Climate Change implications for various Assets and Industries

In light of ongoing changes towards the policies and regulations on climate change, every investor should be concerned about the risks that these changes bring to business. It is less than 5 weeks left for the meeting of global leaders on Climate Change regulation that will introduce Carbon Pricing mechanism.

Here we introduce just the main principles of the Carbon Pricing mechanism and more details can be found on the Leadership Panel.

Carbon Pricing Mechanism

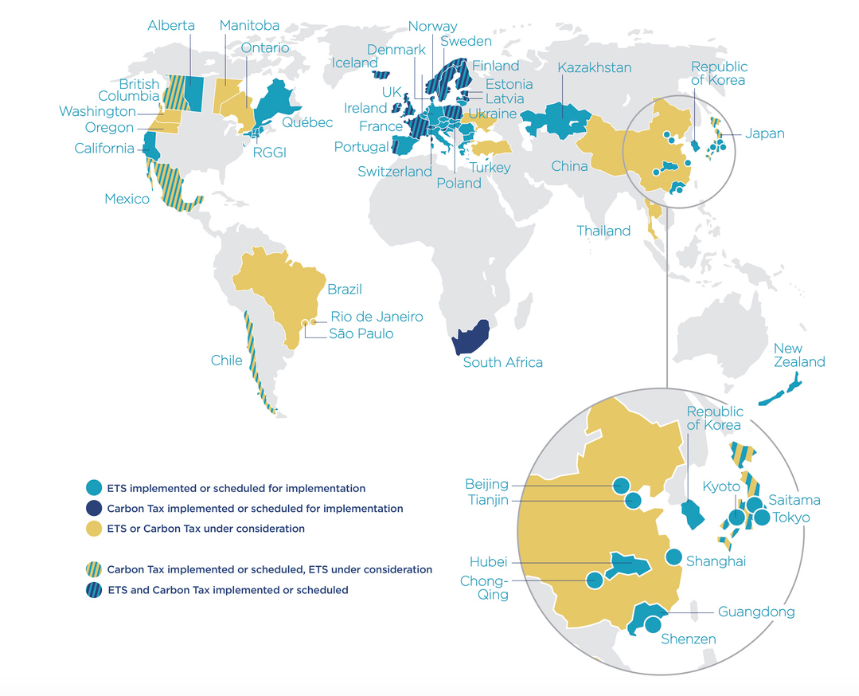

Carbon Pricing will launch more efficient tax systems such as Emissions Trading Systems (ETS) and Carbon Taxes. ETS or cap-and-trade systems caps the total level of greenhouse gas emissions and lowers the cap over time. AS companies are allowed a limited number of emissions permits, supply and demand forces are created on the market. As a result ETS establishes a market price for greenhouse gas emissions, as industries with low emissions are able to sell their extra allowances to larger emitters. While Carbon Tax directly sets a price on carbon by defining a tax rate on greenhouse gas emissions. The difference between Carbon Tax and ETS is that the emission reduction outcome of a carbon tax is not pre-defined by the carbon price is. Either ETS or Carbon Tax choice of the instrument will depend on national and economic circumstances.

Below is the global map of countries and cities already use carbon pricing mechanisms or are planning to implement them. These almost 40 countries and 20 cities, states and provinces are responsible for more than 22% of global emissions.

Source: Carbon Pricing Leadership

Investing in a time of Climate Change

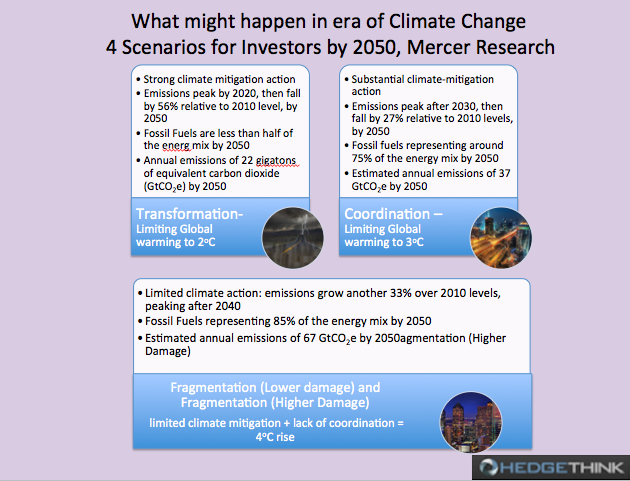

Since climate change poses portfolio risks as well as opens up new opportunities it is vital to evaluate risks and develop risk averse strategies for institutional investors who manage trillions of dollars. Mercer’s Investments team published a report where they evaluate risk for institutional investors and recommend strategies based on four scenarios. Their analysis estimate the potential impact of climate change on industry sectors, asset classes and total portfolio returns, between 2015 and 2050.

As suggested by Mercer, there are four risk factors that indicate the future implications of climate change for investors, so called ‘TRIP’ which stands for

- Technology rate of progress and investment in the development of technology to support the low-carbon economy

- Resource Availability – the impact on investments of chronic weather patterns

- Impact – physical impact on investment of acute weather incidence/severity

- Policy – all international national and sub-national targets, mandates, legislation and regulations meant to reduce the risk of further man-mad or “anthropogenic’ climate change.

