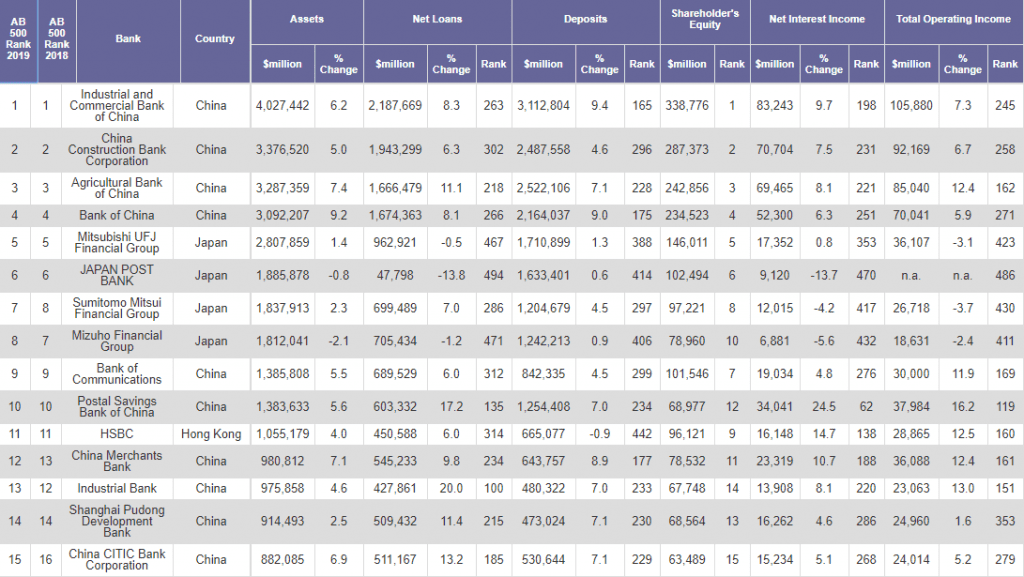

Chinese banks continue to dominate the Asian Banker 500 (AB500) list. The so-called “Big Four” Chinese banks top the ranking, with Industrial and Commercial Bank of China as the largest bank in the region, with $4,027,442 million in assets. China Construction Bank Corporation ($3,376,520 million) and Agricultural Bank of China ($3,287,359 million) close the podium. The last big Chinese bank, The Bank of China, with $3,092,207 million in assets ranks fourth in the list.

The Asian Banker (AB500) covers banks from 20 countries and territories. Altogether, they account for a combined $58.4 trillion in assets, $30.4 trillion in net loans, $40.5 trillion in deposits and $416 billion in net profit. Meanwhile, the top 10 ranking remains relatively unchanged from 2018’s list, with the only exception of Sumitomo Mitsui Financial Group moving up the ranks to seventh place, overtaking Mizuho Group.

Among all Asian banks analyzed, Chinese banks total assets accounted for 50.3% of the combined assets of the 500 largest banks in Asia Pacific. And beyond the “Big Four,” other Chinese banks continue to dominate the list. Bank of Communications ($1,385,808 million) in 9th position and Postal Savings Bank of China ($1,383,633 million) closed the top 10.

Japanese banks consolidate their position in the region, placing four of their banks in the top ten. Mitsubishi UFJ Financial Group, with $2,807,859 million in assets ranks fifth, followed by JAPAN POST BANK ($1,885,878 million), Sumitomo Mitsui Financial Group ($1,837,913 million), and the only new entry in the top ten, Mizuho Financial Group ($1,812,041 million).

“There was a noticeable drop in the number of Japanese banks recorded from 99 in the previous year’s evaluation to 92 this year. The drop can be partially attributed to regional bank mergers in Japan,” was mentioned in the research.

In fact, banks in some Asia Pacific markets face mounting pressure to sustain performance. Banks in Japan, especially regional banks, have been struggling with sluggish loan demand due to an ageing and shrinking population, and their profitability has suffered as years of ultra-low interest rates in the country have continued to depress bank margins. They overtook Bangladeshi banks with the highest average cost to income ratio in the region at 65.5%, and they recorded the average return on assets of 0.24%, compared to 0.31% in the previous year. Japanese regional banks have begun consolidation efforts since the 1990s, but the approval process is lengthy due to current antitrust legislation. Relaxed rules are expected to make it easier for regional banks to merge, but consolidation won’t solve the problems completely.

