When high-end technology meets well being-driven ideas everything can be achieved. At least, that is what they think at Kora, a new start-up that teams up blockchain and Financial Inclusion in order to tackle lack of financial access for millions of people in Africa.

Kora is a project born in September, 2016, when entrepreuner Dickson Nsofor and expert Maomao Hu decided to use the blockchain high stance to embrace a good cause, the Financial Inclusion problem in Africa.

Originally from Nigeria, one of the most developed countries in Africa, Mr Nsofor is well aware of the difficulties that lacking in access of basic financial services can carry in people’s wealth.

In fact, at Kora they see Financial Inclusion as an imperative due to the consequences attached to them:

“Financial services have been proven to help grow wealth. Unfortunately, for much of the world access is uneven and expensive. In many places formal banking is seen as something exclusively for the wealthy. Banks require high minimums and fees for opening and maintaining accounts. Due to the cost to serve and inability to prove identity, many financial institutions don’t open branches in remote or low-income areas, requiring people to travel for hours to transfer money.

People that own and utilize property but don’t have a trusted record to prove it are unable to use it as collateral for loans, turning it into “dead capital”. This exclusion of billions of people from growing and accumulating their capital has disproportionately increased the gap between the rich and the poor, leading to constant agitation in various regions, social instability and indirectly causing political instability. This is both a humanitarian crisis and an economic crisis as a third of the world’s potential for value creation is ostracised.”

However, Mr Nsofor and Mr Hu have a solution or at least, a beginning of it. They decided that if an open-source and easy to track technology, which also features high security standards as it is the blockchain is brought up on this matter, the objective of bringing financial inclusion in this part of the world is real, so far.

Building the blockchain-powered Kora network

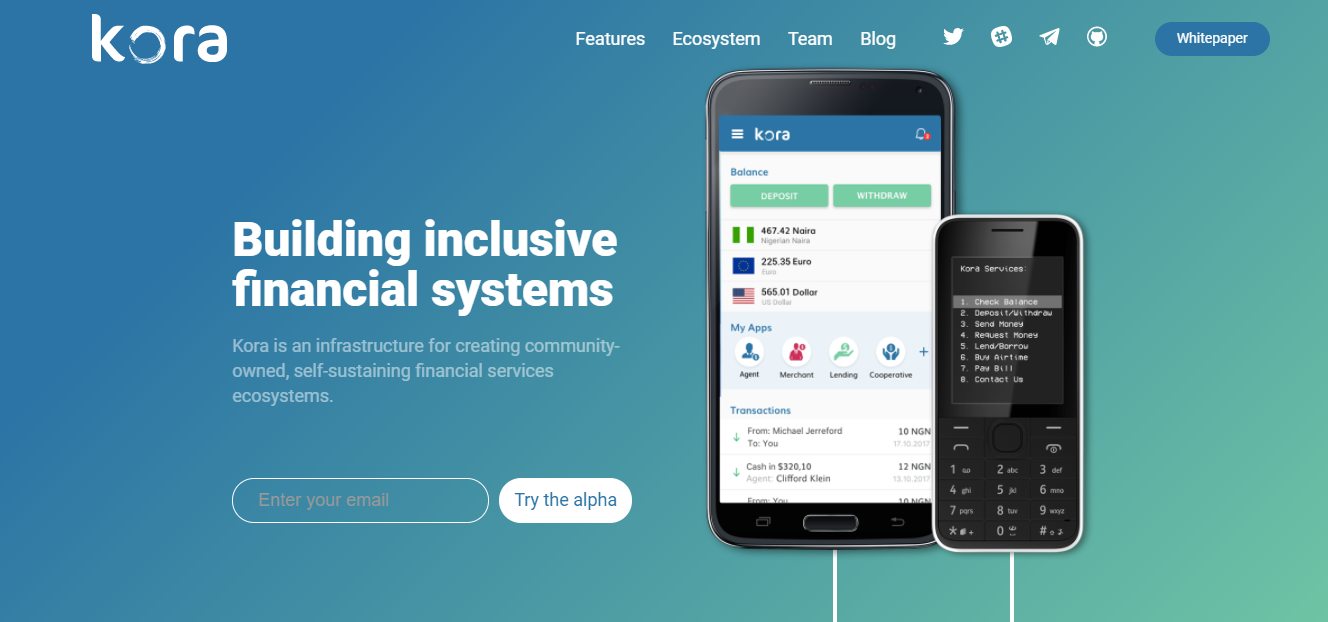

Basically, whay they thought at Kora is to build a network on four layers of infrastructure to provide a low cost, universal access financial services platform accessible via SMS/USSD on feature phones, or with internet access via mobile app, enabled by blockchain technology.

“This helps communities build self-sustaining, community-owned financial services ecosystems. By drastically reducing the cost and time required to provide financial services, and drawing a diverse set of stakeholders into an interoperable network, it unlocks the Long Tail of the global economy, benefiting populations most in need and enriching the global economy by unlocking the capital, intellect, and creativity of the underserved,” the founders say in their white paper.

To do so, they plan on construct a fully functional financial systems, based on:

IDENTITY: Letting a user prove they are who they are, and that they did what they say they did.

SECURE STORAGE: Letting a user protect their funds from being easily stolen or devalued.

MONEY TRANSFER: Transferring value from one entity to another, quickly and securely.

MARKETPLACES: Creating venues for users to exchange money for goods, services and capital.

In a recent interview, founder Mr Nsofor, said how important this project is as it can actually change the status quo and how financial services can be accessed in Africa. For him, Kora is tackling the problematic from two key features:

In first place, “we have found a way to empower existing communities through what we describe in the white paper as CVN’s – simply means simulating community local offline savings practices in a digital way on the Kora Network”.

On the other hand, thanks to the so-called Pegged Crypto-currencies, “we believe very soon central banks will understand the value of pegged crypto-currencies that have the same price as local currency but with a crypto characteristics.”

And he added that “We want at Kora to be the turn key Network solution for every financial service globally starting from Africa.”

They plan to start an ICO in the second week of December after being a success in the first trenches late November, reaching a considerable amount of about $2 million.

Mr Nsofor encourages investors to take part of the upcoming ICO as “the success of the Kora Project will be a milestone in the long running quest to alleviate poverty for billions of people and to let everyone share in the wealth created globally.”

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.