Scenario Signposts

The scenarios developed by Mercer offer investors a range of what’s possible, providing several views of the way the next 35 years might play out. They are as follows:

- Transformation

- Coordination

- Fragmentation (Lower Damages)

- Fragmentation (Higher Damages)

Source: Scenario Signposts, Investing in Climate Change, Mercer Report

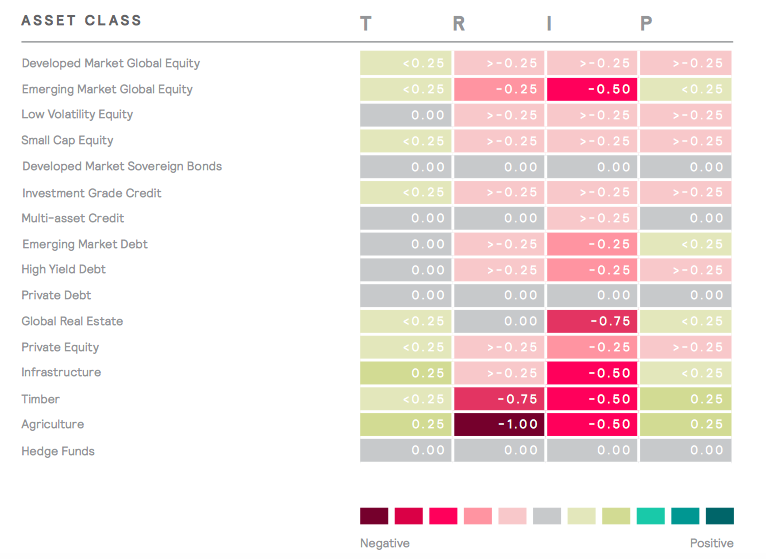

Climate Change implications for different Assets

As a result of these scenarios there is behaviour of asset class and industry based on sensitivity and return impacts. Asset class sensitivity and return impacts resulted in only developed market global equity having a minimum negative impact, regardless of the scenario given its negative sensitivity to the Policy factor. Infrastructure, emerging market equity and real estate are expected to benefit from climate policy and technology, while agriculture and timber have negative sensitivity to Resource and Impact factors and positive Policy and Technology sensitivity.

Source: Sensitivity to the Climate Change Risk Factors — Asset Class Level, Investing in Climate Change, Mercer Report

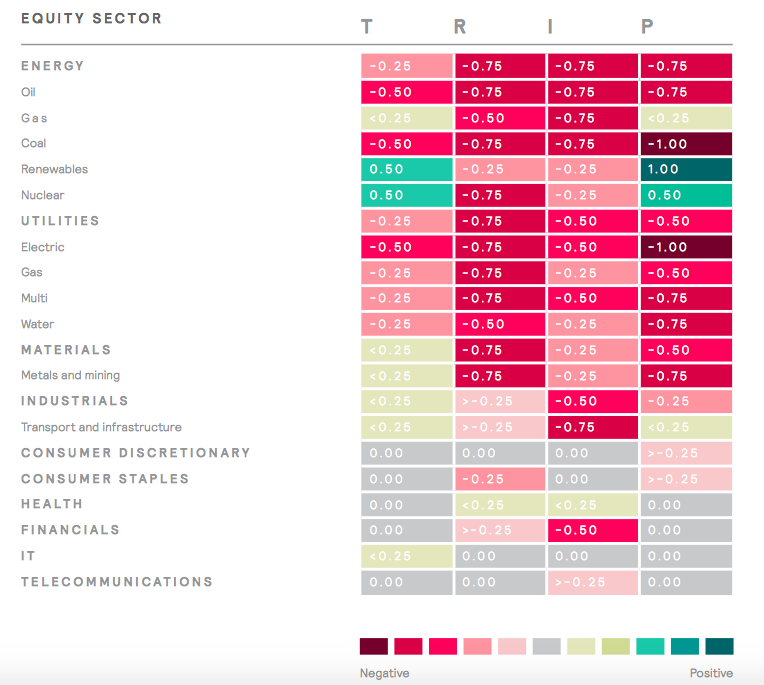

Climate Change implications for different Industries

Obviously, the most sensitive to the Policy factor in the industry-sector level are Energy and Utilities, Coal and Electric utilities being the mostly sensitive negatively. Renewables and Nuclear have the highest positive sensitivity. Energy and Utilies showed the greatest negative sensitivity to the Resource Availability and Impact factors as well. Such industries as Renewables, Nuclear, Materials and Industrials expressed the highest positive sensitivity to the Technology factor showing the development in the progress and investment supporting low-carbon environment.

Source: Sensitivity to the Climate Change Risk Factors — Industry and Sector Level, Investing in Climate Change, Mercer Report

Climate Impact on Equity at a Country Level

Since equities typically comprise a significant proportion of most institutional investment portfolios, climate change implications are better understood for equities given the relatively high level of integration of Environmental, Social and Governance issues relative to other asset classes. Some adjustments based on considerations at a country level suggested the following:

- UK, Australian and Canadian equities to be more sensitive given the higher exposure of these regional equity markets to carbon-intensive sectors

- UK and European equities to be less vulnerable to climate change policy shocks given existing policy and commitments in place. These markets are expected to be better prepared for additional climate -related policy given the relative transparency

- Australian equities to be more sensitive to a climate change policy shock considering the greater level of policy uncertainty

- US is expected to count to drive global equity markets in the near term.

- Emerging markets will benefit from additional climate change mitigation policy and technology developments

The Part 2 of these series will focus on “What implications all these analysis, factors and various indicators have on portfolios and how investors should adapt towards new changes?”

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals