecoin should, in theory, require a periodic audit to ensure that it is truly collateralized.

Few popular fiat-collateralized stablecoins currently available in the market are:

- Tether (USDT)

- Gemini USD (GUSD)

- USD Coin (USDC)

- Statis (EURS)

- bitEUR (BITEUR)

- bitCNY (BITCNY)

From what it seems, and what you might have guessed fiat-collateralized stablecoins can actually eliminate the requirement for a conventional bank account. Secondly, such stablecoins can actually open up an individual to the global financial market.

How? Imagine a situation where people living in Africa, Asia, or South America have an opportunity of accessing European banking services through any of the fiat-collateralized stablecoins, without having to pay any sort of commision. Wouldn’t it be absolutely amazing?

That’s where Aximetria comes in. A Swiss fintech company Aximetria is committed to promoting banking without borders and providing Swiss-level banking service to global consumers in Europe, Africa, Asia and Latin America.

The company recently announced support for Gemini USD (GUSD) and Statis (EURS) stablecoins in its state-of-the-art financial asset management app. Unlike other European neo-banks offering traditional currencies only to Europeans, Aximetria continues to adhere to the policy of providing high-quality, stable and secure financial instruments globally. Furthermore, Aximetria will support all popular stablecoins in its mobile application by mid-2019.

This year the company will also extend its services to B2B payments on the basis of stablecoins, freeing businesses of a number of restrictions and limitations. Aximetria users will be required to go through a remote verification process (KYC), after which they can buy or sell global currencies. They can also securely store and exchange other currencies. Adding stablecoins is the next step in the company’s strategy to combine innovation and the highest level of security so inherent in financial Swiss services.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals