BofAML, HSBC, IDA Singapore Build Pioneering Blockchain Trade Finance App

Consortium of banks and financial authorities proves Letter of Credit transactions can be executed on Blockchain Digital innovation heralds trade efficiency benefits for banks and companies and launches a paper-intensive Letter of Credit (LC) transaction by sharing information between exporters, importers and their respective banks on a private distributed ledger. This then enables them to execute a trade deal automatically through a series of digital smart contracts. Bellow the PR:

August 10, 2016: Bank of America Merrill Lynch, HSBC and the Infocomm Development Authority of Singapore (IDA) announced today that they have jointly developed a prototype solution built on Blockchain technology that could change the way businesses around the world trade with each other. The consortium utilized the Linux Foundation open source Hyperledger Project blockchain fabric which development was supported by IBM Research and IBM Global Business Services.

The application mirrors a paper-intensive Letter of Credit (LC) transaction by sharing information between exporters, importers and their respective banks on a private distributed ledger. This then enables them to execute a trade deal automatically through a series of digital smart contracts.

The proof of concept shows potential to streamline the manual processing of import/export documentation, improve security by reducing errors, increase convenience for all parties through mobile interaction and make companies’ working capital more predictable. The consortium now plans to conduct further testing on the concept’s commercial application with selected partners such as corporates and shippers.

Ather Williams, head of Global Transaction Services, Bank of America Merrill Lynch, said: “We are continuously looking for ways to simplify and improve transaction processing for our clients. Blockchain has reshaped our thinking on how to make transaction processes more efficient and transparent for all parties. The success of this proof of concept is a significant development towards digitizing trade transactions, potentially resulting in considerable benefits to the supply chain process.”

“Many people are talking about the theory of Blockchain, but for the first time we can start to see how this technology might be used to solve the real world challenges our customers face,” said Vivek Ramachandran, Global Head of Product for HSBC’s trade finance business. “It’s really exciting to have a valid proof of concept. Letters of Credit are an important part of the trade system, but they are based on 20th century technology, not 21st. Our challenge is to take this from concept to commercial use; making it quicker and easier for businesses to connect with new suppliers and customers at home and abroad.”

“A letter of credit or LC conducted on Blockchain enables greater efficiencies and visibility in trade finance processes, benefitting multiple parties across its value chain. With participation of more members, greater impactful benefits will be realised by the trade ecosystem. As part of the Smart Nation journey, partnerships and the adoption of such innovations can help transform the banking and finance sector,” said Khoong Hock Yun, Assistant Chief Executive of IDA Singapore’s Development Group.

Trade finance processes are typically time and labour intensive, involving multiple documents and checks to reduce risk and provide assurance to sellers, buyers and their banks. A Letter of Credit (LC), or Documentary Credit, is essentially a guarantee provided by a bank that a seller will receive payment from a buyer once certain conditions are met; for example once the seller can provide proof that they have shipped the buyer’s goods.

With this concept, each of the four parties involved in an LC transaction – the exporter, importer and both of their banks – can visualise data in real time on a tablet and see the next actions to be performed. Each action in the workflow is captured in a permissioned distributed ledger, giving transparency to authorised participants whilst encrypting confidential data.

