Gold, a lively and flexible metal with a radiant sheen, has symbolized wealth and luxury throughout history. The enduring charm of it originates from its inherent value, shaped by its scarcity, sturdiness, and adaptability.

Within the realm of gold’s trade and investment market, a substantial segment is occupied by gold bullions, also known as bars. Having endured the trials of time as a dependable and highly desired option, it possesses an intrinsic value and historical importance that presents an exclusive opening for investors aiming to expand their portfolios.

Whether you’re an experienced investor or a newcomer embarking on the journey of financial planning, delving into the intricacies of investing in it can revolutionize your investment strategy.

The Timeless Allure of Gold Bullions:

Gold bullions have fascinated civilizations for centuries. Their enduring allure stems from the fact that it has been recognized as a symbol of wealth, stability, and luxury across cultures and periods. Unlike currency or stocks, which economic fluctuations or market trends can influence, gold’s value remains relatively stable. This inherent stability has made it a preferred choice for hedging against inflation and economic uncertainties. Additionally, it has a universal appeal, transcending borders and language barriers, making them a truly global investment. For further insight into this impactful tactic to safeguard against inflation and to acquire this valuable metal, reputable online platforms like https://www.goldbullionaustralia.com.au/ can provide useful information and options for purchase.

The Significance of Physical Ownership:

A notable attribute of investing in it pertains to its tangible essence. When you invest in its investment, you’re procuring concrete assets you can physically grasp. This hands-on ownership imparts a feeling of assurance and introduces an additional dimension of variety to your investment collection. Unlike virtual assets, it remains unaffected by the performance of financial establishments or technological systems. This aspect renders it appealing to individuals aiming to curtail their susceptibility to digital susceptibilities.

Navigating Market Trends:

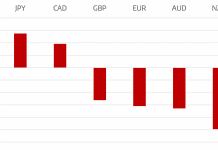

Comprehending market trends holds significant importance for every investor, and the domain of it follows suit. Multiple elements, encompassing economic cues, geopolitical occurrences, and the residing and flow of supply and demand, hold sway over its valuation. Vigilantly monitoring these factors can aid in determining the opportune moments to acquire or divest your gold assets. It’s worth highlighting that prices frequently exhibit an inverse relationship with conventional currency values. This dynamic implies that during periods of economic upheaval, gold can serve as a sanctuary for your investments.

Practical Considerations: Storage and Authentication:

Investing in it comes with practical considerations beyond just market trends. One of these considerations is storage. Unlike other investments that can be managed digitally, it requires physical storage. Many investors store their bars in secure vaults provided by specialized companies. These vaults offer a safe place to keep your precious metals and the convenience of easy access when needed. Additionally, ensuring the authenticity of your gold bullion is paramount. Reputable dealers often provide certification and authentication services, giving you the confidence that your investment is genuine.

Diversification and Risk Management:

While it offers a stable and valuable investment option, it’s important to remember that no investment is entirely risk-free. Diversification, the practice of spreading your investments across different asset classes, remains a fundamental strategy for managing risk. It can be pivotal in your diversification efforts, counterbalancing more volatile investments like stocks or cryptocurrencies. By incorporating this into your portfolio, you can reduce the overall risk and enhance the stability of your assets.

Conclusion:

In the world of investment opportunities, few options have the enduring appeal and stability of gold bullion. Their historical significance, physical tangibility, and potential to act as a hedge against economic uncertainties make them attractive for investors seeking to diversify their portfolios. While navigating the investment world, you must carefully consider market trends, storage options, and risk management strategies. The potential rewards can be substantial. So, whether you’re a seasoned investor looking to bolster your portfolio or a novice investor taking your first steps, exploring the world of gold bullions could be a step towards building a more resilient financial future.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals