October was not a particularly good month for hedge-fund returns. While everything from a flip-flop on tax inversion benefits to adverse legal rulings have been blamed, the prime suspect it seems is the increasingly costly and complicated rules and regulations not just in the United States but globally. From AIFMD (Alternative Investment Fund Managers Directive) angst in Europe to Dodd-Frank dread in America, hedge funds are experiencing regulatory perturbation as never before. Yet, at the same time, there are fund managers who welcome required registration and view it as a legitimizing credential in a highly competitive marketplace.

Expenses Eating Earnings

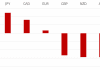

Until 2010, most hedge funds in the United States did not need to register with the SEC nor were they concerned about regulation in the EU. The qualifications necessary to be a player were high enough that market regulators generally took the attitude of theyre big enough to know what theyre doing. But after 2008, came the realization that hedge funds pose a potential systemic risk if left to their own devices. Along with unprecedented rules came unprecedented compliance expenses to factor into return and growth equations. A KPMG survey that polled more than half of the hedge-fund industry disclosed that the average compliance cost for a small fund was $700,000, for a medium-sized fund, $6 million, and the largest funds were paying a whopping $14 million.

Regulation A Resume Builder

Not all managers see mandatory SEC registration as a negative: We were asking the SEC to register us in 2006. Being registered is a huge comfort to our investors?.?.?.?it shows were not crooks, said an executive at one U.S. hedge fund. That sentiment was echoed by a fellow hedge-fund manager: A big pension fund investor is not going to give $200m to some guy running a hedge fund from some office in Cayman any more. But if youre regulated by the FCA or the SEC, if you meet all the requirements of AIFMD, then youre much more likely to get that check.

Only the Strong Survive

Absorbing the cost of regulatory compliance is viewed by some managers as an expense akin to infrastructure investment: Fund managers around the world are working hard to deal with the challenges of compliance. But there is a sense that the investments they are making today will pay off in the future from a competitive standpoint, according to a consultant in a global hedge-fund practice. While that may hold true for the largest funds, the smaller ones may find themselves too small to succeed as the cost of regulation continues to rise.

David draws on 20+ years’ experience in both legal practice and in business services delivery since his own call to the Bar in 1989. With several years in the startup environment, including as a co-founder in the legal tech space specifically, he brings a unique and timely perspective on the role of data, automation and artificial intelligence in the modern and efficient delivery of services for legal consumers. Having been both a corporate buyer of legal services and a services provider, he identifies the greater efficiency and value that can be achieved in legal operations for corporate buyers especially.

An attorney, David worked for law firms Pinsent Masons and Linklaters in London before moving to New York to join Credit Suisse. As CAO, he helped negotiate & execute the relocation of Credit Suisse into its new NYC global HQ. Subsequently, David directed major global outsourcing, shared sourcing, HR operations & process efficiency initiatives including the digitization of records, the global roll-out of PeopleSoft HRMS & Y2K. David has worked extensively in the UK, US, Philippines, India and China markets in the areas of data management, human resources and business process outsourcing.

Most recently, David has been successfully investing in and serving as an advisory board member of several legal services start-ups including a cloud-based solution for legal process automation and e-filing; and a technology solution for large-scale capture of court and other public data used for litigation analysis, among others.

David graduated from the University of Manchester with Honors in Law and Bar School (College of Legal Education) in London, and has been a member of Middle Temple since 1989. He is the founder and former Chairman of The Global Sourcing Council.

Member: Bar of England & Wales, ABA, NYCBA, ACC, DRI