In the world of forex trading, currency pairs have different levels of volatility – some high, some low. This means that your trading method should be different, depending on the volatility of currency pair that you’re trading. The article will explore some of the differences you should remember when trading high or low volatility currency pairs.

The volatility of a currency pair is normally measured using standard deviation. This gives traders information about how much a currency pair can deviate from its current exchange rate over a specific period.

Usually, currency pairs with high liquidity tend to have less volatility. And, the lower the volatility of the currency pair is, the lower the risk is.

High-Volatility Currency Pairs

Below are some of the most volatile currency pairs:

Major currency pairs:

AUD/JPY

NZD/JPY

GBP/AUD

AUD/USD

Emerging market currency pairs:

USD/TRY

USD/ZAR

USD/BRL

USD/HUF

Normally, the major currency pairs are generally less volatile than the emerging market currency pairs. In the list above, the AUD/JPY and NZD/JPY are currently the most volatile among the major currency pairs.

USD/TRY, USD/ZAR, or USD/HUF are high-volatility because they have low liquidity, but also due to the inherent risk in emerging economies.

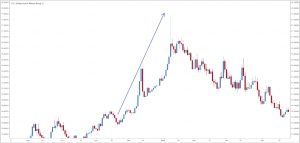

Below is the chart demonstrating the activity of the USD/ZAR by the beginning of 2016. In 45 days, this currency pair’s exchange rate increased more than 22%. A drastic move like this is not rare on emerging market currency pairs’ charts.

Low Volatility Currency Pairs

As we mentioned earlier, low-volatility currency pairs normally have high liquidity. Their big trading volume assures their price stability.

Some of the least volatile currency pairs include:

· EUR/GBP

· USD/CHF

· EUR/USD

· NZD/USD

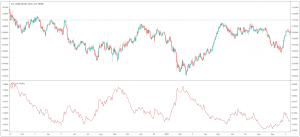

Let’s see an example of a low-volatility currency pair. Below is the chart showing the possible deviation of the USD/CHF by the beginning of October 2016, measured by the Average True Range indicator (ATR). As you can see, the indicator ranged from 45 to 90 pips – a quite low range compared to other currency pairs.

Remember that correlation between two currencies can also affect the volatility. For example, both the US Dollar and the Japanese Yen are considered safe haven currencies, so when the markets are unstable, traders might decide to allocate more money to either currency. The increase in demand will then cause them to strengthen, therefore the USD/JPY pair will unlikely experience much volatility.

Trading Tips

Trading currency pairs with high volatility is certainly riskier than trading ones with low volatility. Therefore, you should pay attention to the current volatility of a currency pair, and always be aware of any potential change in volatility of that currency pair, when you are trading.

You must also know how to calculate volatility, and always pay attention to economic events that could affect volatility.

To measure the volatility of a currency pair, you can use the Average True Range (ATR) or Donchian Channels (named after its creator, Richard Donchian). The moving average is also a good tool to measure volatility. To do this, look at the chart and compare the line for moving average against the current exchange rate.

There are some important notes when you trade currency pair volatility:

· High-volatility currency pairs often move more pips during a particular period of time than low-volatility ones do.

· You may face more slippages when trading high-volatility currency pairs. However, trading with a broker that offers zero slippage as a standard benefit, such as easyMarkets and forex.com, will eliminate this risk.

· Highly volatile currency pairs can make bigger moves. Therefore, you should reduce your position size when trading them.

· Big events (e.g. a trade war) or important economic data releases (e.g. interest rate decisions) can strongly affect a currency pair’s volatility. Therefore, you should use a financial calendar and closely follow economic news to stay updated.

The Bottom Line

Knowing how to measure volatility is necessary when trading forex. It helps you choose the right currency pairs to trade, and also enables you to calculate correct take-profit and stop-loss levels.

Which currency pairs you should trade also depend on your trading experience. Beginner traders should start with low-volatility currency pairs because they are easier to trade. Highly volatile ones can bring a more exciting trading experience and higher potential profit, but the risk also increases; therefore, they are only recommended for experienced traders.

This is an article provided by our partners network. It might not necessarily reflect the views or opinions of our editorial team and management.

Contributed content

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals