Last week we saw a reversal of the previous week in Yields. Equities continue to remain strong as S&P reached new all-time highs, but bonds sold off.

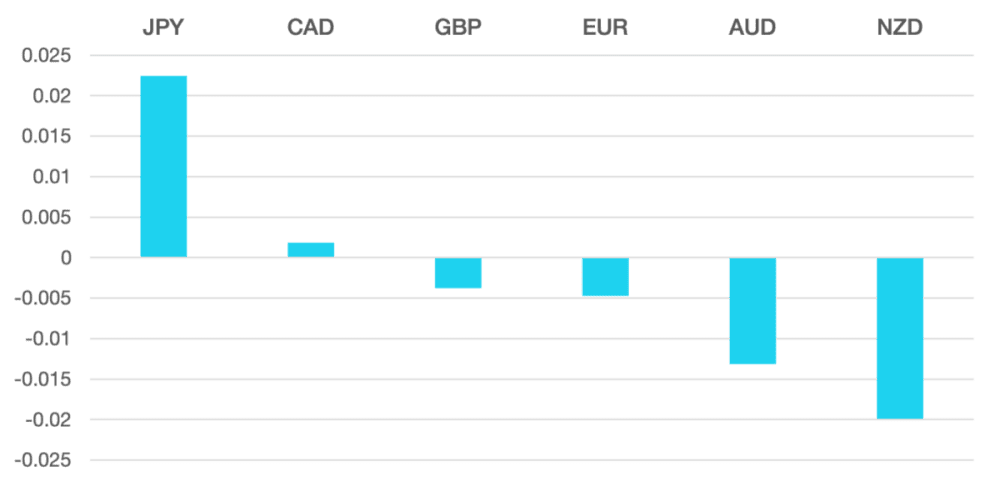

The Dollar moved higher after the previous weeks pause as US Yields rose. the DXY rallied 0.9% to close above 103.

With a quiet economic week in Europe the Euro slipped slightly vs the US Dollar.

UK Economic data however came in relatively mixed especially a surprise uptick in inflation.

We still do not see the BoE changing tack after this, but the GBP did react to the news. By the end of the week GBP was slightly lower vs the Dollar.

Commodity currencies continued their recent run of poor form vs the US Dollar. AUD lost 1.2% and Kiwi lost more than 2%. as continued falling metal prices weigh on commodity currencies and a strong dollar.

Oil feels like a broken record as it intra month volatility remains high but long term is still range bound. Last week the WTI rebounded claiming back much of the previous week’s loss to close around $73.40.

The week ahead sees us move into the Fed blackout period ahead of the January meeting. The market seems to be being looking at rather than the Fed cutting rates but cutting rates more than other central banks which could begin to give downward pressure on the US Dollar.

In terms of data, we have rates from BoJ and ECB along with Manufacturing and Services PMI.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Reversal of Yields first appeared on trademakers.

The post Reversal of Yields first appeared on JP Fund Services.

The post Reversal of Yields appeared first on JP Fund Services.