Cloud computing, like other public services such as electricity and telephone, is based on the concept of converged infrastructure and shared services. In cloud computing, an organisation uses a network of remote servers hosted on the Internet by service providers for its IT needs, rather than owning a local server, hardware and software. Cloud computing provides online access to computer resources and services by a third party service providers.

Advent of cloud technology has enabled to use centralised IT facilities provided cloud service provider and pay bills as per usage. Fund Managers need not have to devote their precious time to build and maintain their own IT infrastructure. Adoption of cloud computing allows hedge fund managers to focus more on their core business. This adds value to hedge funds. Cloud computing can help a hedge fund transform its operations to become a more efficient and customer-focused enterprise.

Cloud computing gives also hedge funds powerful tools to manage investors and prospective investors, raise new funds and provide timely communications to investors, and share forms and documents securely via a seamlessly integrated Investor Portal. Cloud computing relies on sharing of resources to achieve coherence and economies of scale, over a network. It focuses on maximizing the effectiveness of the shared resources.

With the introduction of Amazon’s Elastic Compute Cloud in 2006 and Microsoft Azure in 2008, the organisations started moving away from traditional CAPEX model of investing affront and owning the dedicated hardware and software. They now prefer to use a shared cloud infrastructure and pay as one uses it, popularly known as OPEX model. In 2010, OpenStack, an open-source cloud-software initiative made cloud computing more popular. New technology brought high-capacity networks, hardware virtualization and service-oriented architecture. This has led to a growth in cloud computing. Cloud technology converts a ‘virtual office’ into a ‘true mobile office’. Using a laptop or tab, they can access all the fund’s data, intelligence and work files from anywhere any time. Mangers are in total control of their business.

As clouds are available in various forms such as public, private and hybrid. The question a hedge fund manager should raise is which one to select. It basically depends on the size and complexity of fund’s operation. For example a start-up can go far a public cloud. In a public cloud, the infrastructure is owned and managed by cloud computing service providers and services are accessed by multiple subscribing clients on a flexible, pay-per-use basis, similar to other utility services such as electricity and telephone. Start-ups generally go for a public cloud; this enables them to concentrate on their core activities and grow faster.

On the other hand a private cloud is more suitable to large fund houses. In private cloud, the infrastructure is operated solely for the hedge fund. The hedge fund can own the private cloud or a third party can be hired to host it, either on site or off. A private cloud provides restricted access to the computing capabilities and resources. The hedge fund retains greater customization and control than public clouds would permit.

A cloud survey commissioned by Rackspace Hosting, however, shows 60% of cloud users are moving from public to hybrid cloud. In hybrid cloud, a hedge fund uses public cloud computing capabilities and services for general computing, but stores customer and sensitive data in its private cloud to ensure security. As the hybrid cloud combines the benefits of both public and private funds, its adoption by hedge funds is on increase. While public cloud has some limitations, hybrid cloud provide more control, better security, better reliability, better performance and reduced costs. Hybrid cloud and multi-cloud adoption is on the rise. Another recent survey found that one-third of users continue to use private clouds. One out of every two uses OpenStack clouds.

Another crucial question is that of data security. Data loss remains one of the main concerns for financial organisations looking to adopt cloud services and applications.

“Nearly three quarters of the firms surveyed are extremely concerned about data not being backed up and problems with disaster recovery,” according to a survey carried out by Vanson Bourne, on behalf of NCC Group.

Comprehensive backup solutions are must for those using cloud applications. A hedge Fund Manager needs to do due diligence while choosing a cloud service provider. Cloud provider’s failure could be very detrimental thing to a client that makes use of the cloud. Select only an experienced service provider with proven track record who can be trusted. Managers need to take necessary precautions. Continuity plans must be in place. A Hedge Fund cannot ignore the importance of Disaster Recovery and Business Continuity Plan. It is crucial for the organisation’s reputation and existence.

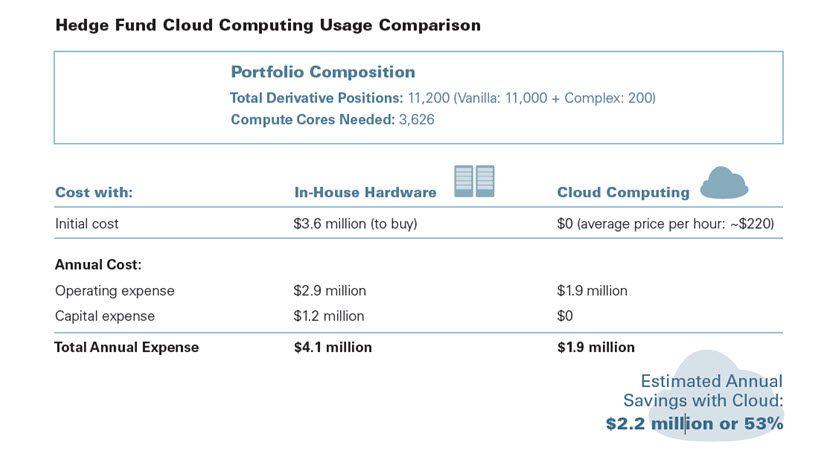

According to Greenwich Associates, hedge funds could get cost reduction of more than 50%with cloud deployment.

Cloud computing industry is growing at an exponential rate of 50% per annum. As technology enhancements continue, made and more business applications get added. Cloud computing gives a competitive edge to hedge fund managers.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.