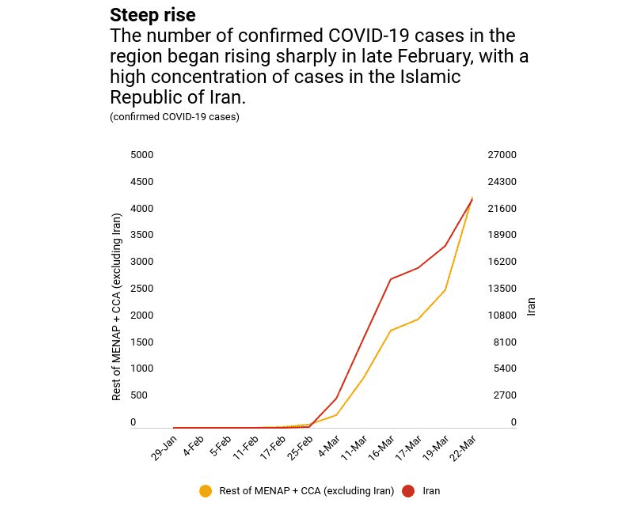

The coronavirus Covid-19 pandemic has reached almost every corner of the planet. Three quarters of the countries in the Middle East and Central Asia have reported positive cases while many of them have started to take measures to try to stop the transmission. This pandemic along with the oil price plunge is taking its toll on the regional economy and it is only expected to intensify. Key sectors like tourism, production and manufacturing and oil exporters are the areas where the impact will be highest and most profound.

The Coronavirus pandemic is already affecting the global economy, with economists forecasting a global recession as deep as that of the Financial Crisis of 2008. The novel coronavirus Covid-19 has led Governments all around the world to take extreme measures like lockdown and enforced self-isolation. In Italy, for example, the government has extended the country-wide lockdown and stopped all non-essential economic activities.

The coronavirus pandemic has become the largest near-term challenge to the global economy. The same can be said to the Middle East, the Caucasus and Central Asia countries.

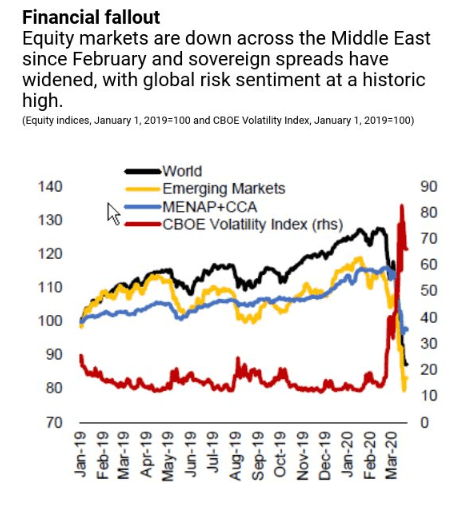

As per the IMF, beyond the devastating toll on human health, the pandemic is causing significant economic turmoil in the region through simultaneous shocks—a drop in domestic and external demand, a reduction in trade, disruption of production, a fall in consumer confidence, and tightening of financial conditions. “The region’s oil exporters face the additional shock of plummeting oil prices. Travel restrictions following the public health crisis have reduced the global demand for oil, and the absence of a new production agreement among OPEC+ members has led to a glut in oil supply. As a result, oil prices have fallen by over 50 percent since the start of the public health crisis. The intertwined shocks are expected to deal a severe blow to economic activity in the region, at least in the first half of this year, with potentially lasting consequences.”

This also entails that lower export receipts will weaken external positions and reduce revenue, putting pressures on government budgets and spilling over to the rest of the economy. Oil importers, on the other hand, will likely be affected by second-round effects, including lower remittance inflows and weaker demand for goods and services from the rest of the region.

The International Monetary Fund also points out that measures to contain the pandemic’s spread are hurting key job-rich sectors, like tourism. In fact, tourist cancellations in Egypt have reached 80 percent, while hospitality and retail have been affected in the United Arab Emirates and elsewhere. Given the large numbers of people employed in the service sector, there will be wide reverberations if unemployment rises and wages and remittances fall.

Production and manufacturing are also being disrupted and investment plans put on hold. These adverse shocks are compounded by a plunge in business and consumer confidence, as we have observed in economies around the world.

Finally, sharp spikes in global risk aversion and the flight of capital to safe assets have led to a decline in portfolio flows to the region by near $2 billion since mid-February, with sizable outflows observed in recent weeks, a risk that expert Jihad Azour said in a recent blog. Equity prices have fallen, and bond spreads have risen. Such a tightening in financial conditions could prove to be a major challenge, given the region’s estimated $35 billion in maturing external sovereign debt in 2020.

Like much of the rest of the world, people in these countries were taken utterly by surprise with this development and many were unprepared.

Policy action against the Coronavirus Crisis

Governments and officials have two priorities to fight the coronavirus crisis. First, there is the protection of public health, and once measures have been taken, to prevent the pandemic from turning into a lasting economic recession.

“The immediate policy priority for the region is to protect the population from the coronavirus. Efforts should focus on mitigation and containment measures to protect public health. Governments should spare no expense to ensure that health systems and social safety nets are adequately prepared to meet the needs of their populations, even in countries where budgets are already squeezed. Governments in the Caucasus and Central Asia, for example, are increasing health spending and considering broader measures to support the vulnerable and shore up demand. In the Islamic Republic of Iran, where the coronavirus outbreak has been particularly severe, the government is ramping up health spending, providing additional funding to its Ministry of Health,” commented IMF expert Jihad Azour.

Especially important is monitoring and supporting the region’s fragile and conflict-torn states—such as Iraq, Sudan, and Yemen—where the difficulty of preparing weak health systems for the outbreak could be compounded by reduced imports due to disruptions in global trade, giving rise to shortages of medical supplies and other goods and resulting in substantial price increases. Uncertainty about the nature and duration of the shocks has complicated the policy response.

The second line of action should be focused on economic policy responses directed at preventing the pandemic from developing into a protracted economic recession with lasting welfare losses to the society through increased unemployment and bankruptcies. “However, the uncertainty about the nature and duration of the shocks has complicated the policy response,” added Jihad. “Where policy space is available, governments can achieve this goal using a mix of timely and targeted policies on hard-hit sectors and populations, including temporary tax relief and cash transfers.”

As everywhere else in the world, the economic response consists of temporary fiscal support and ample liquidity through financial institutions. First off, temporary fiscal support measures should be well-targeted support to affected households and businesses. This support should aim to help workers and firms weather the significant, but hopefully temporary, stop in economic activity that the health measures being implemented to control the spread of the coronavirus will entail. This support will have to take account of the fiscal space that is available, and where policy space is limited be accommodated by reprioritizing revenue and spending objectives within existing fiscal envelopes.

Likewise, where liquidity shortages are a major concern, central banks should stand ready to provide ample liquidity to banks, particularly those lending to small and medium-sized enterprises, while regulators could support prudent restructuring of distressed loans without compromising loan classification and provisioning rules.

Once the immediate coronavirus crisis has begun to dissipate, more conventional fiscal measures could be considered to support the economy and bring it back into the growth space.This can be achieved by restarting infrastructure spending, for example.

However, we are still in the beginning of the crisis and there is a long road ahead for the region and the world to overcome the crisis. “Given the nature of the current slowdown, trying to stimulate the economy at this time is unlikely to be successful and would risk eliminating the limited fiscal space that is still available,” the expert added, reminding all countries facing economic difficulties that the IMF is offering advice and assistance, especially those that urgently need financing to resist shocks.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.