In 2019, Aramco went public on the Saudi stock exchange and raised $29.4 billion, making it the largest IPO in history at the time. Initial Public Offerings (IPOs) are a way for companies to raise capital by offering shares of their company to the public for the first time. Over the years, there have been many successful IPOs that have set records and captured the attention of investors around the world.

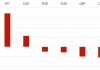

Here are the top 10 IPOs of all time:

Saudi Arabian Oil Co (Aramco)

In 2019, Aramco went public on the Saudi stock exchange and raised $29.4 billion, making it the largest IPO in history at the time. Aramco is the world’s largest oil producer, and the IPO was seen as a way for Saudi Arabia to diversify its economy and reduce its reliance on oil revenue.

Alibaba Group Holding Ltd

In 2014, Alibaba made history by having the largest IPO in history, raising $25 billion. Alibaba is a Chinese e-commerce company that has been able to capitalize on the growing Chinese middle class and expand its reach globally.

Agricultural Bank of China Ltd

In 2010, the Agricultural Bank of China raised $22.1 billion in its IPO. The bank is one of the largest in the world and is a key player in China’s financial sector.

Industrial and Commercial Bank of China Ltd

In 2006, the Industrial and Commercial Bank of China raised $21.9 billion in its IPO. The bank is the largest in China and has a significant presence around the world.

General Motors Co

In 2010, General Motors raised $20.1 billion in its IPO. The company had filed for bankruptcy just a year earlier, but the IPO marked its return to the stock market.

Visa Inc

In 2008, Visa raised $17.9 billion in its IPO. The company is one of the largest payment processing companies in the world and has a significant presence in the financial sector.

Facebook Inc

In 2012, Facebook raised $16 billion in its IPO. The social media giant had a rocky start, with technical issues delaying trading on the Nasdaq exchange and the stock price falling below its initial offering price. However, Facebook has since recovered and is now one of the most valuable companies in the world.

AT&T Wireless Services Inc

In 2000, AT&T Wireless raised $10.6 billion in its IPO. The company was a significant player in the telecommunications industry and was later acquired by Cingular Wireless.

Enel SpA

In 1999, Enel raised $16.3 billion in its IPO. The Italian utility company is one of the largest in Europe and has a significant presence around the world.

Deutsche Telekom AG

In 1996, Deutsche Telekom raised $13.2 billion in its IPO. The company is one of the largest telecommunications companies in the world and is based in Germany.

These top 10 IPOs of all time have set records and captured the attention of investors around the world. An IPO, or Initial Public Offering, is a process through which a privately held company offers shares of its stock to the public for the first time.

An IPO is often seen as a major milestone in the life of a company, as it enables the company to raise significant capital by selling ownership stakes to a wide range of investors. In an IPO, the company will typically work with an investment bank or underwriter to issue shares of stock to the public and to market the offering to potential investors. Once the IPO is completed, the company’s shares will be traded on a public stock exchange, where their value will be determined by supply and demand in the market.

An IPO can be a complex and expensive process, and it typically requires the company to disclose detailed financial information and other information about its business to the public. However, an IPO can also provide a company with increased visibility, access to capital, and other benefits that can help it to grow and succeed over the long term.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals