If you’re a business owner looking for funding but don’t want to give up equity or take on rigid debt, revenue-based financing (RBF) might be the perfect solution. It’s flexible, founder-friendly, and doesn’t require personal guarantees or collateral. But what exactly is RBF, how does it work, and is it right for your business?

Imagine you’re running a fast-growing e-commerce brand or a SaaS startup. Sales are increasing, but you need capital for the next big marketing push, product development, or market expansion.

Traditional loans are risky because of fixed monthly repayments, and equity funding means giving up part of your company, possibly control as well.

Revenue based financing offers another route. It’s not brand new, but in the current business climate, where founders want speed, flexibility, and control, it’s enjoying a surge in popularity.

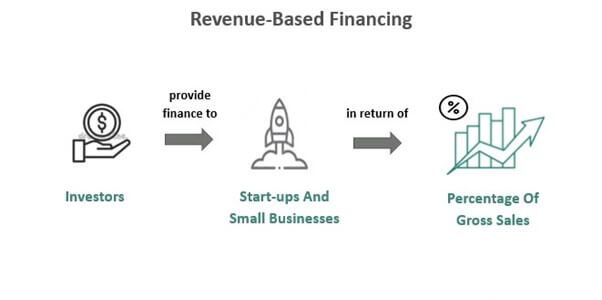

The idea is simple: you borrow money, and instead of fixed repayments, you agree to share a set percentage of your monthly revenue until you’ve paid back the original loan plus a pre-agreed multiple.

In 2025, the alternative finance market in the UK is expected to surpass £6 billion, with a growing share of businesses turning to innovative funding methods like Revenue-based financing (RBF).

Traditional funding routes such as loans and equity investment often come with high risks or ownership dilution, making RBF an increasingly attractive option for fast-growing startups.

RBF works by allowing companies to raise capital without sacrificing ownership, as investors receive a fixed percentage of future revenues until the capital is repaid with a pre-agreed multiple.

This model has gained significant traction, particularly in the Software-as-a-Service (SaaS) industry, where recurring revenue makes repayments predictable.

In fact, 62% of SaaS companies are now using alternative funding methods like RBF to fuel growth, as they prefer the flexibility it offers compared to traditional loans or venture capital.

What Is Revenue Based Financing?

Revenue based financing (also called royalty-based financing) is a funding method where an investor or funding provider gives a business an upfront sum of money. In return, the business agrees to repay a fixed percentage of its gross monthly revenue until the total repayment hits a set cap, usually between 1.3x and 3x the original amount borrowed.

Here’s how it works:

- An investor provides upfront capital.

- The business repays the investor with a fixed percentage of its monthly revenue.

- Payments continue until a predetermined repayment cap (usually 1.2x to 2x the original amount) is reached.

Unlike traditional loans, there’s no fixed repayment schedule, payments fluctuate with revenue. If sales are strong, you pay back faster. If revenue dips, payments decrease.

Let’s say you land a $100,000 advance with a 1.5x repayment cap. You’ll pay back $150,000 through small, regular bites out of your revenue.

Types of Revenue Based Financing

There are two main types of RBF agreements:

Variable Collection Model:

It is the more common of the two. Under this arrangement, you agree to repay a certain percentage of your gross monthly revenue until the loan is fully paid off. This means your repayments naturally fluctuate depending on how well your business is doing. If you have a strong month with high sales, your repayment will be larger.

Conversely, if sales slow down, your payment reduces accordingly. This flexibility can be a real lifesaver during seasonal slumps or unexpected downturns, as you only pay what you can afford at that moment.

Fixed Fee Model

Instead of variable payments, you commit to paying a fixed percentage of your revenue each month for a predetermined term, which can be as long as five years. The monthly repayments tend to be smaller and more predictable.

However, if your revenue grows quickly, you might end up paying more over the life of the agreement because you’re paying that fixed percentage regardless of how well your business performs. This model might appeal to early-stage businesses that want steadier, manageable payments, but it can become more costly if your sales take off rapidly.

How Does Revenue-Based Financing Work?

Let’s go step-by-step.

1. Application

The business applies through an RBF provider, often connecting their accounting software, payment processors, or bank data (e.g., Xero, QuickBooks, Stripe). The provider analyses monthly recurring revenue (MRR) or annual recurring revenue (ARR) to decide eligibility.

2. Approval and Offer

If approved, the business receives one or more offers, each with:

- Funding amount

- Revenue share percentage (often between 3%–8%)

- Repayment cap (e.g., 1.5x the borrowed amount)

Example:

- Funding: $100,000

- Revenue share: 6%

- Repayment cap: 1.5x ($150,000 total repayment)

3. Repayment

Each month, the business pays the agreed percentage of its revenue.

- If revenue is $200,000 in a month → payment is $12,000.

- If revenue is $80,000 → payment drops to $4,800.

Repayments continue until the cap is reached, regardless of time. High revenue months shorten the repayment period; low revenue months extend it.

How is RBF Different from Debt and Equity Financing?

| Feature | Revenue-Based Financing | Debt Financing | Equity Financing |

| Repayment | % of revenue (flexible) | Fixed monthly payments | No repayment (investors get ownership) |

| Ownership | No equity given up | No equity given up | Equity diluted |

| Interest | No interest (just a repayment cap) | Fixed interest rate | N/A |

| Collateral | Not required | Often required | Not required |

| Best For | High-margin, growing businesses | Stable cash flow | High-growth startups seeking VC |

Advantages of Revenue-Based Financing

Let’s run through why so many modern businesses, especially in SaaS, fintech, and e‑commerce, are jumping aboard the RBF train:

- No dilution: You keep control. No selling a chunk of your “baby”.

- No personal guarantees: Your house, car, or life savings are safe.

- Flexible repayments: Payments go up when you earn more, down when you earn less.

- Fast access to cash: Some platforms fund within 24 hours.

- Works well with other funding: Use RBF as a springboard to higher valuations for future rounds.

- Perfect for repeatable, growth-driven spends: Smart for funding marketing, inventory, or product R&D where revenue returns are likely.

Disadvantages and Drawbacks

Let’s be clear, RBF isn’t a magic wand for every business scenario:

- Repeatable revenue required: If you’re pre-revenue or sales are wildly inconsistent, getting RBF is tough.

- Loan amounts tied to current income: Early-stage and smaller firms might not qualify for the chunk of cash they want.

- Not suited to long-term projects: Repayment schedules under two years are typical, so very long-term investments don’t fit well.

- Nowhere to hide: When business is down, repayments ease, but the total still needs to be paid back eventually.

- Not always the cheapest: While caps are fixed, total costs can sometimes be higher than bank loans, especially if you pay back over a long period or if business growth stalls.

Who Should (and Shouldn’t) Use Revenue-Based Financing?

Ideal Candidates:

- Fast-growth SaaS & subscription businesses: With predictable monthly recurring revenue, repayment models are seamless.

- E-commerce companies: Use RBF to buy inventory and ramp up marketing for peak seasons or sales pushes.

- Businesses with seasonality: Those that wax and wane (think retail in December or edtech in September) benefit hugely from the flexibility.

- Startups reluctant to sacrifice equity: If holding onto shares is important, RBF is an elegant way to raise significant funds without outside interference.

Not the Best Fit:

- Pre-revenue startups: No sales = no repayments = no RBF loan.

- Companies with thin margins: High repayments might eat too deeply into profits.

- Firms needing monster-sized capital: If you’re gunning for tens of millions, RBF providers simply might not bite.

What’s RBF Used For?

RBF isn’t just emergency cash. It’s a savvy tool for funding:

- Growth campaigns: Pumping cash into advertising or sales teams.

- Inventory buys: Readying your warehouse for busy season.

- Product development: Investing in tech or expanding your offering.

- Bridge financing: Cover gaps between equity rounds.

- Buying out old investors: Clean up your cap table without painful dilution.

Examples from the Real World

- Fitness apps have used RBF to boost subscriber growth, then raised more traditional, high-valuation rounds on stronger terms.

- SaaS startups have invested RBF capital into product innovation and then scaled quickly through multiple non-dilutive rounds.

- E-commerce brands have used seasonal RBF injections to stock up for Black Friday, repaying naturally from the surge in cash through Q4.

Tips for Getting the Best RBF Deal

- Think longer-term to spread out repayments and ease cashflow headaches.

- Apply while you’re on a growth trajectory better health equals better terms.

- Double-check fee structures and don’t fall for sneaky hidden charges or personal guarantee clauses.

- Vet providers. The best ones act as genuine business partners, not predatory lenders.

Final Thoughts

Revenue based financing is an increasingly popular funding model that sits neatly between traditional loans and equity financing. By offering flexible repayments tied to revenue, it provides an innovative way for businesses, especially SaaS and ecommerce startups, to access capital quickly without sacrificing ownership or control.

It’s not a one-size-fits-all solution, but for many companies, RBF offers the best of both worlds: growth capital with repayment terms that grow and shrink with your business.

So, if you’re looking for an adaptable, founder-friendly funding option that respects your company’s unique revenue rhythm, revenue based financing just might be the perfect fit.

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.