- This comes after warnings that increasing PE allocations could result in lower returns for retirement incomes.

- Equity release market has grown 100% in the past five years – with record activity in 2022 as a result of living squeeze.

- Rudy Khaitan, Managing Partner of the UK’s leading later-life lending specialist, Senior Capital, explains why equity release products could offer attractive risk adjusted yields for pension funds looking to bolster returns.

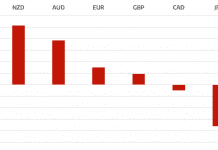

British pension funds have long underperformed rivals, with average annual returns sitting at just 9.5% in 2021, according to Moneyfacts. This is compared to a 20.4% increase by the Canada Pension Plan Investment Board, while AustralianSuper delivered a 22.3% gain. However, Hunt’s ambition to ramp up risker pension allocations is set to assist the UK compete with countries such as Australia, Canada and the US, all of which are currently enjoying the largest pension returns. In comparison to the earlier products offered almost 30 years ago, Britain’s pensions industry has evolved with greater underpinnings in its highly regulated origination and sales process, making it an ideal asset class for pension funds.

The average pension pot currently stands at just £107,300, according to the Office of National Statistics (ONS), indicating a lack of sufficient savings for a comfortable retirement. This has led to the Equity Release Council revealing a 23% year-on-year increase in people turning to equity release – a financial service allowing homeowners to access capital tied up in their home without selling it – as a vital lifeline amidst the cost-of-living crisis.

Managing Partner of Senior Capital, Rudy Khaitan, comments:

“Chancellor Jeremy Hunt’s plan to consolidate workplace pension schemes and allocate up to £75 billion of retirement funds for investment in high growth segments represents a strategic effort to stimulate the UK economy and generate better returns for pensioners. These reforms are expected to not only enhance retirement incomes by over £1,000 a year for typical earners but also drive substantial growth in the UK’s most promising companies.

“Our clients, primarily pension funds and insurers, require long-dated stable cash flows to match their liabilities which often extend to 15-20 years or more. The universe of assets that provide this duration but also meet the required risk-return thresholds, is very limited.

“Senior Capital is in the business of producing rated notes backed by attractive equity release mortgage assets that are structured specifically for insurers’ and pension funds’ exact use cases. These assets not only offer attractive risk adjusted yields but crucially, much coveted 17+ year duration cash flows that align with our clients’ liabilities and (often narrow) regulatory requirements. By incorporating our assets into their portfolios, our clients are able to access profitability more efficiently and sustainably than their competitors, thus providing them with a significant edge in the increasingly competitive markets that they operate in.”

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals