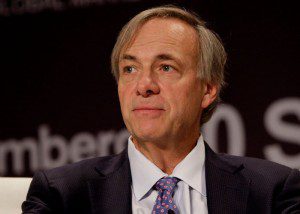

Ray Dalio is one of the superstars of the hedge fund world, and one of the most successful investors of all time. His investment firm, Bridgewater Associates, is the biggest hedge fund in the world (in terms of the amount of capital under management) and was one of the only high-profile names in the investment world to correctly predict the economic crisis of 2008.

Dalio began his investment career at the age of 12 when he bought $300 worth of shares in Northeast Airlines shortly before they merged with another company, after which he tripled his investment. After finishing school, he went on to study at Long Island University and Harvard Business School before moving on to work as a floor trader on the New York Stock Exchange, trading commodity futures. After working for a couple of investment banks, he formed his own investment firm Bridgewater Associates in 1975, and by 2012 the firm had nearly $120 billion under management.

After correctly predicting the coming economic crisis in 2007, when the market was still booming, he published an essay entitled “How the Economic Machine Works; A Template for Understanding What is Happening Now”, giving his explanation of the economic crisis shortly after it kicked off in 2008.

In 2011, he published the 123-page ‘Principles’, outlining his personal philosophy and logic behind investments and corporate management based on his experiences at Bridgewater, which has gone on to become essential reading for anyone involved with the investment industry.

Dalio is notoriously unconventional in the way he runs his business, with his fans describing him in prophetic terms, while his detractors view him somewhat less charitably as being the leader of a corporate cult. Certainly, his insistence that all employees read and abide by his ‘Principles’, a kind of corporate self-help bible based around his ideas on natural selection, is an unconventional step for a fund manager. Yet, while some may argue with his methods, nobody can argue with the success that he has had, or the influence he now wields.

In 2013, Dalio produced and narrated a 30-minute video called How the Economic Machine Works, which can be viewed above. This expounds his belief, in a very persuasive manner, that the economy is actually a lot simpler than it is often made out to be, comparing it to a machine with a few essential inputs or ‘levers’ that control its performance.

In it, he explains the influence of credit on the economy in terms of short- and long-term debt cycles, and how a certain confluence of these cycles can lead to a deleveraging situation, such as the one we saw in 2008, and compares this with previous examples of this such as the Great Depression in the 1930s, Britain in the 1950s, and Japan in the 1990s. As an explanation of the economy, and in particular the recent crisis, it is very elegant, and all the more persuasive given his timely prediction of the events of 2008.

While he does compare the current situation with that of the Great Depression and the onset of the Second World War, and hints darkly that history could repeat itself, it’s not all doom and gloom. He rounds off on a semi-optimistic note by mapping out a way for the economy to be rescued after a deleveraging situation, although with the caveat that it would take at least ten years or a ‘lost decade’ before normal service can be resumed. His visionary insights, his unconventional management philosophies, and above all else his stellar success in the investment business, are the main reasons why Dalio is often referred to as the ‘Steve Jobs of Investing’.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.