Last week the market was data heavy with several Central Banks making their decisions.

The BOJ finally made its move and lifted rates from negative territory for the first time in years. The main headline of course was the Fed which although kept rates unchanged the dovish tone came through.

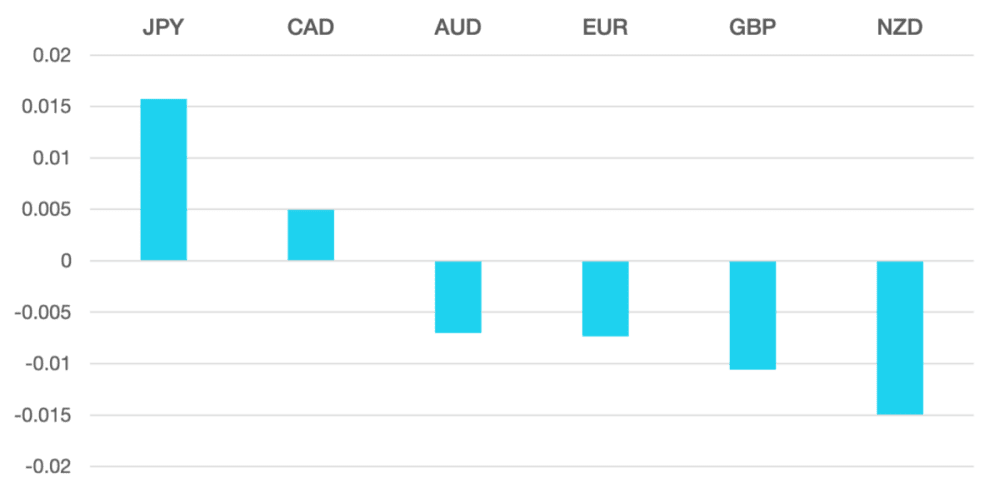

The USD had a second strong week with the DXY rallying over 1%.

GBP had a muted week. While the BoE left rates on hold the last 2 hawkish members moved to hold and comments after seeming to show the BoE is looking dovish for the rest of 2024. This could set the stage for rate reduction beginning with the possibility of 3 rate reductions coming.

Commodity currencies continued to suffer due to a rising dollar for the second week. Both AUD and CAD lost around 0.5% but NZD fared worse losing around 1%.

The week ahead is quieter with most of the Central Bank decisions now complete. However, we still have some data including US GDP and PCE.

The week ahead is a busy one as more central bank decisions come into focus.

We have BoJ on Tuesday along with the Fed, BoE and RBA. This could lead to setting the trajectory for the coming sessions as guidance or decisions are confirmed.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post BOJ Made Its Move first appeared on trademakers.

The post BOJ Made Its Move first appeared on JP Fund Services.

The post BOJ Made Its Move appeared first on JP Fund Services.