The history of funds and hedge funds Part 1 Introduction

Types of Mutual Funds

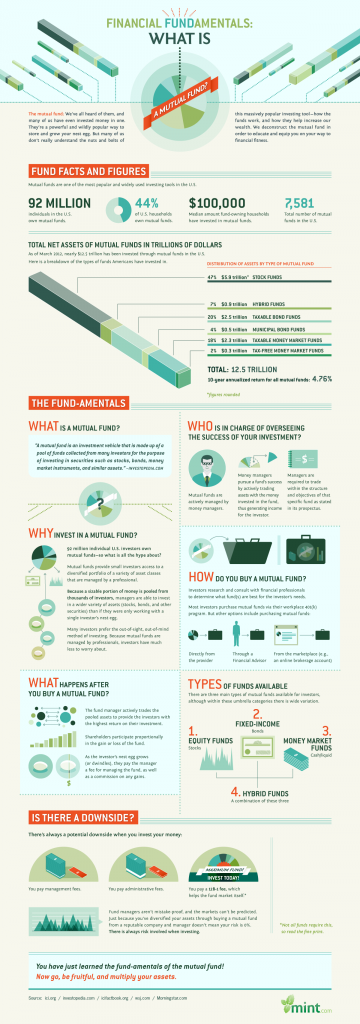

There are several different kinds of funds available to those who are looking for an option to invest their money. The most common type of fund that exists is known as a mutual fund, which then breaks down into further subcategories. The three most widely used and discussed of these in the USA are the open-end, closed-end and unit investment trust. Various other funds also exist, each of which have their own set of advantages, limitations, and characteristics that are defined according to specific rules and depend upon the way they are organized.

Source: https://www.mint.com/blog/investing/mutual-fundamentals-a-visual-guide-052012/?display=wide

Hedge funds are also a popular method used by people to invest their finances, but this a methodology adopted exclusively by those who belong to the elite class across the globe. This is because they are structured along a different concept, which sets them apart from mutual funds.

Still, the quality that they all share is that they offer people a chance to pool their resources together, which leads to the creation of the fund itself. It enables them to save their resources in a safer way by splitting the risk involved between them. The aim of each of the investors can also be taken to be the same if they are contributing to the same fund, since it will be used collectively to buy securities.

How they generally work can be a complicated process to understand at times, but the idea can be understood with much more ease when put into simpler terms. The funds are typically run by a person who has been specially appointed as the person in charge. This person is generally known as the fund manager in case of mutual funds. In the case of hedge funds, they are usually referred to as the investment manager. This is a highly skilled and learned person when it comes to decision-making regarding investments, profits and losses, and they have a thorough understanding of the finance world. He or she must also be well aware of all the current market trends, since a large group of people is entrusting them with a huge responsibility.

The amount that people invest greatly depends on the type of fund that they choose to go for. People who want to spare smaller amounts for this purpose can opt for mutual funds. Thus, this means that a larger fraction of the population can take part in this kind of financial activity and they can easily select those funds which suit their needs better.

Hedge funds on the other hand are not an option that is available to the general public at large. This is because they work quite differently and certain prerequisites must be met before one can invest in a hedge fund.

- First of all, they must have the ability to contribute the large sum of money that is associated with a hedge fund.

- Secondly, they must be cleared by the relevant government agency before they can do so. They must be accredited and must meet the bare minimum cut-off for annual earnings.

Even though there are several differences and similarities between these two prominent types of funds, they have both been on the rise in terms of popularity as more and more people are looking into these depending upon their own personal means. As the past reveals, both of them have immensely evolved over the years and have become a major chunk of the total financial exchanges that take place today.

In order to understand how and when these changes came to be, it is necessary to closely examine the step-by-step development of these financial tools. It must be studied holistically by considering the perspectives of politics, history and economics. This will allow us to truly see how things turned out the way they are right now. This will also lend valuable insight into the key features that stand out and those that are most important to people when it comes to dealing with their money.

In this article, we will begin by looking at the earliest known examples of such funds and why they came into existence. We will then investigate how they were modified decade after decade, until finally reaching their present status. History can often be a fundamental indicator of what shape things may take in the near as well as distant future, and can enable us to make reasonable predictions that could someday prove to be highly beneficial.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals