Choosing a fund platform can be a more complex decision than you might at first think for both investors and advisors. Often people will assume that price is the most important factor. Indeed, some might believe that the cheapest possible option is the best one. However, this is not necessarily the case, and the situation can be a lot more complicated than that. Some platforms offer more than others and choosing platforms that offer value may be more suitable in some cases. Indeed, it may be argued that where price is the only benefit, this may not be enough for some.

According to David Prosser (2015) writing for Kurtosys, cheap can often be good, but companies that focus on price alone may not necessarily offer much value. As Prosser argues:

“Most obviously, this is a race to the bottom – in a price war you have no option but to continue under-cutting the competition, whatever it does, slicing margins ever thinner and eventually moving into loss.”

This leads to the argument that cheapest often is not the best in the market. One of the challenges is that even if the lowest prices are offered this does not mean the same as making a platform the cheapest available option in the market. Charging structures are rather complex in this industry and this makes it rather difficult for investors to be able to find a deal that is cost effective and which suits their needs. There is also the issue of trust which is argued to be lacking in this industry. All of this leads to crises of confidence regarding the decisions that investors make.

Necessary Features of fund platform

Ultimately it may be argued that in choosing a fund platform, both investors and advisors are looking for more than just dirt cheap prices. While no one wants to pay over the odds, typically they are also looking for a range of other features too. One such feature is a platform having a diverse range of funds. In this case if an investor is looking for a specific fund and cannot see it anywhere on the platform then he or she will be forced to go elsewhere. Do you think he/she will return? The answer is an obvious, resounding no. This means that platforms do need to have a range of different funds for investors to choose between. One option that needs to be on such platforms is closed ended investment funds.

Arguably there is nothing worse than a terrible user experience. If fund platforms are not straightforward and intuitive to use then investors may simply go elsewhere. Difficult to use platforms waste time for investors and advisors and give them headaches. Clearly they are far more likely to opt for a platform that offers a good user experience, that is easy to navigate around and find the required pages. One area where some fund platforms may need to improve in this regard is offering solutions that work well on mobile devices – that have actually been designed to work on different kinds of devices.

Another important offering to attract and keep investors and advisors is portfolio tools. Some platforms do not allow investors and advisors to make their own decisions, and this may not necessarily be a favoured approach. Rather, those platforms that provide good tools and research information that allow an investor to come to his/her own decision may be most appealing. Additionally, advisors will be eager to use these kinds of tools when coming up with options to suit their clients’ needs. Actually, offering tools that are specifically designed for advisor use is also very helpful, not least in attracting and retaining advisors. The types of information sought are guidance on relationship management and reporting in addition to data.

Shares

As suggested by Justin Modray, founder of Candid Money and Compare Fund Platforms, the most vital question investors should as is whether they will ever be likely to want or need to hold shares – including investment trusts and exchange traded funds – in their portfolio via a platform. If the answer is yes, then it will rule out the fund-only platforms such as Fidelity and Axa. The cost of holding shares can also prove high via some other platforms, such as Bestinvest, where an uncapped percentage fee applies.

Various structures of investment platforms

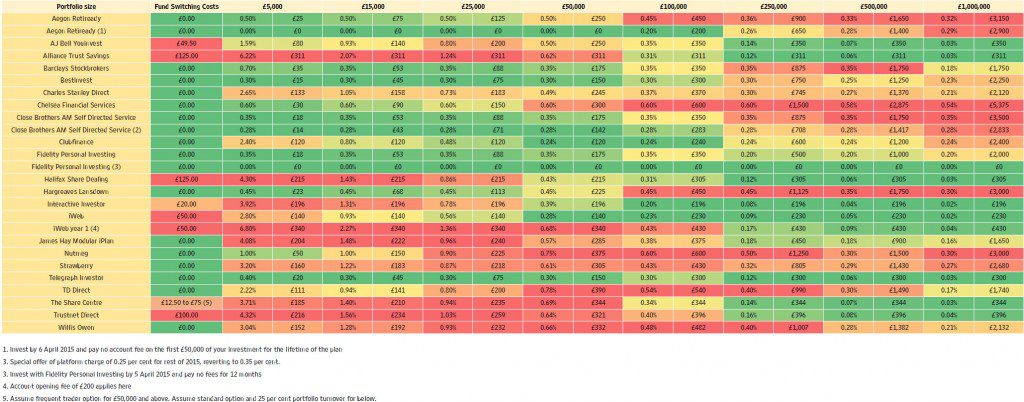

Below table represents pricing levels of different charging structures of investment platforms introduced by Steven Nelson, research manager at The Lang Cat.

Source: What should you consider when choosing your fund platform?, Money observer

He emphasizes that this is only a starting point while the most important is to understand exactly what you’re looking for in an investment platform – and only you can do that.

It is not rocket science. Investors and advisors want platforms that are straightforward to use, that they do not have to think too hard about (unless they want to, and in which case they want to make their own decisions) and that are designed to meet their needs. They need options that provide flexibility too. Platforms that are able to offer these types of attributes are those that are likely to snap up more of the market in the longer term.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.