Last week we finally saw a change from the trend as Dollar was the weeks worst performer.

A cooling US job market and Powell signalling a June rate cut sent the US Dollar tumbling. During his semi-annual statement he hinted that the Fed is not far from the point of comfort to ease monetary policy.

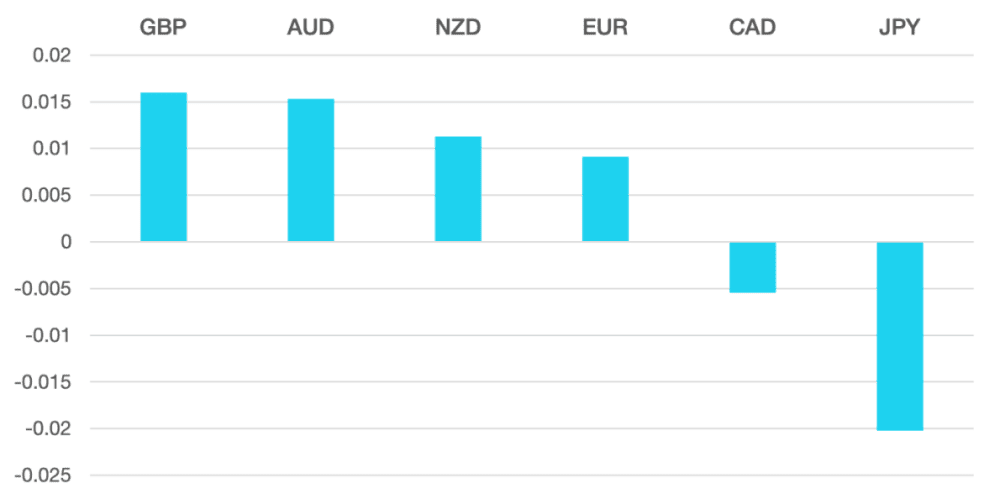

The Yen was in contrast the weeks best performer as it stages a huge rally. This was driven by a growing expectation of a BoJ rate increase this month. The probability of a rate rise has moved from 30% to as high as 70% as it seems the annual wage negotiation looks set to secure the highest wage hikes for more than 2 decades.

Elsewhere it was a mixed week. The GBP was the second-best performer as it rose with the general risk on sentiment but gained against the Euro. GBP rose through 1.28 to end the week around 1.2850.

Commodity currencies had a good week again buoyed by general risk on. AUD was a performer as improved trade relations with China took the currency higher vs a weak dollar.

Oil reversed most of the previous week’s gains and still remains in a volatile range. WTI closed 2.5% lower around $77.5.

The week ahead could see a continuation of the weakening dollar. The US CPI reading will give a further indication of the Fed’s next move. Other than that, it is a quieter week on the data front.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Loss as Yen Rises first appeared on trademakers.

The post Dollar Loss as Yen Rises first appeared on JP Fund Services.

The post Dollar Loss as Yen Rises appeared first on JP Fund Services.