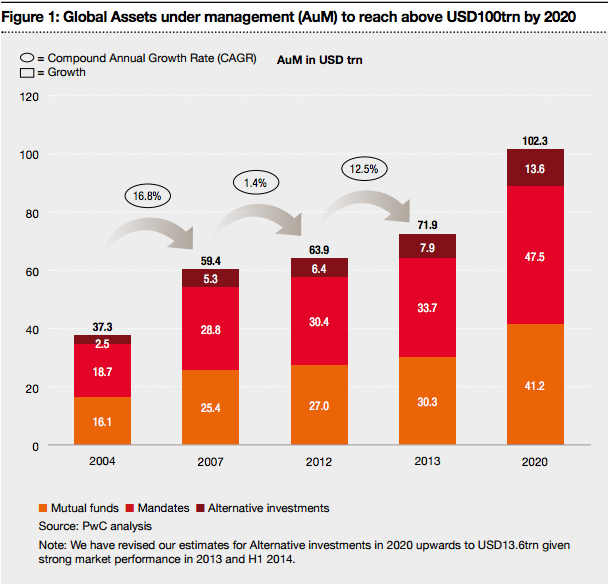

For asset management firms, by 2020 handling tax risk will be a way that companies differentiate themselves from one another and are able to achieve competitive advantage. PWC believes that:

“Investors will expect robust and efficient tax infrastructure and will have minimal tolerance of tax uncertainty or adjustments. As a result, tax will be a key operational and business activity.”

Indeed, PWC believes this will provide opportunities for businesses rather than necessarily just ending up as a risk to manage. One of the issues is that asset managers will come under greater attention from tax authorities and this will require specialist teams to be in place to deal with this. PWC suggests that asset managers will react to this by making sure that they have strategic tax resources throughout their business operations.

Source: Asset management 2020 and beyond

Transparency and Portfolio Taxation

One important factor in all of this is that tax transparency will be essential in the financial markets by 2020. The Common Reporting Standard will play an important role in bringing this about. It is argued that there will be onshore financial centre products and these will be tax exempt sometimes, with no withholding tax on redemptions or distributions. This will be driven by companies trying to get investment inbound. REIT funds are expected to be created as a part of this.

Portfolio taxation is expected to become an area where asset managers will be in conflict with each other. There will be a greater focus on post-tax yields rather than pre-tax, and every aspect of purchase and sale will need to be considered to make sure that tax risks are fully understood. It is considered likely that by 2020 there will be integrated businesses. They will include asset management, wealth management and banking activities and as a part of this, tax advisory will be offered. Another key trend expected, is that some companies will brand themselves on the basis of tax. This will be central to marketing and building a good reputation.

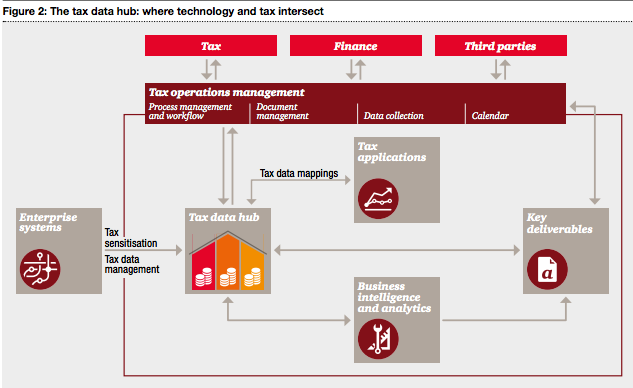

Tax technology

Tax technology is also going to become a very important function going forward. The technology environment will be set up so that databases consider the tax factor in detail. Technology for tax will be programmed such that it enables investment firms to be able to make optimised decisions about tax. This will allow them to provide the authorities with the information that they need, as well as investors.

Source: Asset management 2020 and beyond

The technology will provide transparency and reporting that all players will need. People will be more interested in funds that show that they are tax efficient, and this will provide competitive advantage. Technology tools will provide excellent opportunities for optimising workflow. In fact it is expected that tax authorities will be able to get the information that they need directly from asset managers from their systems rather than asset management firms having to actually go about sending it to them. This is yet to be seen if it will pan out this way.

The tax function of the future is expected to be extremely different than it is today by 2020. It is expected to play a very important role in the management each day of operational risks and it will no longer only be about compliance and making tax assessments. Instead a focus on the analysis of data that is complicated and the implications of this in business will become standard. The profile and set up of the tax activities in asset management will have changed. This will involve significant ties with operational activities to make sure that it will be possible to provide advice both internally and to executives on the tax function.

To be able to deal with all of this effectively asset managers have to make sure that tax people that are very skilled are central to the business. In some cases this will mean bringing in new talent and in others it will just involve making tax more integral to everything. Those organisations where managers really understand the importance of the tax function to operations will be those that are more likely to succeed in this new environment. It is recommended that senior executives make clear the importance of tax throughout the organisation.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.