On the other hand, Siam Commercial Bank overtook Bangkok Bank to become the largest bank in Thailand. KASIKORNBANK is now the second-largest bank in the country and Bangkok Bank is the third. Nonetheless, it remains to be seen whether Siam Commercial Bank will remain the largest.

The capitalisation of Vietnamese banks remained weak, especially the state-owned commercial banks, but they must meet the capital adequacy ratio (CAR) requirement of at least 8% as per the State Bank of Vietnam’s Basel II standards starting from 1 January 2020. Some local banks are expected to be undercapitalised in 2020 and may become targets of acquisition. Besides, banks in China, India and Taiwan are also less capitalised. The weighted average CAR of banks in these three markets stood at around 13.9% in 2018. Chinese banks, especially the smaller ones, are becoming increasingly capital constrained, as bank lending growth has continued to outpace the growth of bank deposits and capital adequacy requirements have been stricter in the country. Some banks have already issued more capital instruments or established plans to raise additional funds.

Hong Kong banks demonstrated sustained financial strength, but they face a tougher operating environment in 2019. In addition to the slowdown in China and the US-China trade war, the political turmoil and protests have weighed heavily on their financial results in 2019. Meanwhile, the emergence of virtual banks will increase competition in the Hong Kong banking sector, which is already highly competitive.

In total, there are 21 banks from China in the top 50, while Japan, the second powerhouse in the region, has been able to place only 8, though 4 of them being featured in the top 10. South Korean banks close the podium with 6 of their banks ranking within the top 50. Their highest ranked bank was KB Financial Group ($430,800 million) in 25th place.

The State of Banking In Asia

Despite new regulatory schemes, principally driven by Basel III compliance, protectionism policies by the Trump’s administration and a slowdown in the worldwide economy, Asian banks are enjoying impressive efficiency ratios and strong growth boosted by an aggressive digitisation.

Like their counterparts elsewhere, Asia’s banking CEOs know they face a digital revolution. Global Financial’s expert recently pointed out that overcoming the digital revolution requires them to execute a scalable innovation-based business strategy in an evermore cutthroat regional banking ecosystem if they are to maintain solid growth in return on equity. They have been investing heavily in digitisation, bringing them to the brink of some critical decisions: whether to be a first mover or a fast follower, how to apply new technology to legacy systems in a cost-efficient manner, and how to address the growing threat of data theft and cyber fraud.

In doing so, they may have some advantages over their global rivals. “Asian banks for the most part emerged relatively unscathed from the global financial crisis, with higher levels of capital versus their Western peers, and have been less distracted by risk and regulation,” says Jan Bellens, sector leader for Banking & Capital Markets at EY in Singapore. “Hence, they have been able to embrace digitisation and innovation more comprehensively, helped by an open mindset among regional regulators. In 2018, the region’s banks demonstrated they are increasingly able to leverage data and meet the challenges of a demanding customer base,” Bellens adds, “while at the same time collaborating with fintech and big tech.”

Digitisation plays a key role in banking development in Asia. One good example is Singapore-based powerhouse OCBC, Southeast Asia’s second-largest bank. Up to 87% of financial transactions in Singapore are completed digitally, so it’s no surprise that OCBC is centering its business plan on digital transformation. The bank has earned a reputation for strategic collaboration with fintech and ecosystem partners; some 95% of its new customers in the city-state are digital. The OCBC OneWealth app, using an OpenAPI platform, enables third parties to integrate OCBC products and services; and Emma, an AI-powered chatbot, answers home-loan queries. The bank even uses facial-recognition technology in some transactions.

Another example of good digital practice comes from the largest bank in Asia, the Industrial and Commercial Bank of China. The bank delivered 4.1% profit growth last year (US$44.26 billion) and achieved gains of 6.5% and 6.2% in business revenue and total assets, respectively. Likewise, ICBC’s investment in digital banking appears to be delivering cost reductions as the bank’s cost-to-income ratio declined by more than 1% to 25.7%.

More From Simon Pearson

https://www.hedgethink.com/top-europes-50-largest-banks-assets-simon-pearson/

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.