“The $1bn Club, those hedge funds with at least $1bn or more in assets under management, have continued to grow over the past twelve months, both in terms of the assets they command and their influence on the hedge fund industry. This group of 570 hedge funds now accounts for 92% of the total assets managed by hedge funds,” says Amy Bensted, Head of Hedge Fund Products, Preqin- the leading source of information for the alternative assets industry

Today total hedge fund industry assets size has grown to $3.16tn and more than 5000 hedge fund managers are operating. But the hedge fund industry is highly concentrated. 90% of the total assets is controlled by 10% of Hedge Fund Managers. A study by Preqin reveals that asset-size of most of the Hedge Funds are small. Only 570 hedge fund managers have at least $1bn assets under their management. These 570 managers control $2.78tn out of the total $3.16tn in assets for the industry as of the end of Q1 2015.

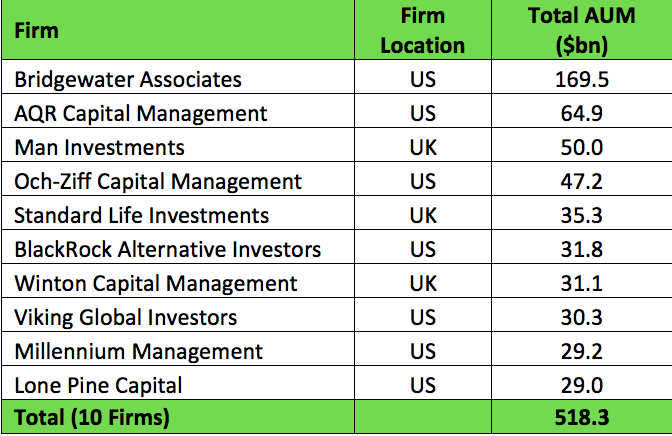

A large proportion of these assets are concentrated among a small pool of large managers. There are only 22 fund managers who have assets exceeding $20tn. And the top 10 Hedge Funds together have assets exceeding half a trillion dollar:

Source: Hedge Fund Spotlight, May 2015 by Preqin

Bridgewater Associates with $169.5bn in assets under management is the largest hedge fund managing more than 2% of Hedge Fund Industry assets. It is far away from its nearest competitor are AQR Capital Management with just $64.9bn in assets.

Investors prefer large hedge funds with a long track record. Institutional investors generally require an average track record of three years from a fund. Institutional investors ask for more transparency. As most of the top large funds are more than two decades old, they meet investors’ criteria. New regulations such as AIFMD, Dodd-Frank and JOBS need higher compliance and have put small and medium hedge funds in a disadvantageous position. Large fund managers are able to attract capital from institutional investors. As a result there is a growing tendency towards concentration of assets.

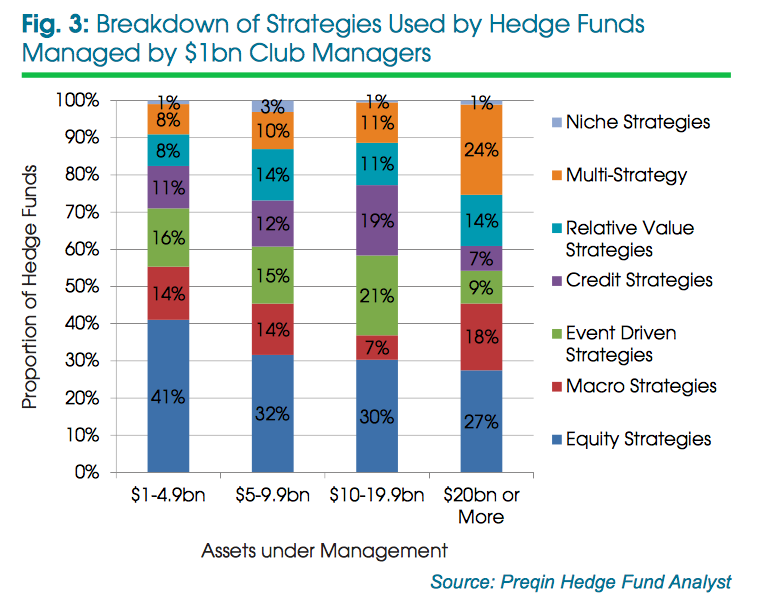

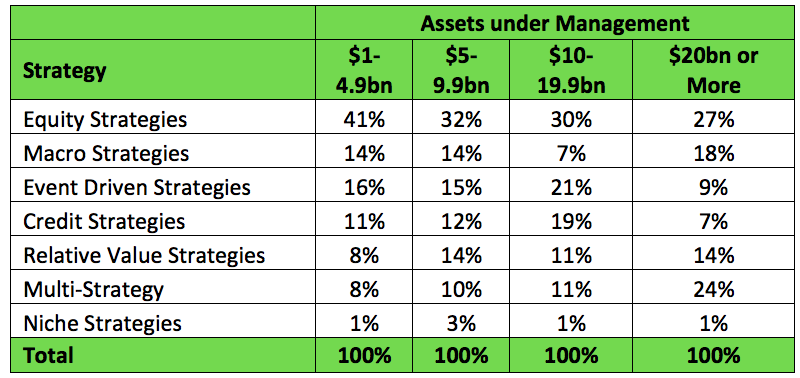

Source: Hedge Fund Spotlight, May 2015 by Preqin

Geographically also, the hedge fund industry has remained mostly centered in the US and UK. All top 10 firms are located either in the US or UK. The analysis further shows that out of 570 hedge fund managers with at least $1bn assets, 202 managers are located in New York managing collectively over $1tn assets and 83 in London managing $363bn in assets.

Analysis of investors’ preference shows macro strategy funds are the most sought by big investors. Half of the large investors, having at least $1bn investment in hedge funds, have shown preference for macro funds. Hedge funds employ a diverse range of strategies which are influenced also by their asset sizes besides other factors. There are significant differences in strategies between the larger and smaller fund managers. One out of every four managers has equity strategies. Particularly smaller funds prefer equity strategies. Large funds with their expertise and vast experience go for a range of core strategies besides multi-strategy and also macro strategies. Multi-strategy funds are more common among firms with over $20bn. The multi-strategy investing reduces the risk of concentrated portfolio and dependence on a single strategy to produce consistent returns.

Source: Hedge Fund Spotlight, May 2015 by Preqin

Thus, the Hedge Fund Industry is passing through a phase of consolidation. Investors look for large hedge funds with good track record. Compared to small funds, top performing large hedge funds find it more comfortable to raise capital from investors. With their infrastructure and core competencies, large fund managers are able to use multi-strategy and macro strategy for better return on investment.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.