It is believed by consultancy PWC that asset management will face a Brave New World in 2020. There have been some game changers identified by PWC that will help organisations to operate in the new environment. PWC believes that there are six of these. The game changers are explained to be that

- (1) asset management will take centre stage,

- (2) distribution will change to a focus on regional and global platforms,

- (3) fee models will change,

- (4) alternatives will become more mainstream,

- (5)there will be a new breed of global managers, and

- (6) asset management will enter the 21st century.

Each of these will now be explored in turn.

Source: Asset Management in 2020, A brave new world, by PWC

Asset Management

Asset management has taken the back seat for a long time, but PWC suggests that by 2020 it will have moved out into the forefront. There are several drivers of this.

- One is regulation that was put in place after the global economic crisis which will impact on what banks can do.

- The second driver is the rise of retirement and health care in importance as populations in developed countries age. This is anticipated to change portfolio allocations. In particular there will be a lot of focus on solution-based products.

- The other driver is that asset managers will become more important financial players.

Finally, asset managers will be used by SWFs to change their asset bases. This will offer a lot of assets to benefit from.

Regional and Global platforms

The second game changer is that regional and global platforms will dominate as distribution moves around. The Greater China block which includes China, Hong Kong and Taiwan is going to have greater integration. Meanwhile in South East Asia, ASEAN countries will develop a structure that will lead to recognition of mutual funds in the countries of the region. Emerging countries in the region, namely Indonesia, the Philippines and Vietnam have a lot of rich investors in the middle class. Additionally, both in North Asia and South Asia, by 2020 there will be an APEC Asia Funds Passport in place. The founding members of the first fund, namely Australia, New Zealand, Singapore and Korea will find other countries joining in. Latin America will also provide the opportunity for funds to be established in one country and distributed to another, avoiding full registration. In Europe it is expected that the UCITS structure will continue to solidify within its markets of Europe, Asia and Latin America. Those geographies that will benefit will be those that are stable and will commit to an international fund industry.

Fee models

Fee models are also expected to be transformed. It is expected that investment firms will use varied models for the mass affluent, since it will be too costly for lots of companies to provide services to retail investors. They will instead focus on self-directed services. The mass affluent market will be self directed. There will be a lower cost model over asset management services as commissions are expected to be moved out of the way it works. This will provide an opportunity for passive products that are low cost like ETFs. One benefit of this is that simple products will win out, since advisors do not have to spend time explaining strategies, and solutions that are well targeted will gain precedence. Companies will focus on educating as well.

Alternatives

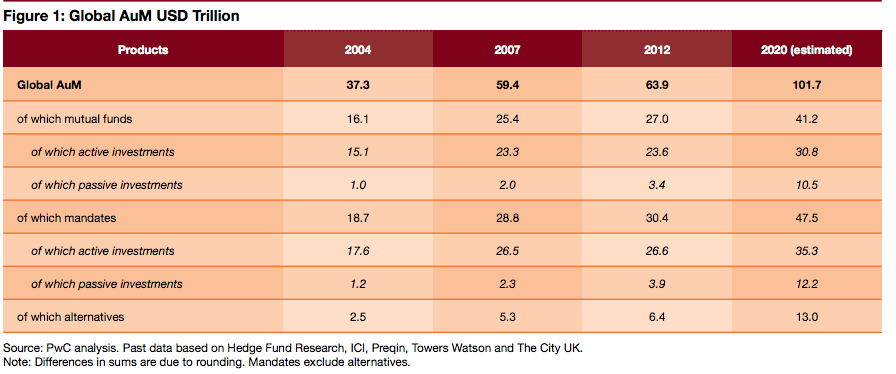

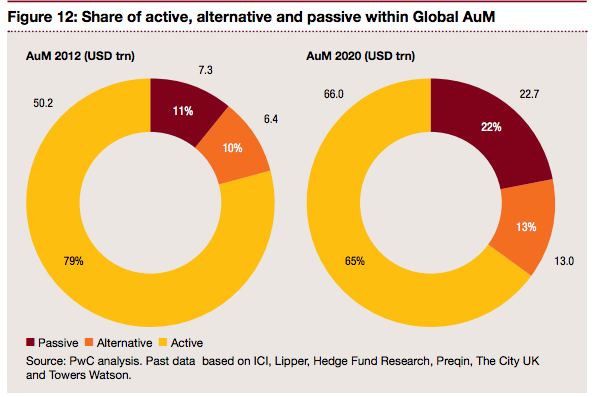

Alternatives are likely to become more normal, and passives will be core to this. It is expected that ETFs will proliferate. It is predicted by PWC that alternatives and passive products will comprise 35% of the total assets managed in the industry. These include exchange traded funds and index tracked schemes.

Source: Asset Management 2020, A Brand New World, by PWC

The investments will include hedge funds and similar products, real estate and private equity. Passive is likely to grow from 10% of the market in 2012 to 22% in 2020. Alternative assets will mostly be regulated and it is unlikely that they will be able to be outside of the regulator view. It is also predicted that alternatives are likely to become so mainstream that they will not be able to even be considered as particularly alternative anymore.

New breed of global managers

The fifth imperative according to PWC is a new breed of global managers. They will use slick platforms and solutions that are aimed at specific customers to build a stronger brand. Organisations will look to achieve scale and this will be driven by the unbundling of fees throughout the globe. Firms will need to avoid errors so that they do not irritate investors and get themselves a bad name. Attracting the best talent will be a competitive advantage.

Asset Management in 21st century

The final imperative is that asset management will enter the 21st century. People will expect a solution that is customised, smooth and integrated, and these needs will lead to asset managers using technology more in the future. It is anticipated that companies will hire chief digital officers to achieve this. Currently asset managers are weaker in areas like social media. It will be important to build the right infrastructure. Technology will be a major focus by 2020.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.