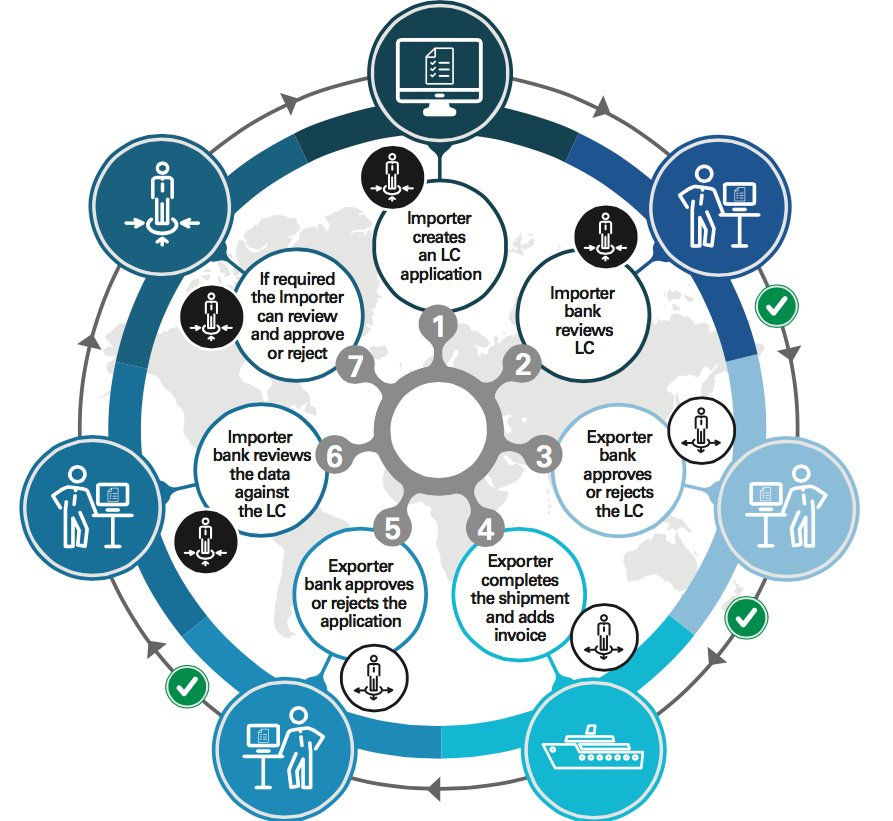

How does the concept work?

Step 1: Importer creates an LC application for the Importer Bank to review and stores it on the Blockchain.

Step 2: Importer Bank receives notification to review the LC and can then approve or reject it based on the data provided. Once checked and approved, access is then provided to the Exporter Bank automatically for approval.

Step 3: Exporter Bank approves or rejects the LC. Once approved, the Exporter is able to view the LC requirements and is prompted to view through the application.

Step 4: Exporter completes the shipment, adds invoice and export application data and attaches a photo image of any other required documents. Once validated, these documents are stored on the Blockchain.

Step 5: Exporter Bank approves or rejects the application and documents.

Step 6: Importer Bank reviews the data and images against the LC requirements, marking any discrepancies for review by the Importer. When approved, the LC goes straight to completed status or is sent to the Importer for settlement.

Step 7: If required due to a discrepancy, the Importer can review the export documents and approve or reject them.

About The Platform:

Infocomm Development Authority of Singapore

The mission of the Infocomm Development Authority of Singapore (IDA) is to develop information technology and telecommunications within Singapore with a view to serve citizens of all ages and companies of all sizes. IDA does this by actively supporting the growth of innovative technology companies and start-ups in Singapore, working with leading global IT companies as well as developing excellent information technology and telecommunications infrastructure, policies and capabilities for Singapore. For more news and information visit www.ida.gov.sg

HSBC

HSBC Holdings plc, the parent company of the HSBC Group, is headquartered in London. The Group serves customers worldwide from around 4,400 offices in 71 countries and territories in Asia, Europe, North and Latin America, and the Middle East and North Africa. With assets of US$2,608bn at 30 June 2016, HSBC is one of the world’s largest banking and financial services organisations.

Bank of America

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 47 million consumer and small business relationships with approximately 4,700 retail financial centers, approximately 16,000 ATMs, and award-winning online banking with approximately 33 million active accounts and more than 20 million mobile active users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business owners through a suite of innovative, easy-to-use online products and services. The company serves clients through operations in all 50 states, the District of Columbia, the U.S. Virgin Islands, Puerto Rico and more than 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

Bank of America Merrill Lynch is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp., all of which are registered broker-dealers and Members of SIPC, and, in other jurisdictions, by locally registered entities. Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured * May Lose Value * Are Not Bank Guaranteed.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals